IRS Schedule R 1040 Form 2023

What is the IRS Schedule R 1040 Form

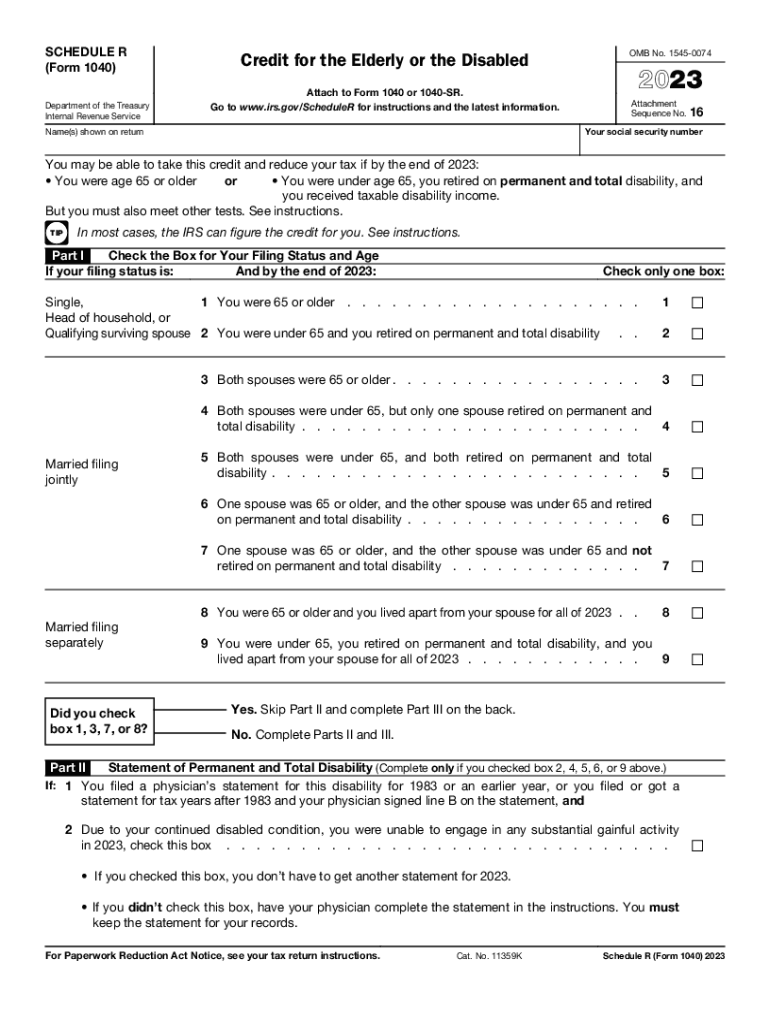

The IRS Schedule R is a supplemental form used by eligible taxpayers to claim the credit for the elderly or the disabled. This form is specifically designed for individuals who are filing their annual tax returns using Form 1040. The credit aims to provide financial relief to those who meet specific age or disability criteria, allowing them to reduce their overall tax liability. Understanding the purpose and eligibility requirements of Schedule R is essential for those looking to benefit from this tax credit.

How to use the IRS Schedule R 1040 Form

To use the IRS Schedule R, taxpayers must first determine their eligibility based on age or disability status. Once eligibility is confirmed, the form can be filled out alongside the main tax return, Form 1040. It is important to follow the instructions provided on the form carefully, as this will ensure accurate reporting of income and other relevant information. Taxpayers should also gather any necessary documentation that supports their claim for the credit, as this may be required for verification purposes.

Steps to complete the IRS Schedule R 1040 Form

Completing the IRS Schedule R involves several key steps:

- Verify eligibility by checking age (65 or older) or disability status.

- Gather required documents, including proof of income and any relevant medical documentation.

- Fill out the form accurately, providing all requested information, such as filing status and income details.

- Calculate the credit amount based on the provided instructions.

- Attach the completed Schedule R to your Form 1040 before submission.

Eligibility Criteria

To qualify for the credit claimed on IRS Schedule R, taxpayers must meet specific criteria. Generally, individuals must be at least 65 years old or permanently and totally disabled. Additionally, income limits apply, which may vary based on filing status. It is crucial to review the latest IRS guidelines to ensure compliance with the eligibility requirements, as these can change from year to year.

Filing Deadlines / Important Dates

Taxpayers must adhere to specific filing deadlines when submitting their IRS Schedule R. The standard deadline for filing individual income tax returns, including Schedule R, is typically April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions they may apply for, which can provide additional time to file their returns.

Form Submission Methods

IRS Schedule R can be submitted through various methods, including online filing, mailing a paper return, or in-person submission at designated IRS offices. For those filing online, it is essential to use compatible tax software that supports Form 1040 and its schedules. When mailing, ensure that the form is sent to the correct address specified by the IRS for your state. In-person submissions may require an appointment, depending on the local IRS office's policies.

Quick guide on how to complete irs schedule r 1040 form

Prepare IRS Schedule R 1040 Form effortlessly on any gadget

Digital document handling has become favored by businesses and individuals alike. It offers a perfect environmentally friendly alternative to conventional printed and signed papers, as you can locate the appropriate form and securely save it online. airSlate SignNow provides you with all the tools you need to create, modify, and electronically sign your documents quickly without delays. Manage IRS Schedule R 1040 Form on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign IRS Schedule R 1040 Form with ease

- Obtain IRS Schedule R 1040 Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent parts of the documents or obscure sensitive details with tools that airSlate SignNow offers specifically for this purpose.

- Create your electronic signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, SMS, or invite link, or download it to your computer.

Put aside concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from your device of choice. Modify and electronically sign IRS Schedule R 1040 Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs schedule r 1040 form

Create this form in 5 minutes!

How to create an eSignature for the irs schedule r 1040 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IRS Schedule R and why is it important?

IRS Schedule R is a tax form that helps eligible taxpayers calculate their retirement savings contributions credit. It is important because it allows individuals to maximize their tax benefits associated with retirement contributions, potentially leading to signNow savings.

-

How can airSlate SignNow assist with filing IRS Schedule R?

With airSlate SignNow, you can easily collect signatures and eSign documents required for filing IRS Schedule R. Our platform streamlines the document workflow, ensuring that all necessary forms are completed accurately and submitted on time for maximum efficiency.

-

Does airSlate SignNow offer features tailored for IRS Schedule R documentation?

Yes, airSlate SignNow includes features such as templates and customizable forms specifically designed for IRS Schedule R documentation. This allows users to quickly prepare the necessary forms and ensure compliance with IRS regulations.

-

What are the pricing plans for airSlate SignNow?

airSlate SignNow offers flexible pricing plans, including options tailored for individuals and businesses. Pricing varies based on features needed, but the cost-effectiveness of our solution makes it easy to manage IRS Schedule R filings without breaking the budget.

-

Can I integrate airSlate SignNow with other financial software for IRS Schedule R?

Absolutely! airSlate SignNow seamlessly integrates with various financial software systems, making it easy to manage your IRS Schedule R documents alongside your existing financial tools. This integration enhances productivity and simplifies the eSigning process.

-

What benefits does airSlate SignNow provide for managing IRS Schedule R?

airSlate SignNow offers several benefits for managing IRS Schedule R, including ease of use, cost savings, and enhanced security. Users can expedite their filing process, reduce paperwork, and ensure their documents are safely stored and easy to retrieve.

-

Is airSlate SignNow suitable for small businesses dealing with IRS Schedule R?

Yes, airSlate SignNow is particularly suitable for small businesses as it provides an affordable and efficient way to handle IRS Schedule R filings. Our user-friendly platform allows small teams to manage their documentation with ease, freeing up time for core business activities.

Get more for IRS Schedule R 1040 Form

- Form 1120 s 2018

- Arizona form 322

- 2017 schedule j 2018 form

- Printable irs tax form 8949 2018

- Form 104cr 072213 colorado

- Form 5500 2017 2018

- Form 8615 tax for certain children with unearned income

- Instructions for form 8995 instructions for form 8995 qualified business income deduction simplified computation

Find out other IRS Schedule R 1040 Form

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free

- eSign Maine Healthcare / Medical LLC Operating Agreement Now

- eSign Louisiana High Tech LLC Operating Agreement Safe

- eSign Massachusetts Government Quitclaim Deed Fast

- How Do I eSign Massachusetts Government Arbitration Agreement

- eSign Maryland High Tech Claim Fast

- eSign Maine High Tech Affidavit Of Heirship Now

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple