What is Form 6198 at Risk Limitations TurboTax Intuit 2024-2026

Understanding Form 6198: At-Risk Limitations

Form 6198, officially known as the At-Risk Limitations form, is utilized by taxpayers to determine the amount of loss they can deduct from their income for tax purposes. This form is particularly relevant for individuals engaged in business activities or investments where their financial risk is limited. The IRS requires this form to ensure that taxpayers do not claim losses that exceed their actual investment at risk. Understanding the nuances of this form is crucial for accurate tax reporting and compliance.

Steps to Complete Form 6198

Completing Form 6198 involves several key steps:

- Begin by entering your name and taxpayer identification number at the top of the form.

- Identify the activities for which you are claiming at-risk amounts. This may include partnerships, S corporations, or other business ventures.

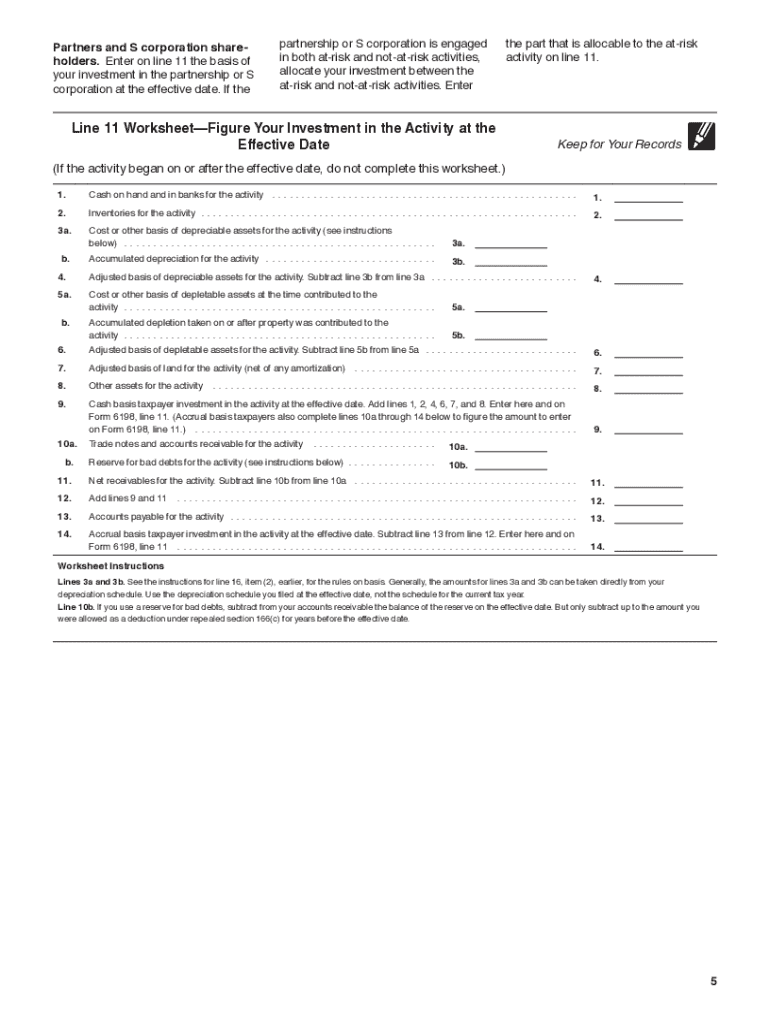

- Calculate your at-risk amounts for each activity by detailing your investments and any liabilities associated with those investments.

- Complete the relevant sections of the form, ensuring that you accurately report any losses and gains related to your at-risk activities.

- Review the form for accuracy before submitting it with your tax return.

Eligibility Criteria for Using Form 6198

To use Form 6198, taxpayers must meet specific eligibility criteria. Generally, this form applies to individuals who have invested in a business or activity where their financial risk is limited. Key criteria include:

- Taxpayers must have a stake in the business or investment, indicating a financial commitment.

- Losses claimed must not exceed the amount the taxpayer has at risk in the activity.

- Form 6198 is typically required for partnerships, S corporations, and certain types of investments.

Filing Deadlines for Form 6198

Taxpayers must adhere to specific filing deadlines when submitting Form 6198. Generally, the form is due on the same date as your federal income tax return. For most individuals, this is April 15. If you file for an extension, ensure that Form 6198 is submitted by the extended deadline. It is essential to stay informed about any changes in tax law that may affect these deadlines.

IRS Guidelines for Form 6198

The IRS provides comprehensive guidelines for completing and submitting Form 6198. Taxpayers should refer to the instructions accompanying the form for detailed information on:

- How to calculate at-risk amounts accurately.

- What constitutes an at-risk investment.

- Documentation required to support claims made on the form.

Following these guidelines is crucial for ensuring compliance and avoiding potential penalties.

Common Scenarios for Using Form 6198

Form 6198 is relevant in various taxpayer scenarios, including:

- Individuals who are self-employed and have invested in their business.

- Investors in partnerships or S corporations where their financial risk is limited.

- Taxpayers who have incurred losses from rental properties or other investments.

Understanding these scenarios helps taxpayers determine if they need to file Form 6198 and how it impacts their overall tax situation.

Create this form in 5 minutes or less

Find and fill out the correct what is form 6198 at risk limitations turbotax intuit

Create this form in 5 minutes!

How to create an eSignature for the what is form 6198 at risk limitations turbotax intuit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 6198 and how is it used?

Form 6198 is a tax form used to report income from a business that is not a corporation. It is essential for individuals who are self-employed or have partnerships. Using airSlate SignNow, you can easily fill out and eSign form 6198, ensuring that your tax documents are accurate and submitted on time.

-

How can airSlate SignNow help with completing form 6198?

airSlate SignNow provides a user-friendly platform that simplifies the process of completing form 6198. With our intuitive interface, you can quickly input your information, save your progress, and eSign the document securely. This streamlines your workflow and reduces the chances of errors.

-

Is there a cost associated with using airSlate SignNow for form 6198?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our plans are designed to be cost-effective, providing you with the tools necessary to manage form 6198 and other documents efficiently. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for form 6198?

airSlate SignNow includes features such as document templates, eSignature capabilities, and secure cloud storage, all of which are beneficial for managing form 6198. These features ensure that you can create, edit, and sign your documents seamlessly. Additionally, you can track the status of your forms in real-time.

-

Can I integrate airSlate SignNow with other applications for form 6198?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to streamline your workflow when handling form 6198. Whether you use CRM systems, cloud storage, or accounting software, our integrations help you manage your documents more efficiently.

-

What are the benefits of using airSlate SignNow for form 6198?

Using airSlate SignNow for form 6198 provides numerous benefits, including enhanced efficiency, reduced paperwork, and improved accuracy. Our platform allows you to complete and eSign documents from anywhere, saving you time and effort. Additionally, the secure environment ensures your sensitive information is protected.

-

Is airSlate SignNow secure for handling sensitive documents like form 6198?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling sensitive documents like form 6198. We utilize advanced encryption and security protocols to protect your data. You can trust that your information is secure while using our platform.

Get more for What Is Form 6198 At Risk Limitations TurboTax Intuit

- Sbar for doctors form

- Filled medical certificate sample 30939766 form

- Sleutelovereenkomst voorbeeld word form

- Tn odometer discrepancy form

- Business communication today 15th edition pdf download form

- Ics 205 form

- Special event food permit hawaii form

- Rbtinitial competency assessment packet requirements form

Find out other What Is Form 6198 At Risk Limitations TurboTax Intuit

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online