Publication 596 2024

What is the Publication 596

Publication 596 is an essential document provided by the IRS that outlines the guidelines for the Earned Income Credit (EIC). This publication details eligibility criteria, income limits, and the necessary calculations for taxpayers to determine their eligibility for this credit. The EIC is designed to assist low to moderate-income working individuals and families, providing them with a financial boost through a tax refund.

How to use the Publication 596

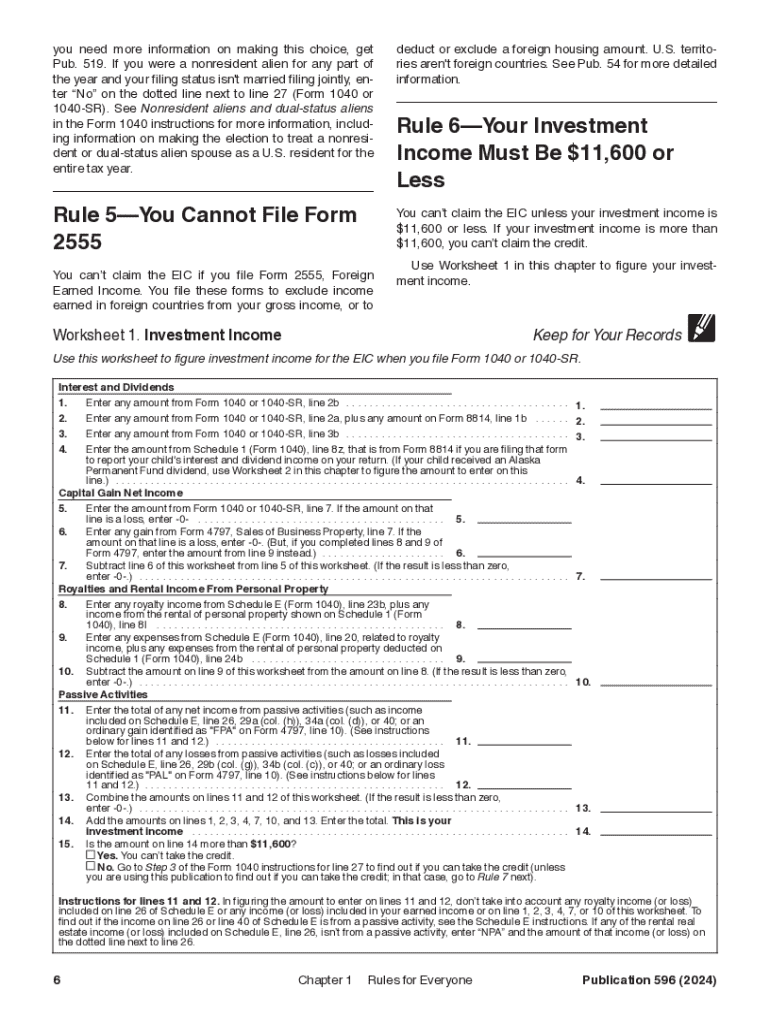

To effectively use Publication 596, taxpayers should first review the eligibility criteria outlined in the document. It is crucial to understand the income limits and filing status that apply to their specific situation. Once eligibility is confirmed, individuals can follow the step-by-step instructions within the publication to calculate their credit amount. The publication also includes worksheets that help in accurately determining the earned income and the qualifying children, if applicable.

Key elements of the Publication 596

Key elements of Publication 596 include the definitions of earned income, the criteria for qualifying children, and the income thresholds for the tax year. The publication also provides detailed examples that illustrate how to calculate the credit based on various income scenarios. Additionally, it highlights the importance of filing accurately to avoid potential penalties related to incorrect claims.

Eligibility Criteria

Eligibility for the Earned Income Credit as outlined in Publication 596 depends on several factors, including filing status, number of qualifying children, and earned income level. Taxpayers must meet specific income thresholds that vary based on their filing status and the number of children they claim. The publication provides a comprehensive table that outlines these income limits for the current tax year, ensuring taxpayers can easily determine their eligibility.

Application Process & Approval Time

The application process for claiming the Earned Income Credit involves completing the appropriate tax forms, including the IRS credit form, and submitting them along with the tax return. Taxpayers should ensure all required documentation is included to avoid delays. The approval time for the credit typically aligns with the processing time of the tax return, but taxpayers can expect longer wait times if additional verification is needed.

Filing Deadlines / Important Dates

Publication 596 also outlines important filing deadlines for claiming the Earned Income Credit. Taxpayers must file their returns by the annual deadline, usually April 15, unless an extension is granted. Additionally, specific dates may apply for taxpayers who wish to amend their returns to claim the credit retroactively. Staying informed about these deadlines is crucial to ensure timely processing and receipt of any credits due.

Create this form in 5 minutes or less

Find and fill out the correct publication 596 770951012

Create this form in 5 minutes!

How to create an eSignature for the publication 596 770951012

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the payback tax credit?

The payback tax credit is a financial incentive designed to help businesses recover costs associated with certain investments. This credit can signNowly reduce your tax liability, making it easier for companies to invest in growth and innovation. Understanding how the payback tax credit works can help you maximize your savings.

-

How can airSlate SignNow help me with the payback tax credit?

airSlate SignNow streamlines the process of signing and managing documents related to the payback tax credit. With our easy-to-use platform, you can quickly eSign necessary forms and keep track of your submissions. This efficiency can save you time and ensure you don’t miss out on potential savings.

-

Are there any costs associated with using airSlate SignNow for the payback tax credit?

airSlate SignNow offers a cost-effective solution for managing documents related to the payback tax credit. Our pricing plans are designed to fit various business needs, ensuring you get the best value for your investment. You can choose a plan that suits your budget while still benefiting from our comprehensive features.

-

What features does airSlate SignNow offer for managing payback tax credit documents?

airSlate SignNow provides a range of features to help you manage documents for the payback tax credit efficiently. These include customizable templates, secure eSigning, and document tracking. Our platform ensures that you can handle all necessary paperwork with ease and confidence.

-

Can I integrate airSlate SignNow with other tools for the payback tax credit process?

Yes, airSlate SignNow offers seamless integrations with various tools that can enhance your payback tax credit process. Whether you use accounting software or project management tools, our platform can connect with them to streamline your workflow. This integration helps you manage your documents and finances more effectively.

-

What are the benefits of using airSlate SignNow for the payback tax credit?

Using airSlate SignNow for the payback tax credit offers numerous benefits, including increased efficiency and reduced paperwork. Our platform allows you to eSign documents quickly, ensuring you meet deadlines and maximize your tax credits. Additionally, our user-friendly interface makes it accessible for all team members.

-

Is airSlate SignNow secure for handling payback tax credit documents?

Absolutely! airSlate SignNow prioritizes security, especially when dealing with sensitive documents related to the payback tax credit. We utilize advanced encryption and compliance measures to protect your data, giving you peace of mind while managing your important paperwork.

Get more for Publication 596

- Texas family law practice manual form 4 2

- Patient prescription form veterans administration va only

- Kenton county quarterly withholding form

- Golf course budget spreadsheet form

- Calorimetry lab gizmo answers form

- 534 e for your protection and privacy please press form

- Planned absence form community christian school

- Xcel energy solarrewards final electrical inspection form

Find out other Publication 596

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now