City of Perrysburg Income Tax Form P Tax Year

What is the City Of Perrysburg Income Tax Form P Tax Year

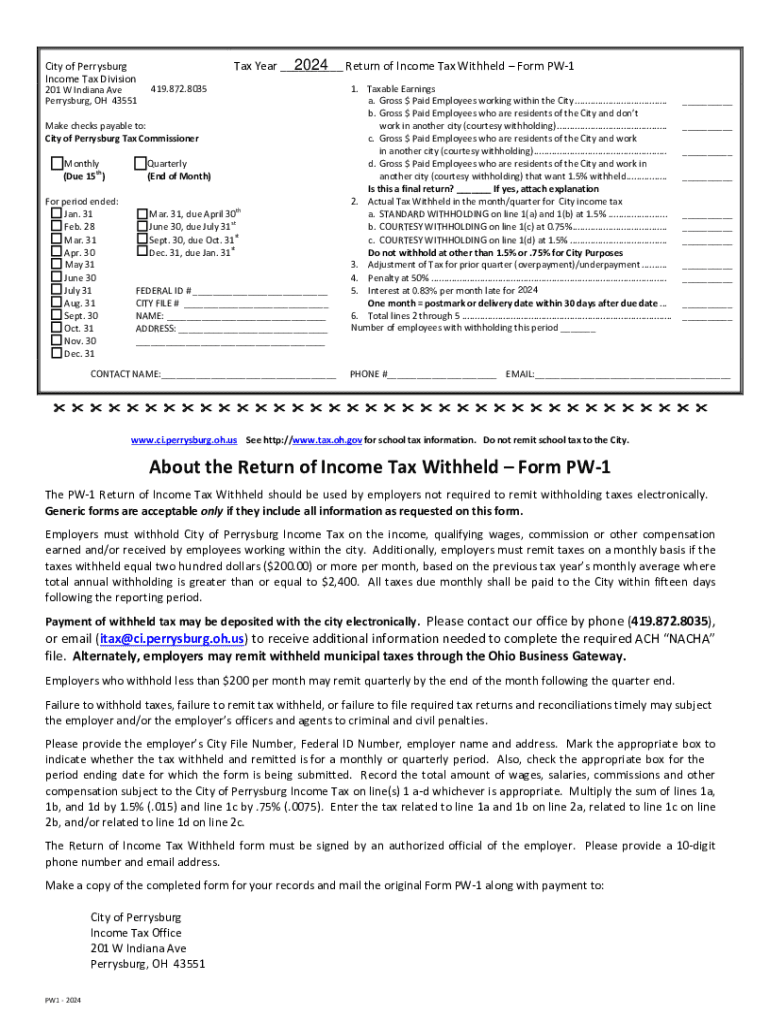

The City of Perrysburg Income Tax Form P is a specific tax form used by residents and businesses in Perrysburg, Ohio, to report income and calculate city income tax obligations for a given tax year. This form is essential for ensuring compliance with local tax regulations. It includes various sections that capture income details, deductions, and credits applicable to the taxpayer's situation. Understanding this form is crucial for accurate tax reporting and avoiding penalties.

How to use the City Of Perrysburg Income Tax Form P Tax Year

Using the City of Perrysburg Income Tax Form P involves several steps. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, carefully fill out the form, ensuring that all income sources are reported accurately. Pay attention to the instructions provided with the form, as they guide you through each section. After completing the form, review it for any errors before submitting it to the appropriate city tax authority.

Steps to complete the City Of Perrysburg Income Tax Form P Tax Year

Completing the City of Perrysburg Income Tax Form P requires a systematic approach:

- Collect all relevant income documents, such as W-2 and 1099 forms.

- Fill in personal information, including name, address, and Social Security number.

- Report all sources of income in the designated sections.

- Deduct any allowable expenses or credits as instructed.

- Calculate the total tax owed or refund due.

- Sign and date the form before submission.

How to obtain the City Of Perrysburg Income Tax Form P Tax Year

The City of Perrysburg Income Tax Form P can be obtained through several methods. Residents can visit the official city website, where the form is typically available for download in PDF format. Additionally, physical copies may be available at local government offices, such as the tax department. It is advisable to ensure you have the correct version for the specific tax year you are filing.

Filing Deadlines / Important Dates

Filing deadlines for the City of Perrysburg Income Tax Form P are critical to avoid penalties. Typically, the deadline for filing is April 15 of the following year. However, if April 15 falls on a weekend or holiday, the deadline may be extended to the next business day. It is essential to stay informed about any changes to these dates, especially during tax season.

Required Documents

When completing the City of Perrysburg Income Tax Form P, several documents are required to ensure accurate reporting. These include:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Records of any additional income sources

- Documentation for deductions, such as receipts for business expenses

- Previous year’s tax return for reference

Penalties for Non-Compliance

Failure to file the City of Perrysburg Income Tax Form P by the deadline can result in penalties. These may include late fees, interest on unpaid taxes, and potential legal action for persistent non-compliance. It is important for taxpayers to understand their responsibilities and ensure timely submission to avoid these consequences.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the city of perrysburg income tax form p tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the City Of Perrysburg Income Tax Form P Tax Year?

The City Of Perrysburg Income Tax Form P Tax Year is a specific tax form used by residents of Perrysburg to report their income for tax purposes. This form is essential for accurately calculating your tax obligations and ensuring compliance with local tax laws. Completing this form correctly can help you avoid penalties and ensure you pay the correct amount of tax.

-

How can airSlate SignNow help with the City Of Perrysburg Income Tax Form P Tax Year?

airSlate SignNow provides an efficient platform for electronically signing and sending the City Of Perrysburg Income Tax Form P Tax Year. With our user-friendly interface, you can easily fill out and submit your tax forms without the hassle of printing and mailing. This streamlines the process, saving you time and ensuring your documents are securely delivered.

-

What are the pricing options for using airSlate SignNow for tax forms?

airSlate SignNow offers various pricing plans to accommodate different needs, including options for individuals and businesses. Our plans are designed to be cost-effective, ensuring you can manage your City Of Perrysburg Income Tax Form P Tax Year without breaking the bank. You can choose a plan that fits your budget while still accessing all necessary features.

-

Are there any features specifically for tax document management in airSlate SignNow?

Yes, airSlate SignNow includes features tailored for tax document management, such as templates for the City Of Perrysburg Income Tax Form P Tax Year. You can create, edit, and store your tax documents securely within the platform. Additionally, our tracking features allow you to monitor the status of your documents, ensuring you never miss a deadline.

-

Can I integrate airSlate SignNow with other accounting software?

Absolutely! airSlate SignNow offers seamless integrations with popular accounting software, making it easier to manage your financial documents, including the City Of Perrysburg Income Tax Form P Tax Year. This integration allows for a smooth workflow, enabling you to sync your tax data and documents effortlessly.

-

What are the benefits of using airSlate SignNow for tax forms?

Using airSlate SignNow for your tax forms, including the City Of Perrysburg Income Tax Form P Tax Year, provides numerous benefits. You gain access to a secure, efficient platform that simplifies the signing and submission process. Additionally, our solution enhances collaboration, allowing multiple parties to review and sign documents quickly.

-

Is airSlate SignNow secure for handling sensitive tax information?

Yes, airSlate SignNow prioritizes the security of your sensitive tax information. We utilize advanced encryption and security protocols to protect your data while you complete the City Of Perrysburg Income Tax Form P Tax Year. You can trust that your information is safe and secure throughout the entire process.

Get more for City Of Perrysburg Income Tax Form P Tax Year

Find out other City Of Perrysburg Income Tax Form P Tax Year

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors