Ohio it RE Form

What is the Ohio IT RE

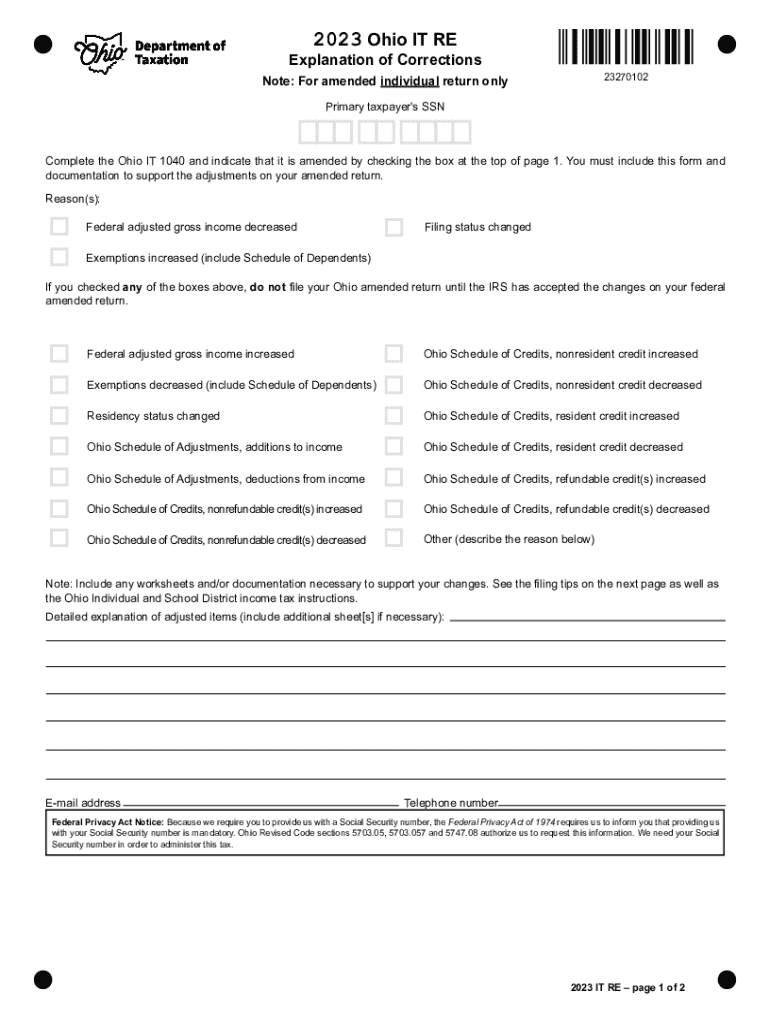

The Ohio IT RE is a tax form used by individuals to explain adjustments made to their income tax returns. This form is essential for taxpayers who need to clarify discrepancies or provide additional information regarding their tax filings. It serves as a means to communicate with the Ohio Department of Taxation about reasons for amendments, ensuring compliance with state tax regulations. Understanding its purpose is crucial for maintaining accurate tax records and avoiding potential penalties.

How to use the Ohio IT RE

Using the Ohio IT RE involves several straightforward steps. First, gather all relevant documentation related to your original tax return and any amendments you wish to explain. Next, fill out the form accurately, ensuring that you provide detailed explanations for each correction or adjustment. It is important to include any supporting documents that substantiate your claims. Finally, submit the completed form to the appropriate tax authority, either online or via mail, depending on your preference.

Steps to complete the Ohio IT RE

Completing the Ohio IT RE requires careful attention to detail. Follow these steps:

- Review your original tax return and identify any areas that require correction.

- Obtain the Ohio IT RE form from the Ohio Department of Taxation's website or other authorized sources.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide a clear explanation for each correction, referencing specific line items from your original return.

- Attach any necessary documentation that supports your explanations.

- Double-check your entries for accuracy before submission.

Key elements of the Ohio IT RE

The Ohio IT RE includes several key elements that are essential for its effective use. These elements consist of:

- Taxpayer Information: Personal details such as name, address, and identification numbers.

- Explanation Section: A dedicated area where taxpayers must provide detailed reasons for the corrections being made.

- Supporting Documents: Any additional paperwork that validates the claims made in the explanation section.

- Signature: A signature line where the taxpayer certifies the accuracy of the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the Ohio IT RE are crucial for compliance. Generally, the form must be submitted within a specified period after the original tax return was filed or amended. It is important to stay informed about these deadlines to avoid penalties. Typically, the deadline aligns with the state tax filing dates, which can vary each year. Taxpayers should check the Ohio Department of Taxation's website for the most current dates and any updates related to filing requirements.

Penalties for Non-Compliance

Failure to comply with the requirements of the Ohio IT RE can lead to various penalties. These may include fines, interest on unpaid taxes, and potential audits. It is essential for taxpayers to ensure that all information submitted is accurate and complete. Non-compliance can also result in delays in processing refunds or adjustments, further complicating a taxpayer's financial situation. Understanding these potential consequences can motivate individuals to take the necessary steps to file correctly and on time.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ohio it re

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to ohio it re?

airSlate SignNow is a powerful eSignature solution that allows businesses to send and sign documents electronically. It streamlines the signing process, making it easier for companies in Ohio to manage their document workflows efficiently. With its user-friendly interface, airSlate SignNow is an ideal choice for those looking for an effective ohio it re solution.

-

What are the pricing options for airSlate SignNow in Ohio?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses in Ohio. Whether you're a small startup or a large enterprise, you can choose a plan that fits your budget and requirements. This cost-effective solution ensures that you get the best value for your investment in ohio it re.

-

What features does airSlate SignNow provide for ohio it re?

airSlate SignNow includes a variety of features designed to enhance your document management experience. Key features include customizable templates, real-time tracking, and secure cloud storage. These functionalities make it a comprehensive ohio it re tool for businesses looking to optimize their signing processes.

-

How can airSlate SignNow benefit my business in Ohio?

By using airSlate SignNow, businesses in Ohio can signNowly reduce the time and costs associated with traditional document signing. The platform enhances productivity by allowing users to send, sign, and manage documents from anywhere. This efficiency is crucial for companies seeking a reliable ohio it re solution.

-

Does airSlate SignNow integrate with other software commonly used in Ohio?

Yes, airSlate SignNow seamlessly integrates with various software applications that businesses in Ohio frequently use. This includes popular tools like Google Workspace, Salesforce, and Microsoft Office. Such integrations make it easier to incorporate airSlate SignNow into your existing workflows, enhancing your ohio it re capabilities.

-

Is airSlate SignNow secure for handling sensitive documents in Ohio?

Absolutely, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling sensitive documents in Ohio. The platform employs advanced encryption and adheres to industry standards to protect your data. This commitment to security is essential for businesses looking for a trustworthy ohio it re solution.

-

Can I use airSlate SignNow on mobile devices in Ohio?

Yes, airSlate SignNow is fully optimized for mobile devices, allowing users in Ohio to manage their documents on the go. The mobile app provides all the essential features needed for sending and signing documents, ensuring that you can stay productive no matter where you are. This flexibility is a key advantage of using airSlate SignNow for ohio it re.

Get more for Ohio IT RE

Find out other Ohio IT RE

- Sign New Mexico Refund Request Form Mobile

- Sign Alaska Sponsorship Agreement Safe

- How To Sign Massachusetts Copyright License Agreement

- How Do I Sign Vermont Online Tutoring Services Proposal Template

- How Do I Sign North Carolina Medical Records Release

- Sign Idaho Domain Name Registration Agreement Easy

- Sign Indiana Domain Name Registration Agreement Myself

- Sign New Mexico Domain Name Registration Agreement Easy

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement