OUT of BUSINESS MOVED OUT of RITA Form

Understanding the Out of Business or Moved Out of RITA

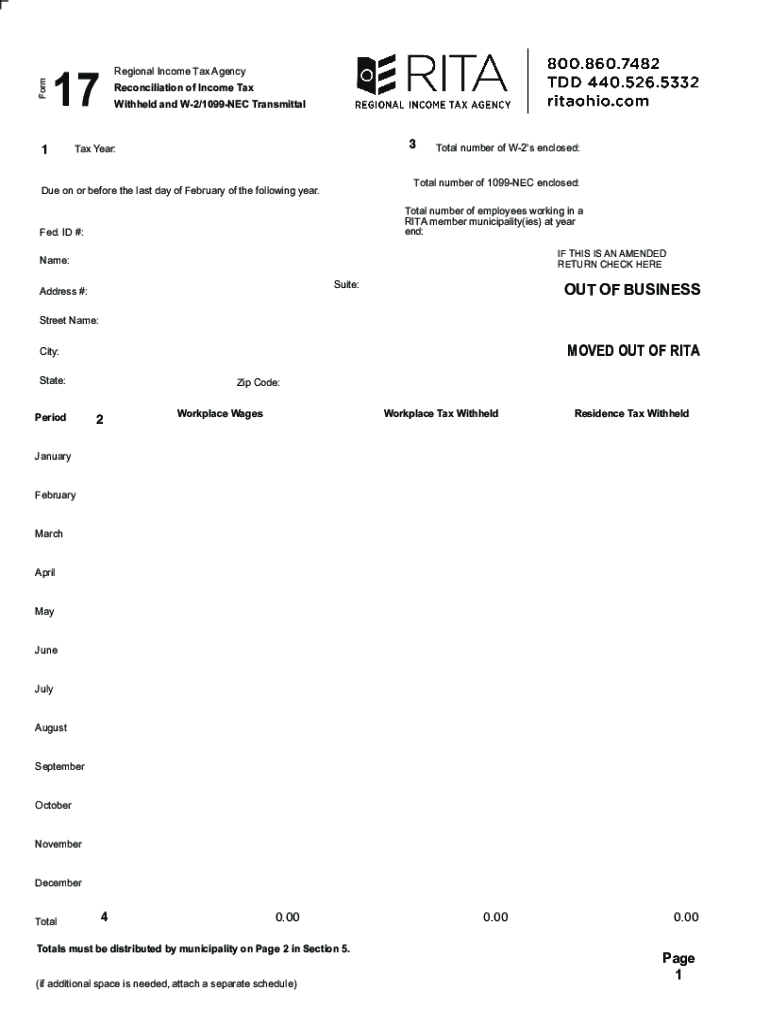

The Out of Business or Moved Out of RITA form is essential for individuals and businesses that have ceased operations or relocated outside the RITA jurisdiction. This form helps ensure that tax records are accurately updated and that any outstanding obligations are settled. It is particularly important for businesses that want to avoid unnecessary tax liabilities or penalties after they have closed or moved.

Steps to Complete the Out of Business or Moved Out of RITA Form

Completing the Out of Business or Moved Out of RITA form involves several key steps:

- Gather all necessary information, including your business name, address, and tax identification number.

- Indicate the date your business ceased operations or the date you moved out of the RITA jurisdiction.

- Provide details regarding any final tax obligations, including any outstanding payments or filings.

- Review the completed form for accuracy before submission.

Required Documents for the Out of Business or Moved Out of RITA

When completing the Out of Business or Moved Out of RITA form, certain documents may be required to support your submission. These may include:

- Your business tax identification number.

- Final tax return or reconciliation documents.

- Proof of business closure or relocation, such as a lease termination or a new address confirmation.

Form Submission Methods for the Out of Business or Moved Out of RITA

The Out of Business or Moved Out of RITA form can typically be submitted through various methods to ensure convenience and efficiency:

- Online submission via the RITA website, if available.

- Mailing the completed form to the designated RITA office.

- In-person submission at a local RITA office, if applicable.

Legal Use of the Out of Business or Moved Out of RITA Form

Using the Out of Business or Moved Out of RITA form is a legal requirement for businesses that have ceased operations or moved out of the RITA jurisdiction. Failing to submit this form can result in continued tax obligations and potential penalties. It is important to ensure compliance with local tax laws to avoid unnecessary complications.

Filing Deadlines for the Out of Business or Moved Out of RITA Form

Timely filing of the Out of Business or Moved Out of RITA form is crucial. Generally, this form should be submitted as soon as your business ceases operations or relocates. Specific deadlines may vary, so it is advisable to check with RITA for any applicable deadlines to ensure compliance.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the out of business moved out of rita

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the rita form 17 and how can airSlate SignNow help?

The rita form 17 is a specific document used for various administrative purposes. airSlate SignNow simplifies the process of filling out and signing the rita form 17 by providing an intuitive platform that allows users to easily create, send, and eSign documents securely.

-

Is there a cost associated with using airSlate SignNow for the rita form 17?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan provides access to features that streamline the management of documents like the rita form 17, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for managing the rita form 17?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure eSigning, all of which enhance the management of the rita form 17. These tools help ensure that your documents are processed efficiently and securely.

-

Can I integrate airSlate SignNow with other applications for the rita form 17?

Absolutely! airSlate SignNow offers seamless integrations with various applications, allowing you to manage the rita form 17 alongside your existing workflows. This integration capability enhances productivity and ensures a smooth document management experience.

-

How does airSlate SignNow ensure the security of the rita form 17?

Security is a top priority for airSlate SignNow. The platform employs advanced encryption and compliance measures to protect your rita form 17 and other sensitive documents, ensuring that your data remains safe throughout the signing process.

-

What are the benefits of using airSlate SignNow for the rita form 17?

Using airSlate SignNow for the rita form 17 offers numerous benefits, including increased efficiency, reduced turnaround time, and enhanced collaboration. The platform's user-friendly interface makes it easy for anyone to manage and sign documents without hassle.

-

Is airSlate SignNow suitable for businesses of all sizes when handling the rita form 17?

Yes, airSlate SignNow is designed to cater to businesses of all sizes. Whether you're a small startup or a large enterprise, the platform provides the necessary tools to efficiently manage the rita form 17 and other documents, making it a versatile solution.

Get more for OUT OF BUSINESS MOVED OUT OF RITA

- Concealed carry permit valdosta ga form

- Special resolution change of company name template australia form

- Usps shipping label template form

- File small claims court form

- Can i use the forms tool for job applications squarespace answers

- Uniqlo online application form

- Job application form builder

- Mc 357 patition to withdraw funds from blocked account judicial council forms

Find out other OUT OF BUSINESS MOVED OUT OF RITA

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple