Ohio Individual Forms Availability

What is the Ohio Individual Forms Availability

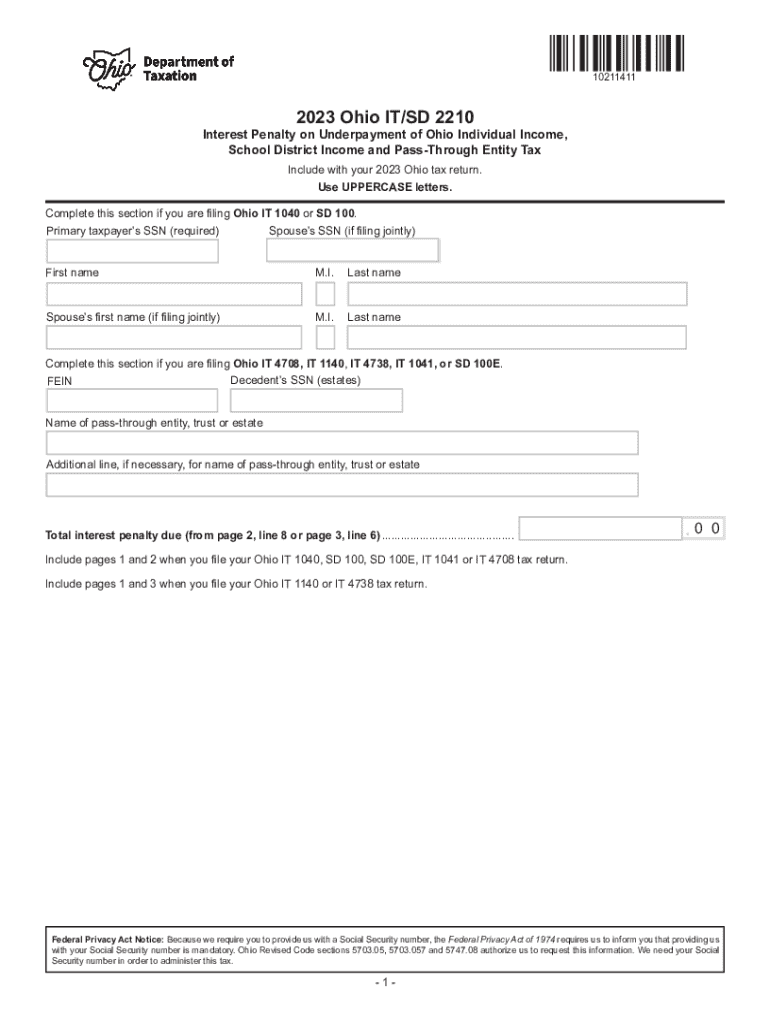

The Ohio Individual Forms Availability refers to the range of forms that Ohio residents need for various tax purposes, including the IT SD 2210. This specific form is used for calculating the underpayment of estimated income tax and is crucial for taxpayers who may not have withheld enough tax throughout the year. Understanding the availability of these forms ensures that individuals can meet their tax obligations effectively.

Steps to complete the Ohio Individual Forms Availability

Completing the Ohio Individual Forms, including the IT SD 2210, involves several steps:

- Gather necessary financial documents, such as W-2s and 1099s, to assess your income and tax withheld.

- Determine if you need to file the IT SD 2210 based on your estimated tax payments and withholding.

- Fill out the form accurately, ensuring all calculations are correct to avoid penalties.

- Review the completed form for any errors before submission.

- Submit the form by the appropriate deadline, either online or via mail.

Filing Deadlines / Important Dates

It is essential to be aware of filing deadlines to avoid penalties. The due date for submitting the IT SD 2210 typically aligns with the annual tax return deadline, which is April 15 for most taxpayers. If you are unable to meet this deadline, you may file for an extension, but it is crucial to pay any estimated taxes owed by the original deadline to minimize interest and penalties.

Required Documents

To complete the IT SD 2210, you will need several key documents:

- W-2 forms from employers, showing income and withheld taxes.

- 1099 forms for any additional income sources.

- Records of estimated tax payments made throughout the year.

- Any relevant documentation that supports your income and deductions.

Penalties for Non-Compliance

Failing to file the IT SD 2210 or underpaying estimated taxes can result in penalties. The state of Ohio imposes interest on unpaid taxes, as well as a penalty for underpayment. This penalty is calculated based on the amount of underpayment and the length of time the payment is overdue. It is important to understand these consequences to ensure compliance and avoid additional financial burdens.

Who Issues the Form

The IT SD 2210 form is issued by the Ohio Department of Taxation. This agency is responsible for managing tax forms and ensuring that taxpayers have access to the necessary resources for filing their taxes accurately. Understanding the issuing authority can help taxpayers find additional support and resources related to the form.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ohio individual forms availability

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the it sd 2210 feature in airSlate SignNow?

The it sd 2210 feature in airSlate SignNow allows users to streamline their document signing process. This feature enhances efficiency by enabling users to send, sign, and manage documents electronically, ensuring a smooth workflow. With it sd 2210, businesses can reduce turnaround times and improve overall productivity.

-

How does airSlate SignNow's it sd 2210 pricing compare to competitors?

airSlate SignNow offers competitive pricing for its it sd 2210 solution, making it an affordable choice for businesses of all sizes. Unlike many competitors, airSlate SignNow provides flexible pricing plans that cater to different needs, ensuring you only pay for what you use. This cost-effective approach helps businesses save money while accessing powerful eSigning features.

-

What are the key benefits of using it sd 2210 in airSlate SignNow?

Using the it sd 2210 feature in airSlate SignNow provides numerous benefits, including enhanced security, improved compliance, and faster document processing. This feature ensures that your documents are signed securely and stored safely, reducing the risk of fraud. Additionally, it sd 2210 helps businesses maintain compliance with industry regulations.

-

Can I integrate it sd 2210 with other software?

Yes, airSlate SignNow's it sd 2210 can be easily integrated with various software applications. This flexibility allows businesses to connect their existing tools and streamline their workflows. Popular integrations include CRM systems, project management tools, and cloud storage services, enhancing the overall functionality of your document management process.

-

Is it sd 2210 suitable for small businesses?

Absolutely! The it sd 2210 feature in airSlate SignNow is designed to cater to the needs of small businesses. Its user-friendly interface and cost-effective pricing make it an ideal solution for small teams looking to enhance their document signing processes without breaking the bank.

-

What types of documents can I sign using it sd 2210?

With airSlate SignNow's it sd 2210 feature, you can sign a wide variety of documents, including contracts, agreements, and forms. This versatility ensures that you can handle all your signing needs in one place. Whether it's legal documents or internal memos, it sd 2210 simplifies the signing process.

-

How secure is the it sd 2210 feature in airSlate SignNow?

The it sd 2210 feature in airSlate SignNow prioritizes security with advanced encryption and authentication measures. This ensures that your documents are protected from unauthorized access and tampering. Additionally, airSlate SignNow complies with industry standards, providing peace of mind for businesses concerned about data security.

Get more for Ohio Individual Forms Availability

Find out other Ohio Individual Forms Availability

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now