Form IFTA 100519IFTA Quarterly Fuel Use Tax Returnifta100

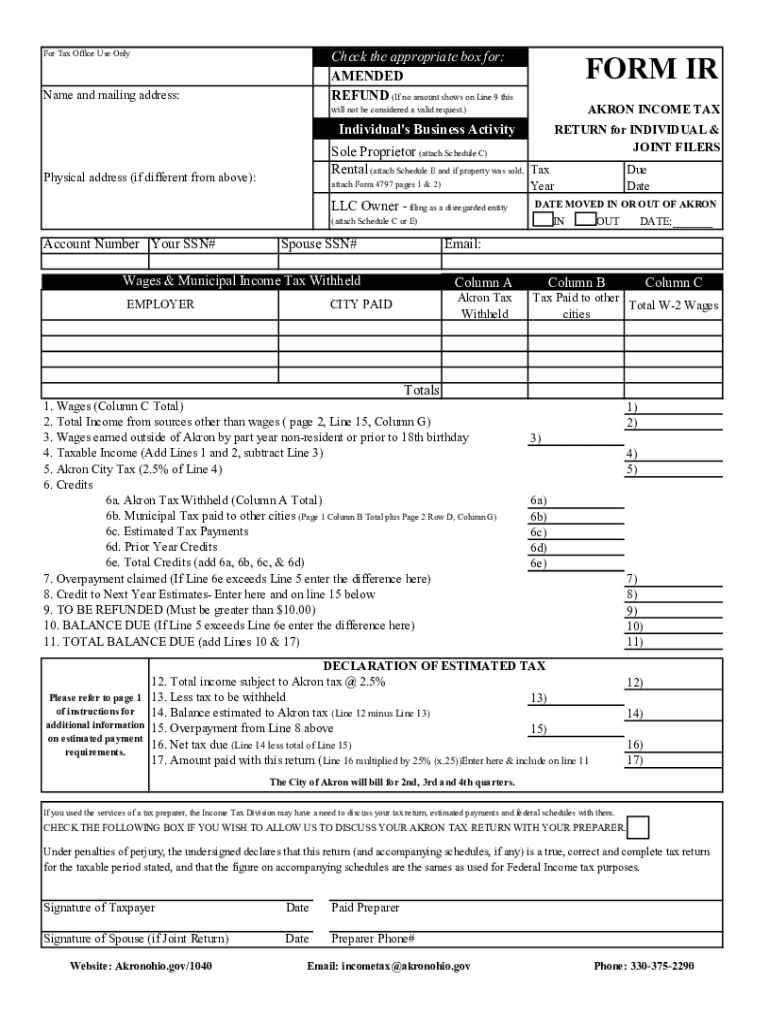

Understanding the Ohio Income Tax Return Form

The Ohio income tax return form is a crucial document for individuals and businesses reporting their income to the state. This form is used to calculate the amount of tax owed based on various income sources, including wages, salaries, and other earnings. The form also allows taxpayers to claim deductions and credits to reduce their taxable income, ensuring compliance with state tax laws.

Steps to Complete the Ohio Income Tax Return Form

Filling out the Ohio income tax return form involves several key steps:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Determine your filing status, which can affect your tax rate and eligibility for certain credits.

- Calculate your total income by adding all sources of income reported on your documents.

- Identify and apply any deductions and credits you qualify for, such as those for education or healthcare expenses.

- Complete the form by entering your calculated income, deductions, and credits.

- Review your form for accuracy before submitting it.

Filing Deadlines and Important Dates

It is essential to be aware of the filing deadlines for the Ohio income tax return form. Typically, the deadline for filing individual income tax returns is April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be mindful of any changes to deadlines that may occur due to state regulations or special circumstances.

Form Submission Methods

Taxpayers have several options for submitting the Ohio income tax return form:

- Online Submission: Many individuals choose to file their returns electronically through approved tax software, which can simplify the process and reduce errors.

- Mail: The form can be printed, filled out, and mailed to the appropriate state tax office. Ensure that you send it well before the deadline to avoid late penalties.

- In-Person: Some taxpayers may prefer to submit their forms in person at designated tax offices, where assistance may also be available.

Key Elements of the Ohio Income Tax Return Form

The Ohio income tax return form includes several key elements that taxpayers must complete:

- Personal Information: This section requires your name, address, and Social Security number.

- Income Details: Report all sources of income, including wages, interest, and dividends.

- Deductions and Credits: Identify any deductions or credits applicable to your situation, which can lower your taxable income.

- Tax Calculation: The form will guide you through calculating the total tax owed based on your reported income and applicable tax rates.

Penalties for Non-Compliance

Failing to file the Ohio income tax return form on time or underreporting income can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is important to ensure that all information is accurate and submitted by the deadline to avoid these consequences.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form ifta 100519ifta quarterly fuel use tax returnifta100

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ohio income tax return form?

The ohio income tax return form is a document that residents of Ohio must complete to report their income and calculate their tax liability. This form is essential for ensuring compliance with state tax laws and can be easily filled out using airSlate SignNow's eSigning features.

-

How can airSlate SignNow help with the ohio income tax return form?

airSlate SignNow simplifies the process of completing and submitting the ohio income tax return form by allowing users to fill out, sign, and send documents electronically. This not only saves time but also ensures that your forms are securely stored and easily accessible.

-

Is there a cost associated with using airSlate SignNow for the ohio income tax return form?

Yes, airSlate SignNow offers various pricing plans that cater to different needs, including options for individuals and businesses. The cost is competitive and provides excellent value for the features available, especially when managing documents like the ohio income tax return form.

-

What features does airSlate SignNow offer for the ohio income tax return form?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking, which are particularly useful for managing the ohio income tax return form. These features enhance efficiency and ensure that your tax documents are handled professionally.

-

Can I integrate airSlate SignNow with other software for my ohio income tax return form?

Absolutely! airSlate SignNow offers integrations with various software applications, making it easy to manage your ohio income tax return form alongside other business tools. This seamless integration helps streamline your workflow and improves overall productivity.

-

What are the benefits of using airSlate SignNow for my ohio income tax return form?

Using airSlate SignNow for your ohio income tax return form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform's user-friendly interface makes it easy for anyone to navigate the tax filing process.

-

Is airSlate SignNow secure for handling the ohio income tax return form?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your ohio income tax return form and other sensitive documents are protected. The platform uses advanced encryption and secure storage solutions to safeguard your information.

Get more for Form IFTA 100519IFTA Quarterly Fuel Use Tax Returnifta100

Find out other Form IFTA 100519IFTA Quarterly Fuel Use Tax Returnifta100

- Electronic signature New Jersey Lease Renewal Free

- Electronic signature Texas Lease Renewal Fast

- How Can I Electronic signature Colorado Notice of Intent to Vacate

- eSignature Delaware Employee Compliance Survey Later

- eSignature Kansas Employee Compliance Survey Myself

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage

- Electronic signature West Virginia Sales Receipt Template Free

- Electronic signature Colorado Sales Invoice Template Computer

- Electronic signature New Hampshire Sales Invoice Template Computer

- Electronic signature Tennessee Introduction Letter Free

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice