Form 433 H SP 5 Solicitud De Plan De Pagos a Plazos Y Declaracin De Ingresos Y Gastos 2020

Understanding Form 433 H SP 5: Purpose and Use

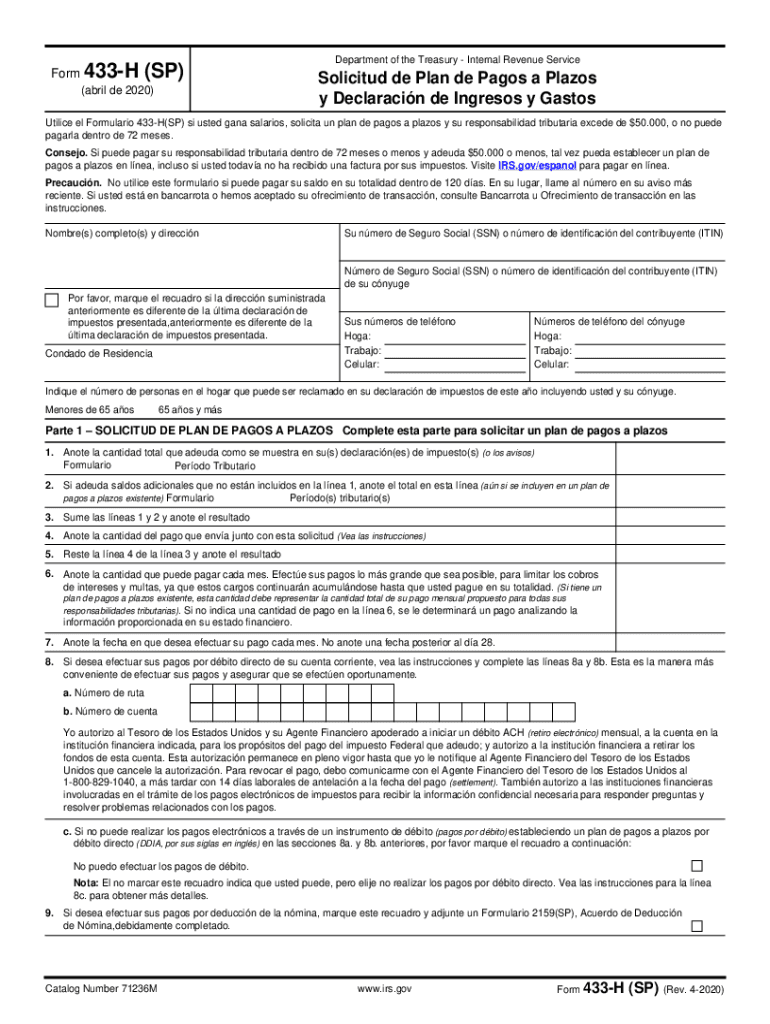

Form 433 H SP 5, known as Solicitud De Plan De Pagos A Plazos Y Declaración De Ingresos Y Gastos, is a crucial document used primarily in the context of tax payments. This form enables individuals and businesses to request a payment plan for their tax liabilities while simultaneously providing a declaration of their income and expenses. By submitting this form, taxpayers can demonstrate their financial situation to the IRS, which helps in negotiating manageable payment terms.

Steps to Complete Form 433 H SP 5

Completing Form 433 H SP 5 involves several clear steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements, expense receipts, and any other relevant financial information. Next, fill out the form by providing detailed information about your income sources, monthly expenses, and assets. It is essential to be thorough and honest in your declarations. After completing the form, review it for any errors before submission to the IRS.

Obtaining Form 433 H SP 5

Form 433 H SP 5 can be obtained directly from the IRS website or through authorized tax professionals. It is available in both digital and paper formats, allowing taxpayers to choose the method that best suits their needs. If you prefer a digital copy, downloading it from the IRS site ensures you have the latest version, which is essential for compliance.

Key Elements of Form 433 H SP 5

The form consists of several key sections that require specific information. Taxpayers must provide personal identification details, a comprehensive list of income sources, and a breakdown of monthly expenses. Additionally, the form requests information about assets and liabilities, which helps the IRS assess the taxpayer's financial situation. Understanding these elements is vital for accurately completing the form and facilitating a successful payment plan request.

IRS Guidelines for Form 433 H SP 5

The IRS has established guidelines for completing and submitting Form 433 H SP 5. These guidelines emphasize the importance of accuracy in reporting income and expenses. Taxpayers are encouraged to keep supporting documentation for all claims made on the form. Adhering to these guidelines can help avoid delays in processing and potential issues with the IRS.

Eligibility Criteria for Payment Plans

To qualify for a payment plan using Form 433 H SP 5, taxpayers must meet specific eligibility criteria. This includes demonstrating a genuine financial hardship that prevents them from paying their tax liabilities in full. The IRS evaluates the information provided on the form to determine eligibility, making it crucial for taxpayers to present a clear and accurate picture of their financial situation.

Submitting Form 433 H SP 5

Form 433 H SP 5 can be submitted to the IRS through various methods. Taxpayers may choose to send the completed form by mail, or in some cases, they may be able to submit it electronically through designated IRS online systems. Understanding the submission options is important to ensure timely processing and to avoid any potential penalties for late submissions.

Create this form in 5 minutes or less

Find and fill out the correct form 433 h sp 5 solicitud de plan de pagos a plazos y declaracin de ingresos y gastos

Create this form in 5 minutes!

How to create an eSignature for the form 433 h sp 5 solicitud de plan de pagos a plazos y declaracin de ingresos y gastos

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 433 H SP 5 Solicitud De Plan De Pagos A Plazos Y Declaracin De Ingresos Y Gastos?

The Form 433 H SP 5 Solicitud De Plan De Pagos A Plazos Y Declaracin De Ingresos Y Gastos is a document used to request a payment plan and declare income and expenses. This form is essential for individuals seeking to manage their tax obligations effectively. By using this form, you can provide the IRS with a clear picture of your financial situation.

-

How can airSlate SignNow help with the Form 433 H SP 5 Solicitud De Plan De Pagos A Plazos Y Declaracin De Ingresos Y Gastos?

airSlate SignNow simplifies the process of completing and submitting the Form 433 H SP 5 Solicitud De Plan De Pagos A Plazos Y Declaracin De Ingresos Y Gastos. Our platform allows you to fill out the form electronically, ensuring accuracy and saving time. Additionally, you can eSign the document securely, making it easy to submit to the IRS.

-

What are the pricing options for using airSlate SignNow for the Form 433 H SP 5?

airSlate SignNow offers various pricing plans to accommodate different needs, starting from a basic plan to more advanced options. Each plan provides access to features that can assist with the Form 433 H SP 5 Solicitud De Plan De Pagos A Plazos Y Declaracin De Ingresos Y Gastos. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the Form 433 H SP 5?

With airSlate SignNow, you can easily create, edit, and manage the Form 433 H SP 5 Solicitud De Plan De Pagos A Plazos Y Declaracin De Ingresos Y Gastos. Key features include document templates, eSigning capabilities, and secure cloud storage. These tools streamline the process and enhance your overall experience.

-

Is airSlate SignNow secure for submitting the Form 433 H SP 5?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your Form 433 H SP 5 Solicitud De Plan De Pagos A Plazos Y Declaracin De Ingresos Y Gastos is protected. Our platform uses encryption and secure access protocols to safeguard your sensitive information. You can confidently submit your documents knowing they are secure.

-

Can I integrate airSlate SignNow with other applications for the Form 433 H SP 5?

Absolutely! airSlate SignNow offers integrations with various applications that can enhance your workflow when dealing with the Form 433 H SP 5 Solicitud De Plan De Pagos A Plazos Y Declaracin De Ingresos Y Gastos. This allows you to connect with tools you already use, making the process more efficient and seamless.

-

What are the benefits of using airSlate SignNow for the Form 433 H SP 5?

Using airSlate SignNow for the Form 433 H SP 5 Solicitud De Plan De Pagos A Plazos Y Declaracin De Ingresos Y Gastos offers numerous benefits, including time savings, increased accuracy, and ease of use. Our platform simplifies the document management process, allowing you to focus on other important tasks. Additionally, eSigning eliminates the need for printing and scanning.

Get more for Form 433 H SP 5 Solicitud De Plan De Pagos A Plazos Y Declaracin De Ingresos Y Gastos

Find out other Form 433 H SP 5 Solicitud De Plan De Pagos A Plazos Y Declaracin De Ingresos Y Gastos

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU