IRS Notice 703 Social Security Income Tax Form

What is the IRS Notice 703 Social Security Income Tax Form

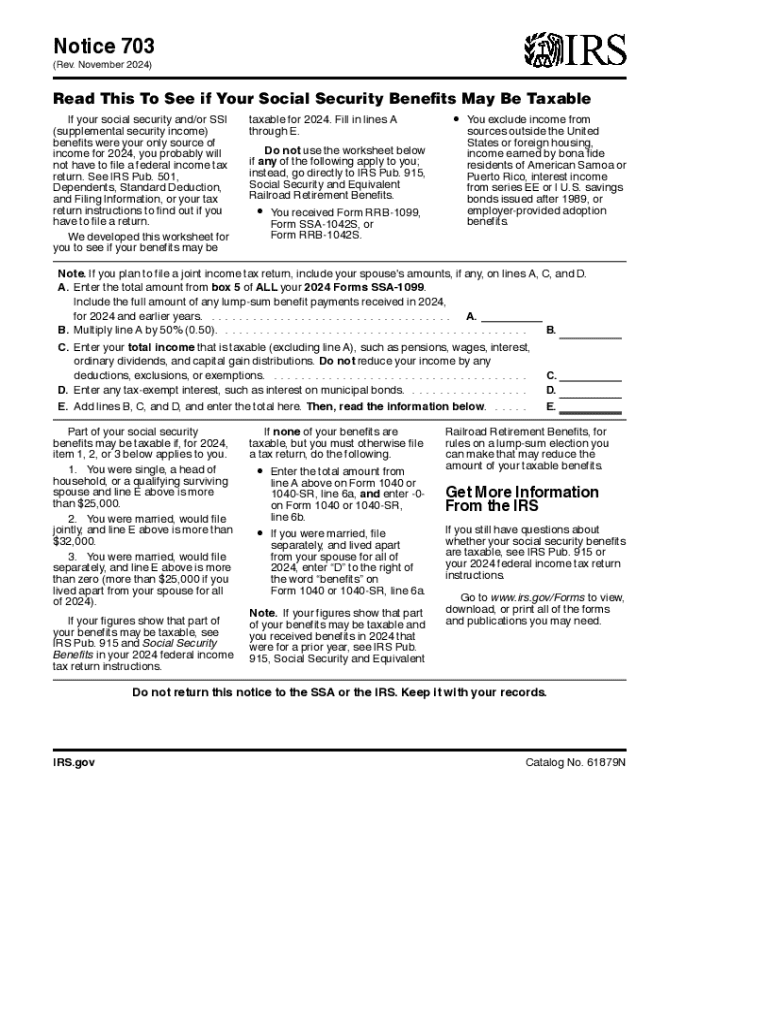

The IRS Notice 703 is a form used by taxpayers to report Social Security income for tax purposes. It is essential for individuals who receive Social Security benefits and need to understand how this income affects their overall tax liability. The notice provides details on the amount of benefits received and any applicable tax implications. Understanding this form is crucial for accurate tax reporting and compliance with IRS regulations.

How to use the IRS Notice 703 Social Security Income Tax Form

To effectively use the IRS Notice 703, taxpayers should first review the information provided on the notice. This includes the total amount of Social Security benefits received during the tax year. Taxpayers must then incorporate this information into their tax returns, ensuring that they report the income accurately. It is important to follow IRS guidelines to determine if any portion of the benefits is taxable, as this can vary based on total income and filing status.

Steps to complete the IRS Notice 703 Social Security Income Tax Form

Completing the IRS Notice 703 involves several steps:

- Review the notice for accuracy, ensuring that the reported benefits match your records.

- Determine your total income, including other sources of income, to assess the taxability of your Social Security benefits.

- Follow IRS instructions to calculate the taxable amount, if applicable, using the appropriate worksheets.

- Include the taxable amount on your tax return, ensuring it is reported in the correct section.

Key elements of the IRS Notice 703 Social Security Income Tax Form

Key elements of the IRS Notice 703 include:

- The total amount of Social Security benefits received during the year.

- Any adjustments or corrections to previous amounts reported.

- Information on how to report the benefits on your tax return.

- Details on how these benefits may impact your overall tax liability.

Filing Deadlines / Important Dates

Filing deadlines for tax returns typically fall on April fifteenth of each year. However, taxpayers receiving IRS Notice 703 should be aware of any specific deadlines related to their Social Security income reporting. It is advisable to keep track of any changes announced by the IRS regarding filing dates, especially for the 2024 tax year.

Penalties for Non-Compliance

Failing to report Social Security income as indicated on the IRS Notice 703 can lead to penalties. The IRS may impose fines for underreporting income, which can include interest on unpaid taxes and additional penalties for negligence. It is crucial for taxpayers to ensure that they accurately report their benefits to avoid these consequences.

Handy tips for filling out IRS Notice 703 Social Security Income Tax Form online

Quick steps to complete and e-sign IRS Notice 703 Social Security Income Tax Form online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We know how stressing filling out documents could be. Obtain access to a HIPAA and GDPR compliant platform for maximum simplicity. Use signNow to e-sign and send out IRS Notice 703 Social Security Income Tax Form for e-signing.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs notice 703 social security income tax form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an IRS Notice 703?

An IRS Notice 703 is a communication from the IRS that informs taxpayers about their tax obligations. It typically outlines any discrepancies or issues related to tax filings. Understanding this notice is crucial for ensuring compliance and avoiding penalties.

-

How can airSlate SignNow help with IRS Notice 703?

airSlate SignNow provides a streamlined solution for managing documents related to IRS Notice 703. With our eSigning capabilities, you can quickly sign and send necessary documents to the IRS, ensuring timely responses to any notices received. This helps maintain compliance and reduces the risk of further complications.

-

What features does airSlate SignNow offer for handling IRS notices?

airSlate SignNow offers features such as secure eSigning, document templates, and real-time tracking. These tools simplify the process of responding to IRS Notice 703 and other tax-related documents. Our platform ensures that all communications are efficient and legally binding.

-

Is airSlate SignNow cost-effective for small businesses dealing with IRS notices?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses. Our pricing plans are flexible and cater to various needs, making it easier for businesses to manage IRS Notice 703 and other important documents without breaking the bank. You can choose a plan that fits your budget and requirements.

-

Can I integrate airSlate SignNow with other software for IRS notice management?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, enhancing your ability to manage IRS Notice 703 and other documents. Whether you use accounting software or CRM systems, our integrations ensure a smooth workflow and better document management.

-

What are the benefits of using airSlate SignNow for IRS Notice 703?

Using airSlate SignNow for IRS Notice 703 offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to handle documents electronically, which speeds up the process and minimizes the risk of lost paperwork. Additionally, our secure environment protects sensitive information.

-

How does airSlate SignNow ensure the security of documents related to IRS notices?

airSlate SignNow prioritizes the security of your documents, including those related to IRS Notice 703. We utilize advanced encryption and secure cloud storage to protect your data. Our compliance with industry standards ensures that your sensitive information remains confidential and secure.

Get more for IRS Notice 703 Social Security Income Tax Form

Find out other IRS Notice 703 Social Security Income Tax Form

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now