Form 1095 B Reprint Cover Letter English DHCS

Understanding the Form 1095-B

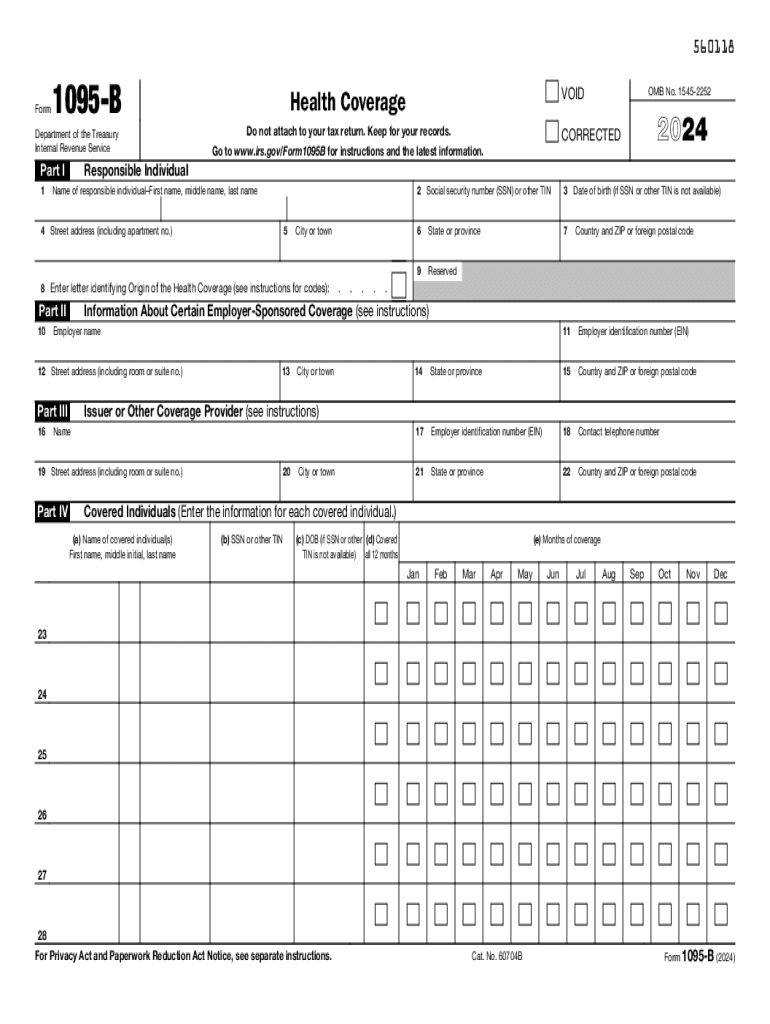

The Form 1095-B is a crucial document used to report health coverage information to the Internal Revenue Service (IRS). This form is primarily issued by health insurance providers, including Medicaid, to confirm that individuals have met the Affordable Care Act's requirement for minimum essential coverage. It includes details such as the type of coverage, the period during which coverage was active, and the individuals covered under the plan. Understanding this form is essential for taxpayers to accurately complete their tax returns and avoid potential penalties.

Key Components of the Form 1095-B

The Form 1095-B contains several important sections that provide necessary information regarding health coverage. Key components include:

- Subscriber Information: This section lists the name and address of the individual who holds the insurance policy.

- Covered Individuals: Names and Social Security numbers of individuals covered under the policy are detailed here.

- Coverage Period: This indicates the months during which the coverage was active, helping to verify compliance with health coverage mandates.

- Issuer Information: The name and contact details of the insurance provider are included for reference.

Obtaining the Form 1095-B

To obtain the Form 1095-B, individuals can request it directly from their health insurance provider. Most insurers automatically send this form to policyholders by mail or electronically. If you have not received your form by early February, it is advisable to contact your insurer for assistance. Additionally, if you are enrolled in Medicaid, you can access your 1095-B form online through your state’s Medicaid website.

Steps to Complete the Form 1095-B

Completing the Form 1095-B involves several straightforward steps:

- Gather Required Information: Collect personal information, including names, Social Security numbers, and coverage details.

- Fill Out the Form: Enter the required information accurately in the designated fields.

- Review for Accuracy: Double-check all entries to ensure there are no errors or omissions.

- Submit the Form: Depending on your situation, you may need to submit the form to the IRS or keep it for your records when filing your tax return.

IRS Guidelines for Form 1095-B

The IRS provides specific guidelines regarding the use and submission of the Form 1095-B. Taxpayers must retain this form for their records, as it serves as proof of health coverage. While the IRS does not require taxpayers to submit the form with their tax returns, it may be requested during audits or reviews. It is important to ensure that the information reported on the form matches what is reported on your tax return to avoid discrepancies.

Filing Deadlines for Form 1095-B

Filing deadlines for the Form 1095-B are critical for compliance. Insurers are required to provide this form to individuals by January 31 of each year. Taxpayers should ensure they receive their form in a timely manner to facilitate accurate tax filing. If you do not receive your form by the deadline, it is advisable to reach out to your insurance provider for assistance.

Handy tips for filling out Form 1095 B Reprint Cover Letter English DHCS online

Quick steps to complete and e-sign Form 1095 B Reprint Cover Letter English DHCS online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We know how stressing filling out documents could be. Obtain access to a HIPAA and GDPR compliant platform for maximum efficiency. Use signNow to electronically sign and send Form 1095 B Reprint Cover Letter English DHCS for collecting e-signatures.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1095 b reprint cover letter english dhcs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 1095 b and why is it important?

Form 1095 b is a tax form used to report health coverage information to the IRS. It is important because it helps individuals verify their health insurance status and ensures compliance with the Affordable Care Act. Businesses must provide this form to employees to confirm that they had health coverage during the tax year.

-

How can airSlate SignNow help with form 1095 b?

airSlate SignNow simplifies the process of sending and eSigning form 1095 b. With our platform, you can easily create, distribute, and collect signed forms, ensuring that your employees receive their tax documents promptly. This streamlines your compliance process and reduces the risk of errors.

-

What features does airSlate SignNow offer for managing form 1095 b?

airSlate SignNow offers features such as customizable templates, secure eSigning, and automated workflows specifically for managing form 1095 b. These tools help you efficiently handle the distribution and collection of forms, making the process faster and more reliable. Additionally, our platform ensures that all documents are securely stored and easily accessible.

-

Is airSlate SignNow cost-effective for handling form 1095 b?

Yes, airSlate SignNow is a cost-effective solution for managing form 1095 b. Our pricing plans are designed to accommodate businesses of all sizes, allowing you to save on printing and mailing costs. By digitizing your document management, you can also reduce administrative overhead and improve efficiency.

-

Can I integrate airSlate SignNow with other software for form 1095 b?

Absolutely! airSlate SignNow offers integrations with various software applications, making it easy to incorporate form 1095 b into your existing workflows. Whether you use HR software, accounting tools, or other document management systems, our platform can seamlessly connect to enhance your operations.

-

What are the benefits of using airSlate SignNow for form 1095 b?

Using airSlate SignNow for form 1095 b provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced compliance. Our platform allows for quick eSigning and tracking of documents, ensuring that you meet deadlines without hassle. Additionally, the secure storage of signed forms protects sensitive employee information.

-

How secure is airSlate SignNow when handling form 1095 b?

airSlate SignNow prioritizes security when handling form 1095 b. We utilize advanced encryption and secure cloud storage to protect your documents and sensitive data. Our compliance with industry standards ensures that your information remains confidential and secure throughout the signing process.

Get more for Form 1095 B Reprint Cover Letter English DHCS

Find out other Form 1095 B Reprint Cover Letter English DHCS

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors