IRS Schedule E Walkthrough Supplemental Income & Loss Form

What is the IRS Schedule E for Supplemental Income & Loss

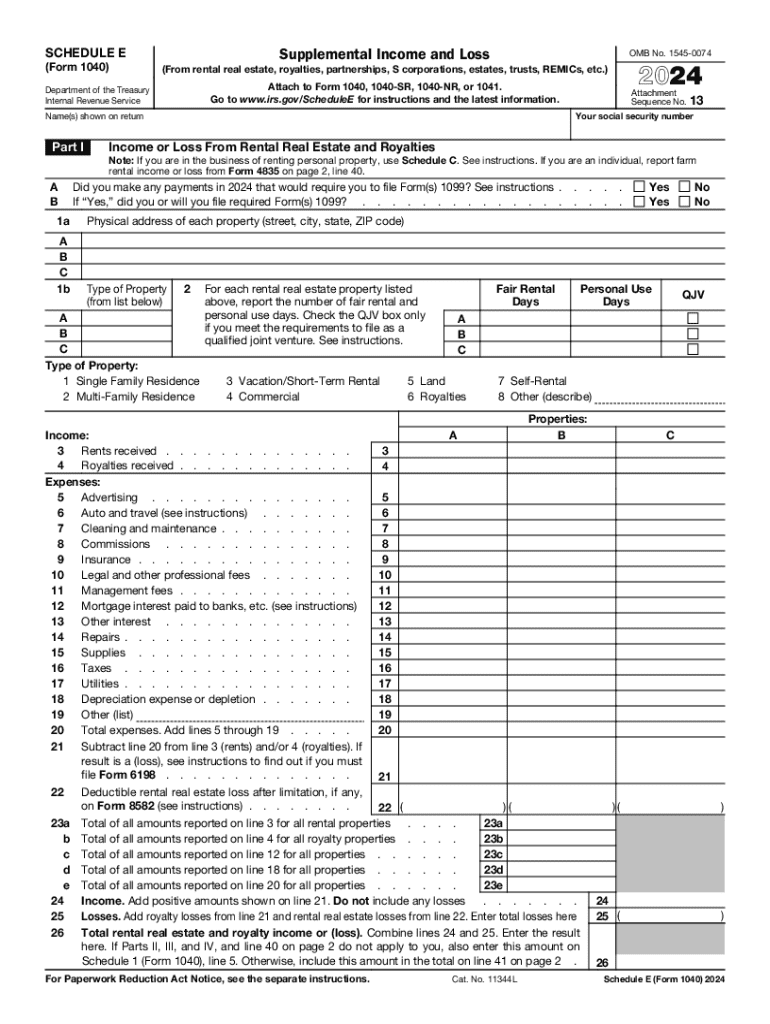

The IRS Schedule E is a tax form used by individuals to report income or loss from various sources, including rental real estate, royalties, partnerships, S corporations, estates, trusts, and more. This form is essential for taxpayers who earn supplemental income, allowing them to detail their earnings and any associated expenses. By accurately completing Schedule E, taxpayers can ensure they comply with IRS regulations while maximizing their deductions related to rental properties and other income sources.

Steps to Complete the IRS Schedule E for Supplemental Income & Loss

Completing the IRS Schedule E involves several steps. First, gather all necessary documentation, including rental agreements, income statements, and expense receipts. Next, fill out Part I of the form, which focuses on income or loss from rental real estate. Report your total rental income, then list any expenses such as mortgage interest, property tax, repairs, and management fees. In Part II, report income or loss from partnerships, S corporations, estates, and trusts. Finally, ensure all calculations are accurate and submit the form with your tax return.

Required Documents for IRS Schedule E Submission

To complete the IRS Schedule E, you will need specific documents and information, including:

- Rental income statements from tenants

- Receipts for deductible expenses, such as repairs and maintenance

- Mortgage interest statements (Form 1098)

- Property tax statements

- Records of any other income related to supplemental sources

Having these documents organized will streamline the process and help ensure accuracy when reporting your income and expenses.

Filing Deadlines for IRS Schedule E

The IRS Schedule E must be filed annually as part of your federal income tax return. For most taxpayers, the deadline is April 15 of the following year. If April 15 falls on a weekend or holiday, the deadline is extended to the next business day. Taxpayers can also file for an extension, which typically allows an additional six months to submit their tax returns, but any taxes owed must still be paid by the original deadline to avoid penalties.

IRS Guidelines for Completing Schedule E

The IRS provides specific guidelines for completing Schedule E, emphasizing the importance of accurate reporting. Taxpayers should ensure that all income is reported, and expenses are substantiated with proper documentation. The IRS also advises that taxpayers familiarize themselves with the definitions of deductible expenses related to rental properties, as incorrect claims can lead to audits or penalties. Regularly reviewing IRS publications can provide additional clarity on the requirements for Schedule E.

Examples of Using the IRS Schedule E for Supplemental Income

Examples of situations where the IRS Schedule E is applicable include:

- A landlord reporting rental income from a residential property

- An individual receiving royalties from a book or patent

- A partner in a business partnership reporting their share of income or loss

- Income from an S corporation where the individual is a shareholder

These examples illustrate the diverse applications of Schedule E in reporting various forms of supplemental income.

Handy tips for filling out IRS Schedule E Walkthrough Supplemental Income & Loss online

Quick steps to complete and e-sign IRS Schedule E Walkthrough Supplemental Income & Loss online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We know how stressing filling out documents could be. Obtain access to a HIPAA and GDPR compliant platform for optimum efficiency. Use signNow to electronically sign and send IRS Schedule E Walkthrough Supplemental Income & Loss for collecting e-signatures.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs schedule e walkthrough supplemental income amp loss

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how can it help businesses from rental?

airSlate SignNow is a powerful eSignature solution that allows businesses to send and sign documents electronically. For companies in the rental industry, it streamlines the process of managing rental agreements and contracts, making it easier to close deals quickly and efficiently.

-

How does pricing work for airSlate SignNow from rental?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses from rental. You can choose from various subscription options based on the number of users and features required, ensuring you only pay for what you need.

-

What features does airSlate SignNow offer for businesses from rental?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure cloud storage. These tools are designed to enhance the efficiency of document management for businesses from rental, allowing for faster processing and improved organization.

-

Can airSlate SignNow integrate with other tools used in the rental industry?

Yes, airSlate SignNow seamlessly integrates with various applications commonly used in the rental industry, such as CRM systems and property management software. This integration helps businesses from rental streamline their operations and maintain a cohesive workflow.

-

What are the benefits of using airSlate SignNow for rental agreements?

Using airSlate SignNow for rental agreements offers numerous benefits, including reduced turnaround time and enhanced security. By digitizing the signing process, businesses from rental can ensure that documents are signed quickly and securely, minimizing delays and potential errors.

-

Is airSlate SignNow user-friendly for those in the rental sector?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone in the rental sector to navigate. Its intuitive interface allows users to send, sign, and manage documents without extensive training or technical knowledge.

-

How does airSlate SignNow ensure the security of documents from rental?

airSlate SignNow prioritizes the security of your documents with advanced encryption and compliance with industry standards. Businesses from rental can trust that their sensitive information is protected throughout the signing process.

Get more for IRS Schedule E Walkthrough Supplemental Income & Loss

- Claim for sickness benefit belize social security board form

- Chapter 16 worksheet the knee and related structures form

- 592v form

- Zung depression scale neurosciencecme form

- Cosmetology daily log sheet form

- Sheike returns form

- Provissional migration form

- Safer food better business for retailers safer food better business for retailers form

Find out other IRS Schedule E Walkthrough Supplemental Income & Loss

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe