Form 656 L Sp Rev 12 Offer in Compromise Doubt as to Liability Spanish Version 2020

What is the Form 656 L sp Rev 12 Offer In Compromise Doubt As To Liability Spanish Version

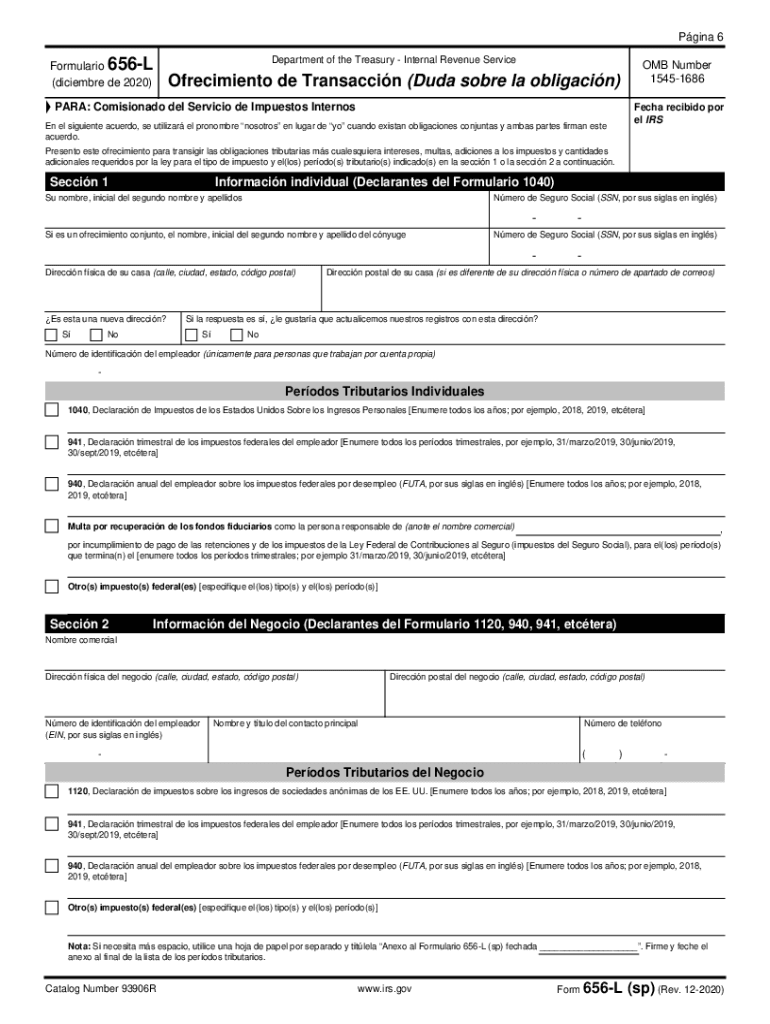

The Form 656 L sp Rev 12, also known as the Offer In Compromise Doubt As To Liability Spanish Version, is a crucial document used by taxpayers in the United States to settle tax liabilities with the IRS. This form is specifically designed for individuals who believe they do not owe the tax debt in question. By submitting this form, taxpayers can formally request the IRS to reconsider their tax obligations based on the assertion that the liability is in doubt. The Spanish version ensures accessibility for Spanish-speaking taxpayers, allowing them to navigate the complexities of tax negotiations more effectively.

How to use the Form 656 L sp Rev 12 Offer In Compromise Doubt As To Liability Spanish Version

To use the Form 656 L sp Rev 12, taxpayers should first ensure they meet the eligibility criteria for filing an Offer In Compromise. After confirming eligibility, the next step is to accurately complete the form, providing all requested information, including personal details and the specific tax liabilities in question. Once the form is filled out, it should be submitted to the IRS along with any required documentation that supports the claim of doubt regarding the tax liability. It is important to keep copies of all submitted documents for personal records.

Steps to complete the Form 656 L sp Rev 12 Offer In Compromise Doubt As To Liability Spanish Version

Completing the Form 656 L sp Rev 12 involves several key steps:

- Obtain the form from the IRS website or authorized providers.

- Fill in the taxpayer's information, including name, address, and Social Security number.

- Detail the tax periods involved and the amounts claimed as liabilities.

- Provide a clear explanation of why the taxpayer believes the liability is in doubt.

- Attach any supporting documentation that substantiates the claim.

- Review the form for accuracy before submission.

Legal use of the Form 656 L sp Rev 12 Offer In Compromise Doubt As To Liability Spanish Version

The legal use of the Form 656 L sp Rev 12 is grounded in the IRS's guidelines for settling tax disputes. Taxpayers must utilize this form to formally express their position regarding disputed tax liabilities. The IRS allows this form to be filed under specific circumstances, primarily when there is a legitimate dispute over the amount owed. Proper legal use ensures that taxpayers maintain compliance with IRS regulations while seeking a resolution to their tax issues.

Eligibility Criteria

To qualify for submitting the Form 656 L sp Rev 12, taxpayers must meet certain eligibility criteria. Primarily, they should have a legitimate reason to doubt the tax liability, such as discrepancies in tax records or changes in tax law that may affect their situation. Additionally, taxpayers should not have any pending bankruptcy proceedings, and they must have filed all required tax returns for the previous five years. Meeting these criteria is essential for the IRS to consider the offer.

Required Documents

When submitting the Form 656 L sp Rev 12, taxpayers must include specific supporting documents to substantiate their claims. These documents may include:

- Copies of relevant tax returns.

- Documentation that supports the claim of liability doubt, such as correspondence with the IRS.

- Financial statements or records that provide insight into the taxpayer's financial situation.

Providing comprehensive documentation enhances the chances of a favorable outcome.

Form Submission Methods

The Form 656 L sp Rev 12 can be submitted to the IRS through various methods. Taxpayers have the option to file the form by mail, ensuring that it is sent to the appropriate IRS address for Offers In Compromise. Additionally, depending on the IRS guidelines, some taxpayers may have the option to submit the form electronically through the IRS's online portal. It is important to verify the current submission methods available to ensure compliance and timely processing.

Create this form in 5 minutes or less

Find and fill out the correct form 656 l sp rev 12 offer in compromise doubt as to liability spanish version

Create this form in 5 minutes!

How to create an eSignature for the form 656 l sp rev 12 offer in compromise doubt as to liability spanish version

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 656 L sp Rev 12 Offer In Compromise Doubt As To Liability Spanish Version?

The Form 656 L sp Rev 12 Offer In Compromise Doubt As To Liability Spanish Version is a document used by taxpayers to propose a settlement with the IRS regarding tax liabilities they believe they cannot pay. This form allows individuals to negotiate their tax debts in Spanish, making it accessible for Spanish-speaking taxpayers.

-

How can airSlate SignNow help with the Form 656 L sp Rev 12 Offer In Compromise Doubt As To Liability Spanish Version?

airSlate SignNow provides a user-friendly platform to complete and eSign the Form 656 L sp Rev 12 Offer In Compromise Doubt As To Liability Spanish Version. Our solution streamlines the process, ensuring that you can submit your offer efficiently and securely.

-

What are the pricing options for using airSlate SignNow for the Form 656 L sp Rev 12 Offer In Compromise Doubt As To Liability Spanish Version?

airSlate SignNow offers flexible pricing plans that cater to different business needs. You can choose from monthly or annual subscriptions, which provide access to features that simplify the completion and signing of the Form 656 L sp Rev 12 Offer In Compromise Doubt As To Liability Spanish Version.

-

Are there any features specifically designed for the Form 656 L sp Rev 12 Offer In Compromise Doubt As To Liability Spanish Version?

Yes, airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking that are particularly beneficial for managing the Form 656 L sp Rev 12 Offer In Compromise Doubt As To Liability Spanish Version. These tools enhance the efficiency and accuracy of your submission.

-

Can I integrate airSlate SignNow with other applications for the Form 656 L sp Rev 12 Offer In Compromise Doubt As To Liability Spanish Version?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to seamlessly manage your documents related to the Form 656 L sp Rev 12 Offer In Compromise Doubt As To Liability Spanish Version. This ensures that your workflow remains uninterrupted and efficient.

-

What are the benefits of using airSlate SignNow for the Form 656 L sp Rev 12 Offer In Compromise Doubt As To Liability Spanish Version?

Using airSlate SignNow for the Form 656 L sp Rev 12 Offer In Compromise Doubt As To Liability Spanish Version provides numerous benefits, including time savings, enhanced security, and ease of use. Our platform simplifies the process, allowing you to focus on your financial situation rather than paperwork.

-

Is airSlate SignNow secure for submitting the Form 656 L sp Rev 12 Offer In Compromise Doubt As To Liability Spanish Version?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your Form 656 L sp Rev 12 Offer In Compromise Doubt As To Liability Spanish Version is submitted safely. Our platform uses advanced encryption and security protocols to protect your sensitive information.

Get more for Form 656 L sp Rev 12 Offer In Compromise Doubt As To Liability Spanish Version

Find out other Form 656 L sp Rev 12 Offer In Compromise Doubt As To Liability Spanish Version

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document