Form 656 L Sp Rev 5 Offer in Compromise Doubt as to Liability DATL Spanish Version 2024-2026

What is the Form 656 L sp Rev 5 Offer In Compromise Doubt As To Liability DATL Spanish Version

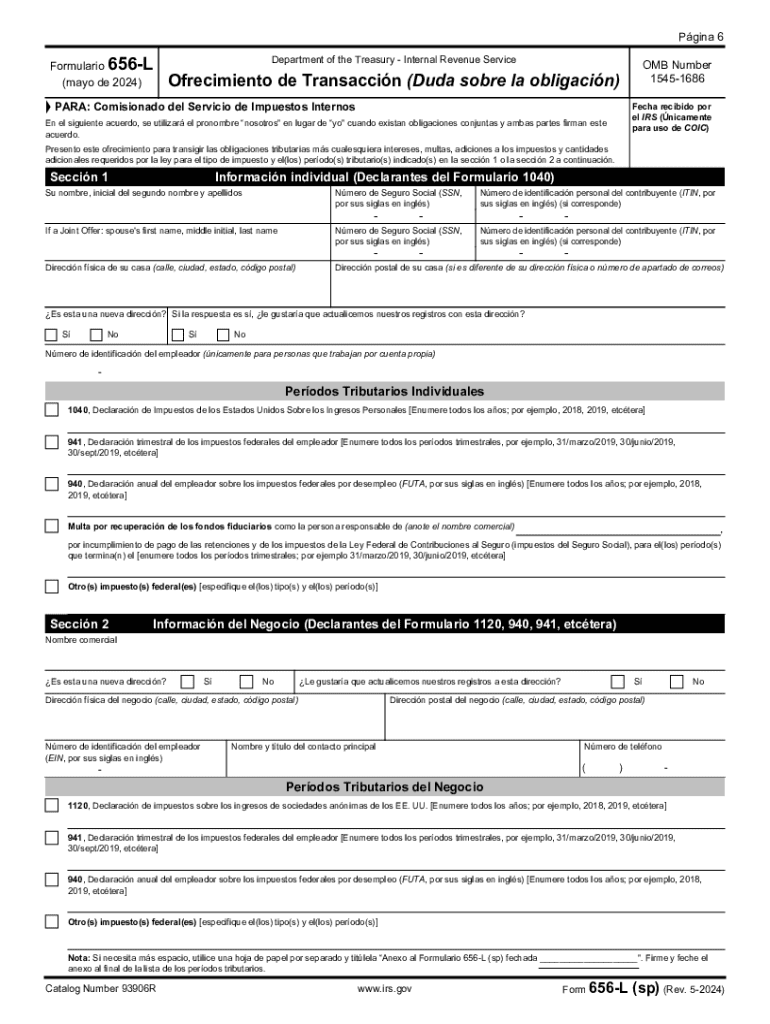

The Form 656 L sp Rev 5, known as the Offer In Compromise Doubt As To Liability (DATL) in its Spanish version, is a document used by taxpayers to propose a settlement with the IRS regarding tax liabilities that are in dispute. This form allows individuals to assert that they do not owe the tax amount claimed by the IRS due to various reasons, such as errors in tax assessments or a lack of legal obligation to pay. The form is specifically designed for Spanish-speaking taxpayers, ensuring accessibility and understanding of the process.

How to use the Form 656 L sp Rev 5 Offer In Compromise Doubt As To Liability DATL Spanish Version

Using the Form 656 L sp Rev 5 involves several steps. Taxpayers must first gather all relevant documentation that supports their claim of doubt regarding the tax liability. This includes any correspondence with the IRS, previous tax returns, and any other pertinent financial information. Once the form is completed, it should be submitted to the IRS along with the required documentation and any applicable fees. It is crucial to ensure that all information is accurate and complete to avoid delays in processing.

Steps to complete the Form 656 L sp Rev 5 Offer In Compromise Doubt As To Liability DATL Spanish Version

Completing the Form 656 L sp Rev 5 requires careful attention to detail. Follow these steps:

- Download the form from the IRS website or obtain a physical copy.

- Fill in your personal information, including your name, address, and Social Security number.

- Clearly state the reasons for your doubt regarding the tax liability.

- Attach supporting documents that validate your claim.

- Review the completed form for accuracy before submission.

Eligibility Criteria

To qualify for submitting the Form 656 L sp Rev 5, taxpayers must demonstrate a legitimate doubt about their tax liability. This can include situations where the IRS has assessed taxes that the taxpayer believes are incorrect or where there is ambiguity in tax law that affects the taxpayer's obligation. Additionally, taxpayers must be current with all filing requirements and should not be in bankruptcy proceedings.

Required Documents

When submitting the Form 656 L sp Rev 5, it is essential to include specific documents to support your claim. Required documents may include:

- Copies of previous tax returns related to the disputed liability.

- Correspondence with the IRS regarding the tax issue.

- Any additional evidence that substantiates your position, such as financial statements or legal documents.

Form Submission Methods

The Form 656 L sp Rev 5 can be submitted to the IRS through various methods. Taxpayers may choose to file the form by mail, ensuring that it is sent to the correct IRS address based on their location. Alternatively, some taxpayers may have the option to submit the form electronically, depending on their specific circumstances and the IRS guidelines at the time of submission. It is important to check the IRS website for the most current submission methods available.

Create this form in 5 minutes or less

Find and fill out the correct form 656 l sp rev 5 offer in compromise doubt as to liability datl spanish version

Create this form in 5 minutes!

How to create an eSignature for the form 656 l sp rev 5 offer in compromise doubt as to liability datl spanish version

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 656 L sp Rev 5 Offer In Compromise Doubt As To Liability DATL Spanish Version?

The Form 656 L sp Rev 5 Offer In Compromise Doubt As To Liability DATL Spanish Version is a specific IRS form used by taxpayers to propose a settlement for tax liabilities they believe they do not owe. This form allows individuals to present their case in Spanish, ensuring better understanding and communication with the IRS.

-

How can airSlate SignNow help with the Form 656 L sp Rev 5 Offer In Compromise Doubt As To Liability DATL Spanish Version?

airSlate SignNow provides an efficient platform for completing and eSigning the Form 656 L sp Rev 5 Offer In Compromise Doubt As To Liability DATL Spanish Version. Our user-friendly interface simplifies the process, allowing you to manage your documents securely and effectively.

-

What are the pricing options for using airSlate SignNow for the Form 656 L sp Rev 5 Offer In Compromise Doubt As To Liability DATL Spanish Version?

airSlate SignNow offers flexible pricing plans that cater to various business needs. You can choose from monthly or annual subscriptions, ensuring you have access to all features necessary for managing the Form 656 L sp Rev 5 Offer In Compromise Doubt As To Liability DATL Spanish Version at a cost-effective rate.

-

Are there any features specifically designed for the Form 656 L sp Rev 5 Offer In Compromise Doubt As To Liability DATL Spanish Version?

Yes, airSlate SignNow includes features tailored for the Form 656 L sp Rev 5 Offer In Compromise Doubt As To Liability DATL Spanish Version, such as customizable templates, secure eSigning, and document tracking. These features streamline the submission process and enhance compliance with IRS requirements.

-

Can I integrate airSlate SignNow with other applications for the Form 656 L sp Rev 5 Offer In Compromise Doubt As To Liability DATL Spanish Version?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to seamlessly manage the Form 656 L sp Rev 5 Offer In Compromise Doubt As To Liability DATL Spanish Version alongside your existing tools. This integration enhances productivity and ensures a smooth workflow.

-

What benefits does airSlate SignNow provide for handling the Form 656 L sp Rev 5 Offer In Compromise Doubt As To Liability DATL Spanish Version?

Using airSlate SignNow for the Form 656 L sp Rev 5 Offer In Compromise Doubt As To Liability DATL Spanish Version offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are handled with care and delivered promptly.

-

Is there customer support available for questions about the Form 656 L sp Rev 5 Offer In Compromise Doubt As To Liability DATL Spanish Version?

Yes, airSlate SignNow provides dedicated customer support to assist you with any inquiries regarding the Form 656 L sp Rev 5 Offer In Compromise Doubt As To Liability DATL Spanish Version. Our team is available to help you navigate the platform and resolve any issues you may encounter.

Get more for Form 656 L sp Rev 5 Offer In Compromise Doubt As To Liability DATL Spanish Version

Find out other Form 656 L sp Rev 5 Offer In Compromise Doubt As To Liability DATL Spanish Version

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document