Form 656 B Sp Rev 4 Offer in Compromise Booklet Spanish Version 2023

What is the Form 656 B sp Rev 4 Offer In Compromise Booklet Spanish Version

The Form 656 B sp Rev 4 Offer In Compromise Booklet Spanish Version is an official document provided by the Internal Revenue Service (IRS) designed for Spanish-speaking taxpayers. This booklet outlines the Offer In Compromise (OIC) program, which allows individuals to settle their tax debts for less than the full amount owed. It serves as a comprehensive guide, detailing eligibility criteria, application procedures, and the necessary forms required to submit a valid offer. The booklet is essential for those seeking to navigate the complexities of tax resolution in their preferred language.

How to use the Form 656 B sp Rev 4 Offer In Compromise Booklet Spanish Version

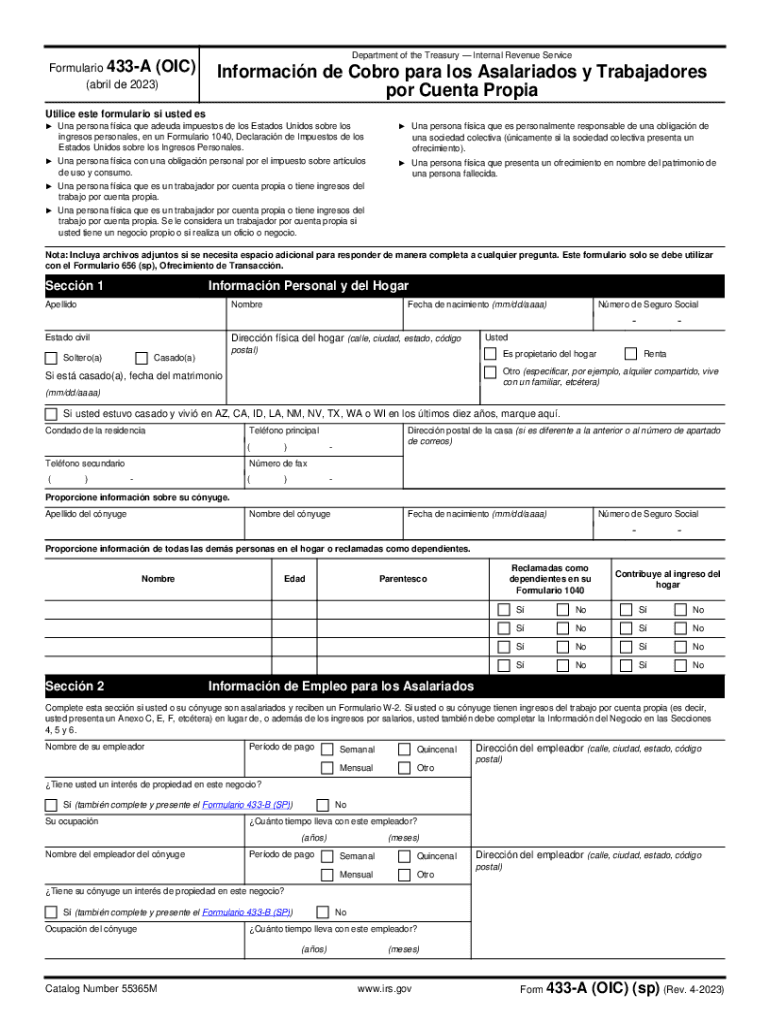

To effectively use the Form 656 B sp Rev 4 Offer In Compromise Booklet Spanish Version, taxpayers should first read through the entire booklet to understand the OIC process. The booklet provides step-by-step instructions on how to complete the necessary forms, including Form 656 and Form 433-A (OIC). Taxpayers should gather all required financial documentation, such as income statements and expense reports, as outlined in the booklet. It is important to follow the instructions carefully to ensure that the application is complete and accurate, which can increase the chances of approval.

Steps to complete the Form 656 B sp Rev 4 Offer In Compromise Booklet Spanish Version

Completing the Form 656 B sp Rev 4 Offer In Compromise Booklet Spanish Version involves several key steps:

- Review eligibility: Ensure you meet the criteria for submitting an OIC.

- Gather documentation: Collect necessary financial information, including income, expenses, and assets.

- Fill out Form 656: Complete the form accurately, providing all required details about your tax situation.

- Complete Form 433-A (OIC): This form requires detailed financial disclosures.

- Submit your offer: Follow the submission guidelines outlined in the booklet, ensuring all forms are included.

Eligibility Criteria

Eligibility for the Offer In Compromise program, as detailed in the Form 656 B sp Rev 4 Offer In Compromise Booklet Spanish Version, includes several factors. Taxpayers must demonstrate an inability to pay the full tax liability, which may be due to financial hardship or other circumstances. Additionally, taxpayers should be compliant with all filing requirements and have made any necessary estimated tax payments. The IRS evaluates each offer based on the taxpayer's ability to pay, income, and expenses, ensuring that the offer is reasonable and justifiable.

Required Documents

When submitting the Form 656 B sp Rev 4 Offer In Compromise Booklet Spanish Version, certain documents are required to support the application. These typically include:

- Form 656: The official offer form.

- Form 433-A (OIC): A comprehensive financial disclosure form.

- Proof of income: Pay stubs, bank statements, or other income documentation.

- Expense documentation: Bills, receipts, and statements that outline monthly expenses.

- Tax returns: Copies of recent tax returns to verify compliance.

Form Submission Methods

Taxpayers can submit the Form 656 B sp Rev 4 Offer In Compromise Booklet Spanish Version through various methods. The primary submission methods include:

- Mail: Send the completed forms and required documentation to the address specified in the booklet.

- Online: Use the IRS online services if available for electronic submission of the offer.

- In-Person: Schedule an appointment with a local IRS office for assistance and submission.

Create this form in 5 minutes or less

Find and fill out the correct form 656 b sp rev 4 offer in compromise booklet spanish version

Create this form in 5 minutes!

How to create an eSignature for the form 656 b sp rev 4 offer in compromise booklet spanish version

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 656 B sp Rev 4 Offer In Compromise Booklet Spanish Version?

The Form 656 B sp Rev 4 Offer In Compromise Booklet Spanish Version is a comprehensive guide designed to help Spanish-speaking individuals understand the Offer In Compromise process with the IRS. This booklet provides essential information on eligibility, required documentation, and step-by-step instructions to submit an offer.

-

How can I obtain the Form 656 B sp Rev 4 Offer In Compromise Booklet Spanish Version?

You can easily download the Form 656 B sp Rev 4 Offer In Compromise Booklet Spanish Version from the IRS website or access it through airSlate SignNow's platform. Our solution allows you to fill out and eSign the form digitally, streamlining the submission process.

-

What are the benefits of using the Form 656 B sp Rev 4 Offer In Compromise Booklet Spanish Version?

Using the Form 656 B sp Rev 4 Offer In Compromise Booklet Spanish Version helps Spanish-speaking taxpayers navigate the complexities of the Offer In Compromise process. It simplifies the information and provides clear instructions, making it easier to understand and complete the necessary forms.

-

Is there a cost associated with the Form 656 B sp Rev 4 Offer In Compromise Booklet Spanish Version?

The Form 656 B sp Rev 4 Offer In Compromise Booklet Spanish Version itself is free to download from the IRS website. However, if you choose to use airSlate SignNow for eSigning and document management, there may be associated subscription fees depending on the plan you select.

-

Can I integrate the Form 656 B sp Rev 4 Offer In Compromise Booklet Spanish Version with other software?

Yes, airSlate SignNow allows for seamless integration with various software applications, enhancing your workflow. You can easily incorporate the Form 656 B sp Rev 4 Offer In Compromise Booklet Spanish Version into your existing systems for efficient document management and eSigning.

-

What features does airSlate SignNow offer for the Form 656 B sp Rev 4 Offer In Compromise Booklet Spanish Version?

airSlate SignNow provides features such as customizable templates, secure eSigning, and real-time tracking for the Form 656 B sp Rev 4 Offer In Compromise Booklet Spanish Version. These features ensure that your documents are handled efficiently and securely throughout the submission process.

-

How does airSlate SignNow ensure the security of the Form 656 B sp Rev 4 Offer In Compromise Booklet Spanish Version?

airSlate SignNow prioritizes security by employing advanced encryption and compliance measures to protect your documents, including the Form 656 B sp Rev 4 Offer In Compromise Booklet Spanish Version. Our platform ensures that your sensitive information remains confidential and secure during the eSigning process.

Get more for Form 656 B sp Rev 4 Offer In Compromise Booklet Spanish Version

Find out other Form 656 B sp Rev 4 Offer In Compromise Booklet Spanish Version

- eSignature West Virginia Rental lease agreement forms Myself

- eSignature Michigan Rental property lease agreement Online

- Can I eSignature North Carolina Rental lease contract

- eSignature Vermont Rental lease agreement template Online

- eSignature Vermont Rental lease agreement template Now

- eSignature Vermont Rental lease agreement template Free

- eSignature Nebraska Rental property lease agreement Later

- eSignature Tennessee Residential lease agreement Easy

- Can I eSignature Washington Residential lease agreement

- How To eSignature Vermont Residential lease agreement form

- How To eSignature Rhode Island Standard residential lease agreement

- eSignature Mississippi Commercial real estate contract Fast

- eSignature Arizona Contract of employment Online

- eSignature Texas Contract of employment Online

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself