Futuro Tax IRS GOV 2024-2026

What is the Futuro Tax IRS GOV

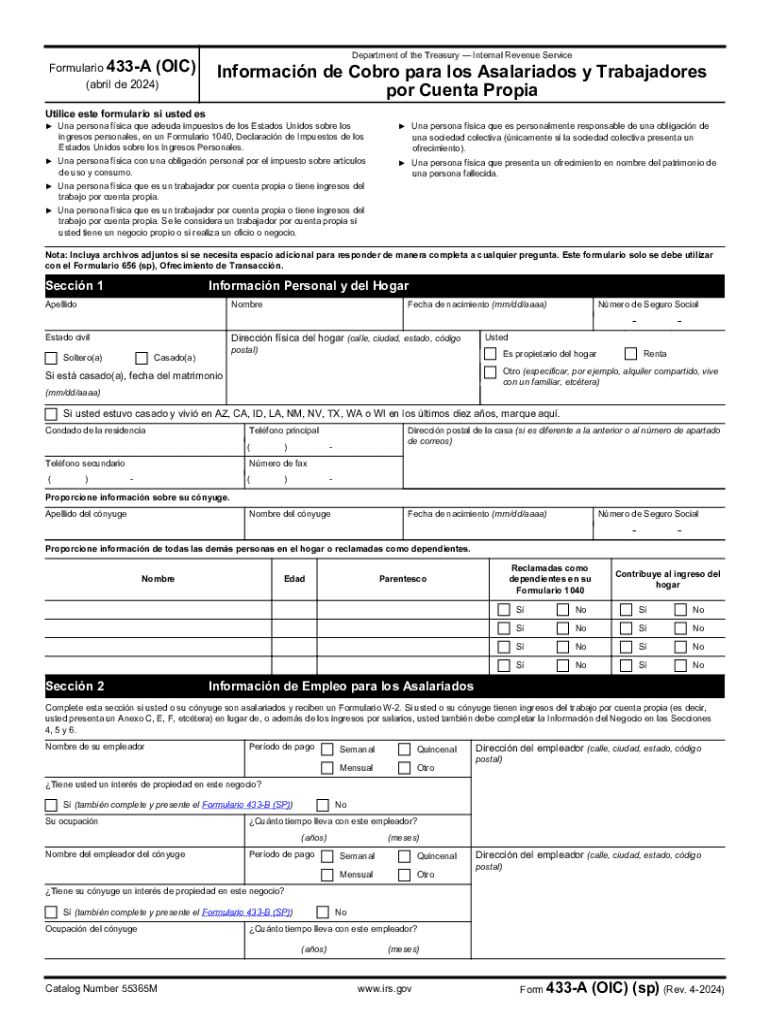

The Futuro Tax IRS GOV is a specific tax form utilized by individuals and businesses to report various financial activities to the Internal Revenue Service (IRS). This form is essential for ensuring compliance with federal tax regulations. It serves as a means for taxpayers to declare income, claim deductions, and report any tax credits they may be eligible for. Understanding this form is crucial for accurate tax filing and avoiding potential penalties.

How to use the Futuro Tax IRS GOV

Using the Futuro Tax IRS GOV involves several steps to ensure proper completion and submission. First, gather all necessary financial documents, including income statements, receipts for deductible expenses, and prior tax returns. Next, carefully fill out the form, ensuring that all information is accurate and complete. After completing the form, review it for any errors before submitting it to the IRS. It can be submitted electronically or via mail, depending on your preference and the specific requirements of the form.

Steps to complete the Futuro Tax IRS GOV

Completing the Futuro Tax IRS GOV requires a systematic approach:

- Collect all relevant financial documents, such as W-2s, 1099s, and expense records.

- Fill out the form accurately, ensuring all sections are completed.

- Double-check the information for accuracy, including Social Security numbers and financial figures.

- Sign and date the form if submitting a paper version.

- Choose your submission method: electronic filing or mailing the form to the appropriate IRS address.

Required Documents

To successfully complete the Futuro Tax IRS GOV, certain documents are required. These include:

- Income statements, such as W-2s and 1099s, to report earnings.

- Receipts for deductible expenses, which can include medical costs, educational expenses, and business-related purchases.

- Prior year tax returns, which can provide a reference for current filings.

- Any relevant tax forms that may apply to specific situations, such as Schedule C for self-employed individuals.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Futuro Tax IRS GOV. It is important to follow these guidelines closely to avoid errors that could lead to delays or penalties. The IRS outlines requirements for eligibility, deadlines for submission, and instructions for electronic filing. Familiarizing yourself with these guidelines can help ensure a smooth filing process and compliance with federal tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the Futuro Tax IRS GOV are crucial to observe to avoid penalties. Typically, the deadline for individual tax returns is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is essential to stay informed about any changes to these dates, as well as any extensions that may be available for specific circumstances, such as natural disasters or other emergencies.

Create this form in 5 minutes or less

Find and fill out the correct futuro tax irs gov

Create this form in 5 minutes!

How to create an eSignature for the futuro tax irs gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Futuro Tax IRS GOV and how does it work?

Futuro Tax IRS GOV is a comprehensive tax solution designed to simplify the filing process for individuals and businesses. It integrates seamlessly with airSlate SignNow, allowing users to eSign and send necessary documents securely. This ensures that your tax filings are not only accurate but also compliant with IRS regulations.

-

What are the pricing options for Futuro Tax IRS GOV?

Futuro Tax IRS GOV offers competitive pricing plans tailored to meet the needs of various users, from individuals to large enterprises. By utilizing airSlate SignNow, you can access cost-effective solutions that enhance your document management and eSigning experience. Check the official website for the latest pricing details and promotions.

-

What features does Futuro Tax IRS GOV provide?

Futuro Tax IRS GOV includes features such as automated tax calculations, document storage, and eSigning capabilities through airSlate SignNow. These features streamline the tax preparation process, making it easier for users to manage their tax documents efficiently. Additionally, it offers real-time updates and compliance checks to ensure accuracy.

-

How can Futuro Tax IRS GOV benefit my business?

Futuro Tax IRS GOV can signNowly benefit your business by simplifying tax compliance and reducing the time spent on paperwork. With airSlate SignNow's eSigning capabilities, you can quickly obtain signatures on essential documents, enhancing workflow efficiency. This allows you to focus more on your core business activities rather than administrative tasks.

-

Is Futuro Tax IRS GOV easy to integrate with other software?

Yes, Futuro Tax IRS GOV is designed to integrate easily with various accounting and financial software. This compatibility allows users to streamline their tax processes and document management through airSlate SignNow. By integrating these tools, you can enhance productivity and ensure that all your tax-related documents are in one place.

-

What security measures does Futuro Tax IRS GOV implement?

Futuro Tax IRS GOV prioritizes the security of your sensitive tax information by employing advanced encryption and secure access protocols. When using airSlate SignNow, your documents are protected during transmission and storage, ensuring compliance with IRS regulations. This commitment to security helps build trust with users handling confidential information.

-

Can I access Futuro Tax IRS GOV on mobile devices?

Absolutely! Futuro Tax IRS GOV is accessible on mobile devices, allowing you to manage your tax documents and eSign from anywhere. This flexibility is enhanced by airSlate SignNow's mobile-friendly interface, making it convenient for users who are always on the go. Stay connected and manage your tax needs efficiently, no matter where you are.

Get more for Futuro Tax IRS GOV

- Ladder inspection checklist pdf 404547807 form

- Signia earmold order form

- Cfs 352 form

- Pita pit menu pdf 218331315 form

- Monthly poolspa report form southern nevada health district southernnevadahealthdistrict

- Hazard identification form

- Licensee information or affidavit filed in accordance

- Business tax receiptnorth miami beach fl form

Find out other Futuro Tax IRS GOV

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF