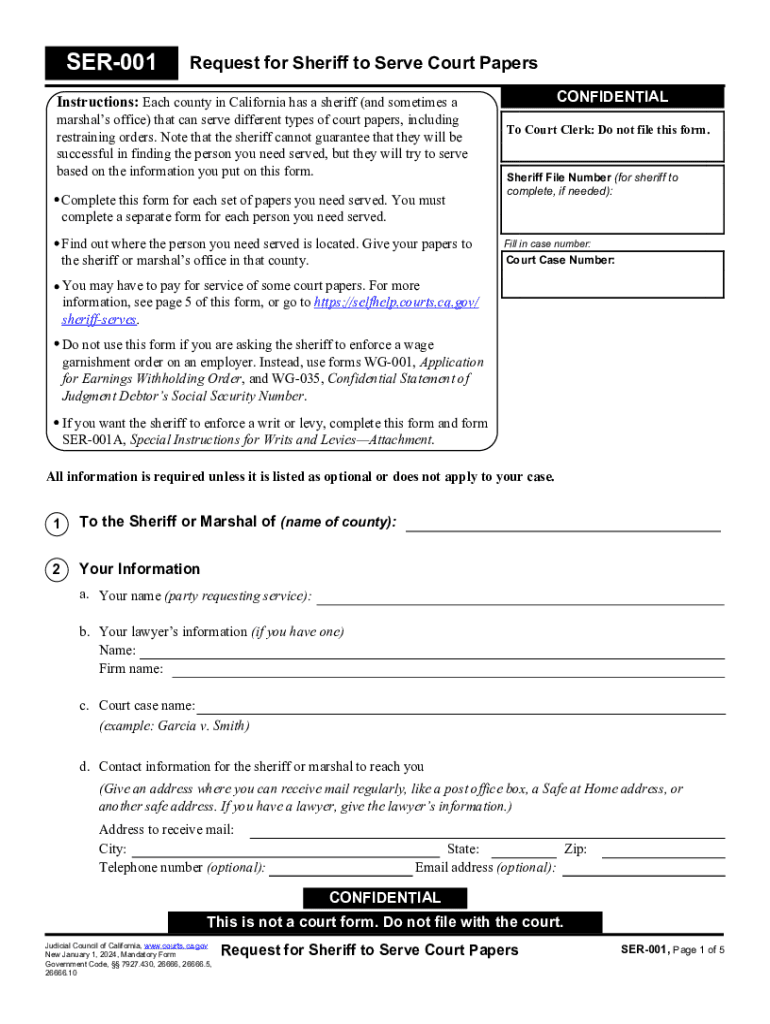

SER 001 Form

What is the SER 001?

The SER 001 form is a specific document used in California for reporting certain financial information. It is primarily associated with state tax obligations and is essential for individuals and businesses to ensure compliance with California's tax regulations. Understanding the purpose and requirements of the SER 001 is crucial for accurate reporting and avoiding potential penalties.

How to use the SER 001

Using the SER 001 form involves several steps to ensure that all necessary information is accurately reported. First, gather all relevant financial documents that pertain to the reporting period. Next, fill out the form with precise details regarding income, deductions, and any other required information. After completing the form, review it thoroughly for accuracy before submission. It is important to follow any specific instructions provided with the form to ensure compliance with California regulations.

Steps to complete the SER 001

Completing the SER 001 form can be streamlined by following these steps:

- Collect all necessary financial records, such as income statements and receipts.

- Download the SER 001 form from an official source or obtain a physical copy.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Provide detailed information about your income and any applicable deductions.

- Review the completed form for accuracy and completeness.

- Submit the form according to the provided instructions, either online or via mail.

Legal use of the SER 001

The SER 001 form is legally required for specific financial reporting in California. It ensures that individuals and businesses are compliant with state tax laws. Failing to use the SER 001 correctly can result in penalties, including fines or additional scrutiny from tax authorities. It is advisable to consult with a tax professional if there are uncertainties regarding the legal implications of using this form.

Required Documents

To complete the SER 001 form accurately, certain documents are required. These typically include:

- Income statements, such as W-2s or 1099s.

- Receipts for any deductions you plan to claim.

- Previous tax returns, if applicable, for reference.

- Any correspondence from the California tax authority that may provide additional context.

Form Submission Methods

The SER 001 form can be submitted through various methods, providing flexibility for users. Options typically include:

- Online submission through the California tax authority's official website.

- Mailing a physical copy to the designated address provided on the form.

- In-person submission at local tax offices, if available.

Handy tips for filling out SER 001 online

Quick steps to complete and e-sign SER 001 online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing forms can be. Get access to a GDPR and HIPAA compliant solution for maximum straightforwardness. Use signNow to e-sign and send SER 001 for e-signing.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ser 001

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the SER 001 form and how can airSlate SignNow help with it?

The SER 001 form is a crucial document for various business processes. airSlate SignNow simplifies the signing and sending of the SER 001 form, ensuring that your documents are securely signed and stored. With our platform, you can streamline your workflow and reduce the time spent on paperwork.

-

Is there a cost associated with using airSlate SignNow for the SER 001 form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our plans are designed to be cost-effective, allowing you to manage the SER 001 form and other documents without breaking the bank. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the SER 001 form?

airSlate SignNow provides a range of features for managing the SER 001 form, including customizable templates, automated workflows, and secure eSigning. These features help you efficiently handle your documents while ensuring compliance and security. You can easily track the status of your SER 001 form throughout the signing process.

-

Can I integrate airSlate SignNow with other applications for the SER 001 form?

Absolutely! airSlate SignNow offers seamless integrations with various applications, allowing you to manage the SER 001 form alongside your existing tools. Whether you use CRM systems, cloud storage, or project management software, our integrations enhance your workflow and productivity.

-

What are the benefits of using airSlate SignNow for the SER 001 form?

Using airSlate SignNow for the SER 001 form provides numerous benefits, including increased efficiency, reduced turnaround time, and enhanced security. Our platform ensures that your documents are signed quickly and securely, allowing you to focus on your core business activities. Additionally, you can access your documents anytime, anywhere.

-

How secure is the signing process for the SER 001 form with airSlate SignNow?

The security of your documents is our top priority at airSlate SignNow. The signing process for the SER 001 form is protected by advanced encryption and authentication measures. This ensures that your sensitive information remains confidential and secure throughout the signing process.

-

Can I track the status of my SER 001 form in airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your SER 001 form in real-time. You will receive notifications when the document is viewed, signed, or completed, giving you complete visibility over the signing process. This feature helps you stay organized and informed.

Get more for SER 001

- Kotak securities kyc form

- Health form young life

- We energies medical form

- Sample memo letter for teachers form

- Hdb indemnity form pdf

- Outpatient laboratory order form

- Form embygnfamily updated august 13schengen

- Form emb bkk 03 last updated april 10 12 schengen visa to sweden purpose to visit relatives in sweden name of applicant date

Find out other SER 001

- How To eSign Louisiana Hold Harmless (Indemnity) Agreement

- eSign Nevada Hold Harmless (Indemnity) Agreement Easy

- eSign Utah Hold Harmless (Indemnity) Agreement Myself

- eSign Wyoming Toll Manufacturing Agreement Later

- eSign Texas Photo Licensing Agreement Online

- How To eSign Connecticut Quitclaim Deed

- How To eSign Florida Quitclaim Deed

- Can I eSign Kentucky Quitclaim Deed

- eSign Maine Quitclaim Deed Free

- How Do I eSign New York Quitclaim Deed

- eSign New Hampshire Warranty Deed Fast

- eSign Hawaii Postnuptial Agreement Template Later

- eSign Kentucky Postnuptial Agreement Template Online

- eSign Maryland Postnuptial Agreement Template Mobile

- How Can I eSign Pennsylvania Postnuptial Agreement Template

- eSign Hawaii Prenuptial Agreement Template Secure

- eSign Michigan Prenuptial Agreement Template Simple

- eSign North Dakota Prenuptial Agreement Template Safe

- eSign Ohio Prenuptial Agreement Template Fast

- eSign Utah Prenuptial Agreement Template Easy