Form 2159 Sp Rev 7 2024-2026

Understanding Form 2159 sp Rev 7

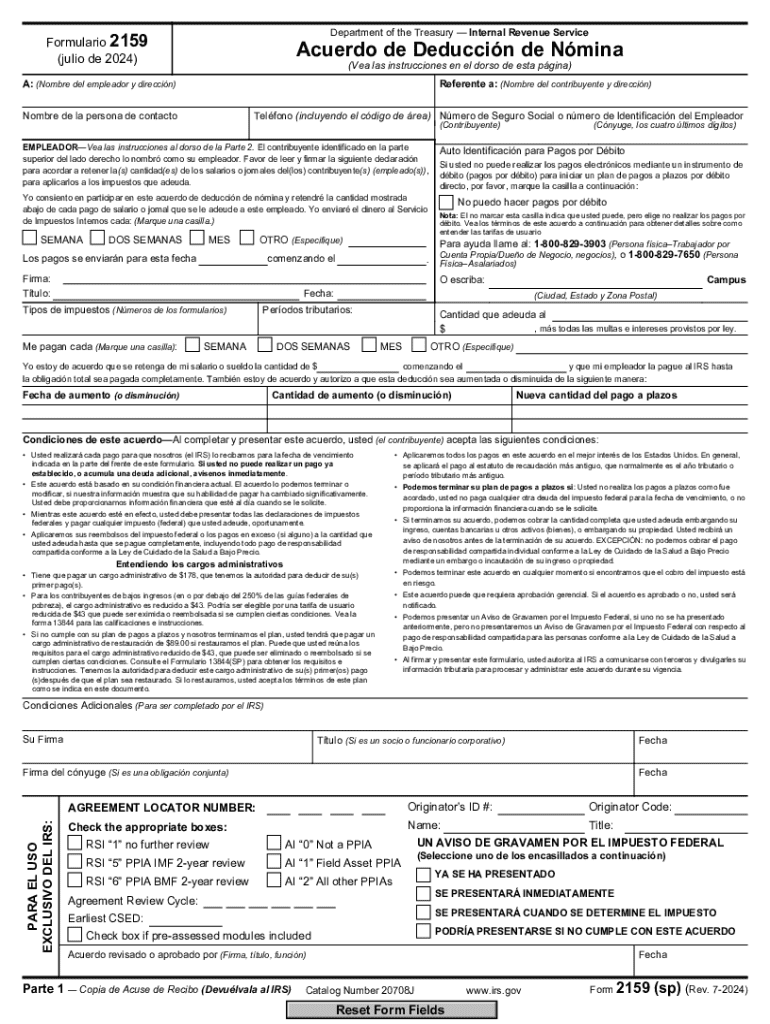

Form 2159 sp Rev 7 is a specific document used primarily for tax purposes in the United States. This form is often utilized by businesses and individuals to report certain financial information to the IRS. Understanding its purpose and the information it requires is essential for accurate and compliant filing.

How to Use Form 2159 sp Rev 7

Using Form 2159 sp Rev 7 involves several steps to ensure proper completion and submission. First, gather all necessary financial documents and information that pertain to the form's requirements. Next, carefully fill out each section of the form, ensuring that all information is accurate and complete. After completing the form, review it for any errors before submission to avoid potential penalties or delays.

Steps to Complete Form 2159 sp Rev 7

Completing Form 2159 sp Rev 7 requires a systematic approach:

- Begin by downloading the latest version of the form from the official IRS website.

- Fill in your personal or business information as required.

- Provide detailed financial data as specified in the form instructions.

- Double-check all entries for accuracy and completeness.

- Sign and date the form before submission.

Legal Use of Form 2159 sp Rev 7

Form 2159 sp Rev 7 is legally binding and must be used in accordance with IRS regulations. It is essential to ensure that the information provided is truthful and complies with all applicable laws. Misuse or submission of false information can lead to serious legal consequences, including fines and penalties.

Filing Deadlines for Form 2159 sp Rev 7

Filing deadlines for Form 2159 sp Rev 7 vary depending on the specific circumstances of the filer. Generally, it is advisable to submit the form by the end of the tax year to ensure compliance with IRS regulations. Keeping track of important dates related to tax filings can help avoid late fees and other penalties.

Obtaining Form 2159 sp Rev 7

Form 2159 sp Rev 7 can be obtained directly from the IRS website. It is available for download in a printable format. Additionally, some tax preparation software may include this form as part of their offerings, providing an easy way to fill it out electronically.

Create this form in 5 minutes or less

Find and fill out the correct form 2159 sp rev 7

Create this form in 5 minutes!

How to create an eSignature for the form 2159 sp rev 7

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 2159 sp Rev 7?

Form 2159 sp Rev 7 is a specific document used for various administrative purposes. It is essential for businesses to understand its requirements and how to properly fill it out. Utilizing airSlate SignNow can streamline the process of completing and signing this form efficiently.

-

How can airSlate SignNow help with Form 2159 sp Rev 7?

airSlate SignNow provides an easy-to-use platform for sending and eSigning Form 2159 sp Rev 7. With its intuitive interface, users can quickly upload the form, add necessary signatures, and ensure compliance with all requirements. This saves time and reduces the risk of errors.

-

What are the pricing options for using airSlate SignNow for Form 2159 sp Rev 7?

airSlate SignNow offers flexible pricing plans that cater to different business needs. Whether you are a small business or a large enterprise, you can find a plan that fits your budget while allowing you to manage Form 2159 sp Rev 7 efficiently. Check our website for detailed pricing information.

-

Are there any features specifically designed for Form 2159 sp Rev 7?

Yes, airSlate SignNow includes features tailored for handling Form 2159 sp Rev 7, such as customizable templates and automated workflows. These features help ensure that all necessary fields are completed correctly and that the document is processed swiftly. This enhances overall productivity.

-

Can I integrate airSlate SignNow with other tools for managing Form 2159 sp Rev 7?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to manage Form 2159 sp Rev 7 alongside your existing tools. This seamless integration helps streamline your workflow and ensures that all documents are easily accessible and organized.

-

What are the benefits of using airSlate SignNow for Form 2159 sp Rev 7?

Using airSlate SignNow for Form 2159 sp Rev 7 provides numerous benefits, including enhanced security, faster processing times, and reduced paperwork. The platform ensures that your documents are securely stored and easily retrievable, making it a reliable choice for businesses.

-

Is airSlate SignNow compliant with regulations for Form 2159 sp Rev 7?

Yes, airSlate SignNow is designed to comply with various regulations, ensuring that your use of Form 2159 sp Rev 7 meets legal standards. The platform adheres to industry best practices for security and data protection, giving you peace of mind when handling sensitive documents.

Get more for Form 2159 sp Rev 7

- Christmas song fill in the blank pdf form

- Annamalai university books download pdf form

- Mmp short form for annual updates

- George fall off the ladder while he paint the ceiling form

- Uab doctors excuse form

- Application to preserve residencefor naturalizati form

- Update to form i 905 application for authorization to issue

- Form i 539 instructions for application to extendchange nonimmigrant status

Find out other Form 2159 sp Rev 7

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed