Schedule I Form 1041 Alternative Minimum TaxEstates and Trusts

What is the Schedule I Form 1041 Alternative Minimum Tax for Estates and Trusts

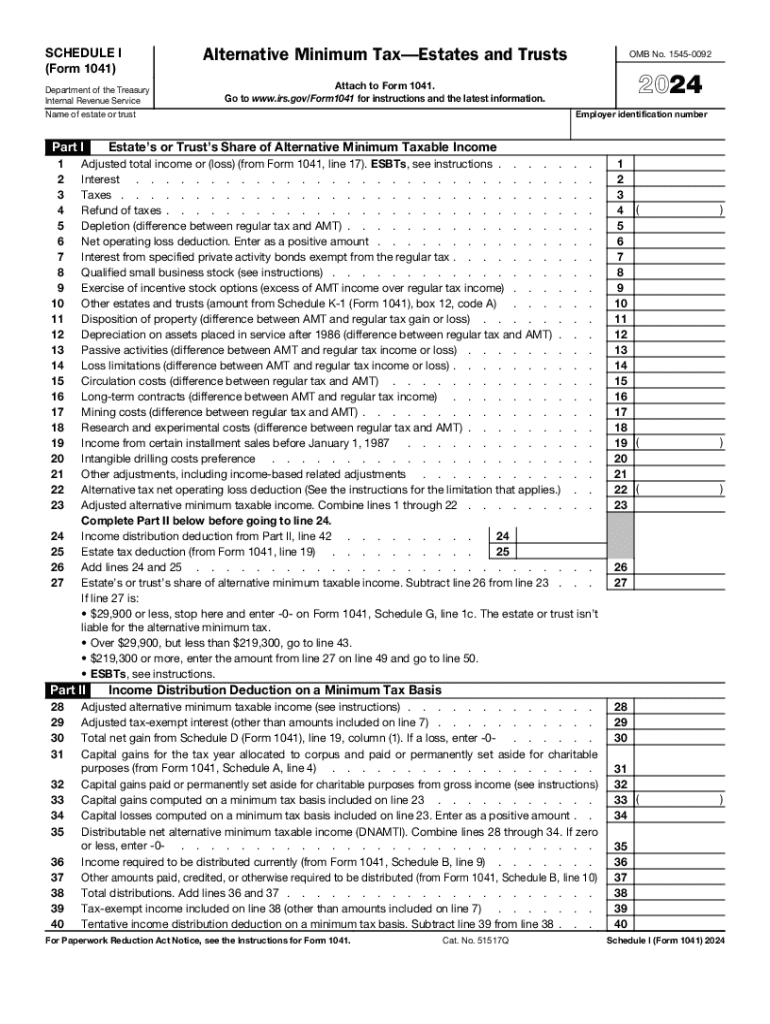

The Schedule I Form 1041 is specifically designed for estates and trusts to report alternative minimum tax (AMT) liabilities. This form helps determine if an estate or trust is subject to the AMT, which is a separate tax calculation that ensures individuals and entities pay a minimum amount of tax, regardless of deductions and credits. The AMT applies to certain types of income and deductions, making it crucial for fiduciaries to understand the implications for tax reporting.

How to Use the Schedule I Form 1041 Alternative Minimum Tax for Estates and Trusts

To effectively use the Schedule I Form 1041, fiduciaries must first gather all relevant financial information pertaining to the estate or trust. This includes income sources, deductions, and any applicable credits. The form requires the calculation of alternative minimum taxable income (AMTI) by adjusting regular taxable income with specific add-backs and exclusions. Once the AMTI is determined, the fiduciary can apply the AMT rates to calculate the tax owed. It is essential to ensure accuracy in these calculations to avoid potential penalties.

Steps to Complete the Schedule I Form 1041 Alternative Minimum Tax for Estates and Trusts

Completing the Schedule I Form 1041 involves several key steps:

- Gather all financial documents related to the estate or trust.

- Calculate the regular taxable income using Form 1041.

- Adjust the taxable income to determine the alternative minimum taxable income (AMTI) by adding back certain deductions.

- Apply the AMT rates to the AMTI to compute the alternative minimum tax liability.

- Complete the Schedule I Form 1041 with the calculated figures.

- Submit the completed form along with the main Form 1041 by the filing deadline.

IRS Guidelines for the Schedule I Form 1041 Alternative Minimum Tax for Estates and Trusts

The IRS provides specific guidelines for completing the Schedule I Form 1041. Fiduciaries must adhere to the instructions outlined in the IRS documentation, which detail eligibility criteria, filing procedures, and reporting requirements. It is important to reference the most current IRS guidelines to ensure compliance and to avoid any discrepancies that could lead to audits or penalties. Understanding these guidelines helps fiduciaries navigate the complexities of alternative minimum tax calculations.

Filing Deadlines for the Schedule I Form 1041 Alternative Minimum Tax for Estates and Trusts

The filing deadline for the Schedule I Form 1041 coincides with the due date for Form 1041, which is generally the fifteenth day of the fourth month after the end of the tax year. For estates and trusts operating on a calendar year, this typically falls on April fifteenth. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. Fiduciaries should be aware of these deadlines to ensure timely filing and avoid penalties for late submissions.

Required Documents for the Schedule I Form 1041 Alternative Minimum Tax for Estates and Trusts

To complete the Schedule I Form 1041, fiduciaries will need several key documents:

- Form 1041, the main tax return for estates and trusts.

- Financial statements detailing all income and expenses of the estate or trust.

- Documentation of any deductions and credits claimed.

- Records of any prior year AMT calculations, if applicable.

Having these documents readily available will streamline the completion of the Schedule I Form 1041 and ensure accurate reporting.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule i form 1041 alternative minimum taxestates and trusts

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of schedule 1 2024 in airSlate SignNow?

The schedule 1 2024 is crucial for businesses looking to streamline their document signing processes. It outlines the key features and updates that will enhance user experience and efficiency. By understanding schedule 1 2024, users can better leverage airSlate SignNow's capabilities.

-

How does airSlate SignNow support the schedule 1 2024 requirements?

airSlate SignNow is designed to meet the evolving needs of businesses, including those outlined in schedule 1 2024. Our platform offers robust eSigning features that comply with the latest regulations. This ensures that your documents are not only signed but also legally binding.

-

What pricing plans are available for airSlate SignNow in 2024?

In 2024, airSlate SignNow offers several pricing plans tailored to different business needs. Each plan provides access to essential features that align with schedule 1 2024 requirements. You can choose a plan that best fits your budget and operational needs.

-

What features are included in the schedule 1 2024 update?

The schedule 1 2024 update includes enhanced security measures, improved user interface, and new integrations. These features are designed to make document management more efficient and secure. Users can expect a smoother experience when utilizing airSlate SignNow.

-

How can I integrate airSlate SignNow with other tools in 2024?

Integrating airSlate SignNow with other tools is seamless and straightforward in 2024. The platform supports various integrations that align with schedule 1 2024, allowing you to connect with CRM systems, cloud storage, and more. This enhances your workflow and productivity.

-

What are the benefits of using airSlate SignNow for my business?

Using airSlate SignNow provides numerous benefits, including cost-effectiveness and ease of use. With features that comply with schedule 1 2024, businesses can ensure efficient document handling. This leads to faster turnaround times and improved customer satisfaction.

-

Is airSlate SignNow suitable for small businesses in 2024?

Absolutely! airSlate SignNow is an ideal solution for small businesses in 2024. The platform's pricing and features are designed to cater to smaller operations while still meeting the standards set by schedule 1 2024. This makes it accessible and beneficial for businesses of all sizes.

Get more for Schedule I Form 1041 Alternative Minimum TaxEstates And Trusts

Find out other Schedule I Form 1041 Alternative Minimum TaxEstates And Trusts

- How Do I Sign Minnesota Legal Residential Lease Agreement

- Sign South Carolina Insurance Lease Agreement Template Computer

- Sign Missouri Legal Last Will And Testament Online

- Sign Montana Legal Resignation Letter Easy

- How Do I Sign Montana Legal IOU

- How Do I Sign Montana Legal Quitclaim Deed

- Sign Missouri Legal Separation Agreement Myself

- How Do I Sign Nevada Legal Contract

- Sign New Jersey Legal Memorandum Of Understanding Online

- How To Sign New Jersey Legal Stock Certificate

- Sign New Mexico Legal Cease And Desist Letter Mobile

- Sign Texas Insurance Business Plan Template Later

- Sign Ohio Legal Last Will And Testament Mobile

- Sign Ohio Legal LLC Operating Agreement Mobile

- Sign Oklahoma Legal Cease And Desist Letter Fast

- Sign Oregon Legal LLC Operating Agreement Computer

- Sign Pennsylvania Legal Moving Checklist Easy

- Sign Pennsylvania Legal Affidavit Of Heirship Computer

- Sign Connecticut Life Sciences Rental Lease Agreement Online

- Sign Connecticut Life Sciences Affidavit Of Heirship Easy