Agreement to Compromise Debt by Returning Secured Property Form

What is the Agreement To Compromise Debt By Returning Secured Property

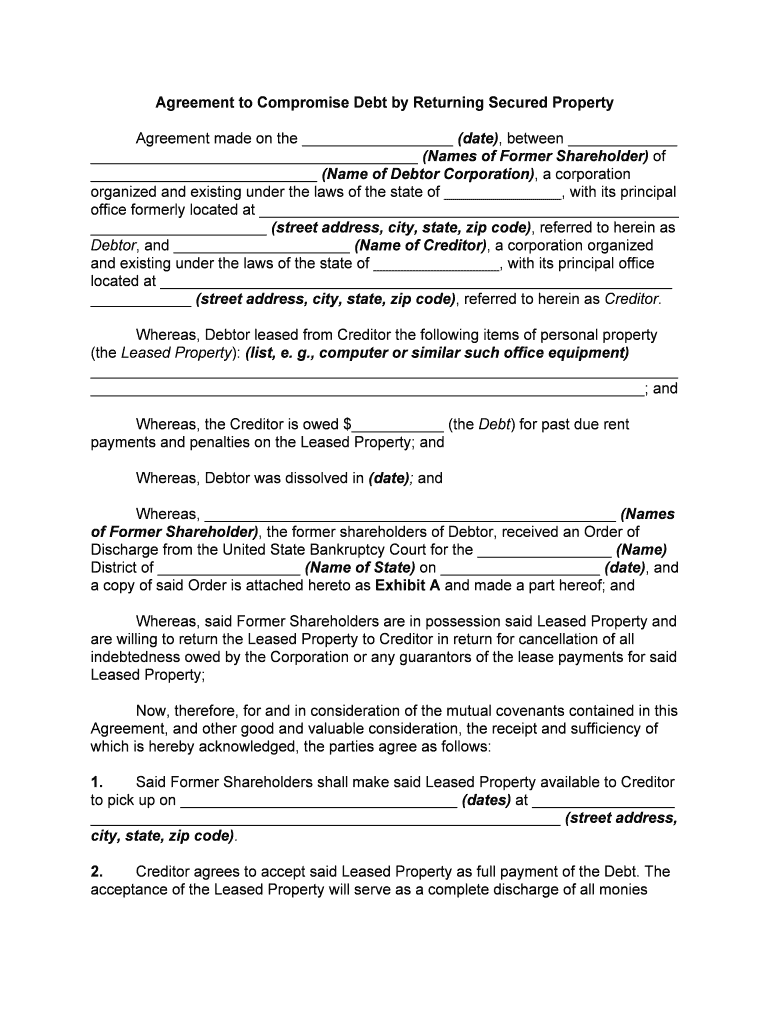

The Agreement To Compromise Debt By Returning Secured Property is a legal document used to settle a debt by returning property that was used as collateral. This agreement allows a debtor to negotiate with a creditor to relinquish the secured property instead of paying the full amount owed. It is often utilized when the debtor is unable to meet their financial obligations but wishes to avoid bankruptcy. By returning the secured property, the debtor may reduce their overall debt burden while providing the creditor with a form of restitution.

How to use the Agreement To Compromise Debt By Returning Secured Property

Using the Agreement To Compromise Debt By Returning Secured Property involves several steps. First, the debtor should assess the value of the secured property and determine the total debt owed. Next, they should communicate with the creditor to express their intention to negotiate a compromise. Once an agreement is reached, both parties must complete the document, ensuring that all relevant details, such as the description of the property and the terms of the compromise, are clearly stated. Finally, both parties should sign the agreement to make it legally binding.

Steps to complete the Agreement To Compromise Debt By Returning Secured Property

Completing the Agreement To Compromise Debt By Returning Secured Property involves the following steps:

- Gather all necessary information regarding the secured property and the debt.

- Contact the creditor to discuss the possibility of a compromise.

- Draft the agreement, including the terms of the property return and any debt reduction.

- Review the document with legal counsel if needed, to ensure compliance with state laws.

- Both parties should sign and date the agreement to finalize the terms.

Key elements of the Agreement To Compromise Debt By Returning Secured Property

Key elements of the Agreement To Compromise Debt By Returning Secured Property include:

- Identification of parties: Clearly state the names and addresses of the debtor and creditor.

- Description of secured property: Provide a detailed description of the property being returned.

- Debt details: Outline the amount of debt being compromised and any remaining balance.

- Terms of return: Specify the conditions under which the property will be returned.

- Signatures: Ensure both parties sign the agreement to validate it legally.

Legal use of the Agreement To Compromise Debt By Returning Secured Property

The legal use of the Agreement To Compromise Debt By Returning Secured Property is governed by state laws and regulations. It is essential for both parties to understand their rights and obligations under the agreement. The document must comply with relevant legal frameworks to ensure it is enforceable in a court of law. Additionally, the agreement should be executed in good faith, with full disclosure of all pertinent information regarding the debt and property.

Quick guide on how to complete agreement to compromise debt by returning secured property

Effortlessly Complete Agreement To Compromise Debt By Returning Secured Property on Any Device

The management of documents online has become increasingly favored by both businesses and individuals. It serves as an excellent environmentally-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the correct form and securely keep it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents quickly and without interruptions. Handle Agreement To Compromise Debt By Returning Secured Property on any device with the airSlate SignNow Android or iOS applications and enhance any document-focused procedure today.

How to Modify and eSign Agreement To Compromise Debt By Returning Secured Property with Ease

- Locate Agreement To Compromise Debt By Returning Secured Property and click Get Form to begin.

- Utilize the tools available to fill out your document.

- Mark important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign tool, which takes moments and holds the same legal validity as a conventional handwritten signature.

- Review the details and then click the Done button to secure your changes.

- Select your preferred method to share your form: via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, exhaustive form searching, or errors that necessitate reprinting new copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you choose. Alter and eSign Agreement To Compromise Debt By Returning Secured Property and guarantee outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Agreement To Compromise Debt By Returning Secured Property?

An Agreement To Compromise Debt By Returning Secured Property is a legal arrangement where a debtor agrees to transfer ownership of secured assets back to the lender to settle outstanding debts. This can help avoid lengthy litigation while providing a feasible solution for both parties.

-

How can airSlate SignNow help with drafting an Agreement To Compromise Debt By Returning Secured Property?

airSlate SignNow offers customizable document templates that simplify the process of drafting an Agreement To Compromise Debt By Returning Secured Property. Our platform allows users to easily edit, sign, and manage documents securely and efficiently.

-

What are the benefits of using airSlate SignNow for my Agreement To Compromise Debt By Returning Secured Property?

Using airSlate SignNow for your Agreement To Compromise Debt By Returning Secured Property provides notable benefits, including faster document turnaround times and enhanced security. Our solution offers reliable eSignature capabilities that ensure legal compliance and streamline the negotiation process.

-

Is there a cost associated with creating an Agreement To Compromise Debt By Returning Secured Property using airSlate SignNow?

Yes, there is a subscription fee for airSlate SignNow, which is considered cost-effective compared to traditional methods of document signing. Plans are structured to fit various business needs, making it easy to choose the right option for managing agreements related to compromising debt.

-

Can I integrate airSlate SignNow with other software for my Agreement To Compromise Debt By Returning Secured Property?

Absolutely! airSlate SignNow integrates seamlessly with various popular applications, including CRM systems and cloud storage services. This means you can manage your Agreement To Compromise Debt By Returning Secured Property alongside your other business applications for greater efficiency.

-

How does airSlate SignNow ensure the security of my Agreement To Compromise Debt By Returning Secured Property?

airSlate SignNow prioritizes security with features such as encrypted data transmission and secure storage, ensuring that your Agreement To Compromise Debt By Returning Secured Property is protected. We also offer audit trails to track changes and verify signatory actions.

-

What features does airSlate SignNow offer for managing my Agreement To Compromise Debt By Returning Secured Property?

airSlate SignNow includes features such as customizable templates, bulk sending, and user-friendly dashboards that enhance the management of your Agreement To Compromise Debt By Returning Secured Property. These tools help streamline your workflow and improve overall document handling.

Get more for Agreement To Compromise Debt By Returning Secured Property

Find out other Agreement To Compromise Debt By Returning Secured Property

- Sign Montana Child Support Modification Online

- Sign Oregon Last Will and Testament Mobile

- Can I Sign Utah Last Will and Testament

- Sign Washington Last Will and Testament Later

- Sign Wyoming Last Will and Testament Simple

- Sign Connecticut Living Will Online

- How To Sign Georgia Living Will

- Sign Massachusetts Living Will Later

- Sign Minnesota Living Will Free

- Sign New Mexico Living Will Secure

- How To Sign Pennsylvania Living Will

- Sign Oregon Living Will Safe

- Sign Utah Living Will Fast

- Sign Wyoming Living Will Easy

- How Can I Sign Georgia Pet Care Agreement

- Can I Sign Kansas Moving Checklist

- How Do I Sign Rhode Island Pet Care Agreement

- How Can I Sign Virginia Moving Checklist

- Sign Illinois Affidavit of Domicile Online

- How Do I Sign Iowa Affidavit of Domicile