Form 433 a OIC Sp Rev 4 Collection Information Statement for Wage Earners and 2024-2026

Understanding the Form 433 A OIC sp Rev 4 Collection Information Statement For Wage Earners And

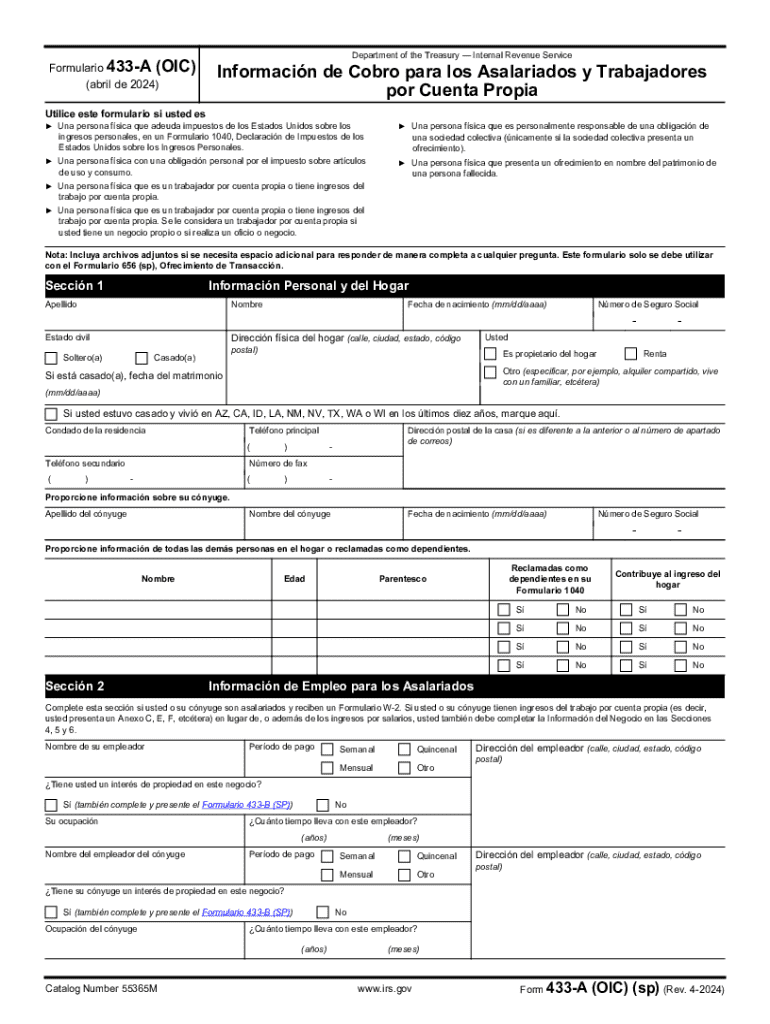

The Form 433 A OIC sp Rev 4 Collection Information Statement For Wage Earners And is a crucial document used by individuals seeking to settle their tax liabilities with the IRS through an Offer in Compromise (OIC). This form collects detailed financial information about a taxpayer's income, expenses, and assets. By providing a comprehensive overview of their financial situation, taxpayers can demonstrate their inability to pay the full tax amount owed, which is essential for the IRS to consider their offer.

Steps to Complete the Form 433 A OIC sp Rev 4 Collection Information Statement For Wage Earners And

Completing the Form 433 A OIC sp Rev 4 requires careful attention to detail. Begin by accurately filling out personal information, including your name, Social Security number, and address. Next, provide information about your employment and income sources. It is important to list all income accurately, including wages, bonuses, and any other earnings. After detailing your income, outline your monthly expenses, ensuring to include necessary living costs such as housing, utilities, and food. Finally, report any assets you possess, such as bank accounts, vehicles, and real estate. Each section must be completed thoroughly to avoid delays in processing your OIC.

Legal Use of the Form 433 A OIC sp Rev 4 Collection Information Statement For Wage Earners And

The Form 433 A OIC sp Rev 4 is legally recognized by the IRS as a valid document for taxpayers applying for an Offer in Compromise. It is essential that the information provided is accurate and truthful, as submitting false information can lead to penalties, including the rejection of the offer or legal repercussions. Taxpayers should understand that this form is a formal request for the IRS to evaluate their financial circumstances and determine their eligibility for a reduced tax settlement.

Required Documents for the Form 433 A OIC sp Rev 4 Collection Information Statement For Wage Earners And

When submitting the Form 433 A OIC sp Rev 4, taxpayers must include supporting documentation to substantiate the information provided. This typically includes recent pay stubs, bank statements, and documentation of monthly expenses. Additionally, it may be necessary to provide tax returns for the previous year and any other relevant financial statements. Ensuring that all required documents are included can help expedite the review process by the IRS.

Eligibility Criteria for the Form 433 A OIC sp Rev 4 Collection Information Statement For Wage Earners And

To qualify for an Offer in Compromise using the Form 433 A OIC sp Rev 4, taxpayers must meet specific eligibility criteria. Primarily, they must demonstrate an inability to pay their tax debt in full. The IRS evaluates a taxpayer's financial situation based on their income, expenses, and assets. Additionally, individuals must have filed all required tax returns and made any necessary estimated tax payments for the current year. Meeting these criteria is essential for the IRS to consider an OIC application.

Filing Deadlines for the Form 433 A OIC sp Rev 4 Collection Information Statement For Wage Earners And

Timely submission of the Form 433 A OIC sp Rev 4 is critical in the OIC process. While there is no specific deadline for submitting this form, it is advisable to file it as soon as possible after determining eligibility for an offer. Additionally, taxpayers should be aware of any deadlines related to their overall tax situation, such as pending tax liabilities or collection actions by the IRS. Staying informed about these timelines can help prevent complications during the OIC process.

Create this form in 5 minutes or less

Find and fill out the correct form 433 a oic sp rev 4 collection information statement for wage earners and 771138685

Create this form in 5 minutes!

How to create an eSignature for the form 433 a oic sp rev 4 collection information statement for wage earners and 771138685

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 433 A OIC sp Rev 4 Collection Information Statement For Wage Earners And?

The Form 433 A OIC sp Rev 4 Collection Information Statement For Wage Earners And is a document used by individuals to provide the IRS with detailed financial information. This form is essential for those seeking an Offer in Compromise, allowing them to settle their tax debts for less than the full amount owed.

-

How can airSlate SignNow help with the Form 433 A OIC sp Rev 4 Collection Information Statement For Wage Earners And?

airSlate SignNow simplifies the process of completing and submitting the Form 433 A OIC sp Rev 4 Collection Information Statement For Wage Earners And. Our platform allows users to easily fill out, eSign, and send the form securely, ensuring compliance and efficiency.

-

What are the pricing options for using airSlate SignNow for the Form 433 A OIC sp Rev 4 Collection Information Statement For Wage Earners And?

airSlate SignNow offers flexible pricing plans that cater to different business needs. Whether you are a small business or a large enterprise, you can choose a plan that fits your budget while ensuring you have access to all the necessary features for managing the Form 433 A OIC sp Rev 4 Collection Information Statement For Wage Earners And.

-

Are there any integrations available for airSlate SignNow when working with the Form 433 A OIC sp Rev 4 Collection Information Statement For Wage Earners And?

Yes, airSlate SignNow integrates seamlessly with various applications and platforms. This allows users to streamline their workflow when handling the Form 433 A OIC sp Rev 4 Collection Information Statement For Wage Earners And, making it easier to manage documents and data across different systems.

-

What features does airSlate SignNow offer for the Form 433 A OIC sp Rev 4 Collection Information Statement For Wage Earners And?

airSlate SignNow provides a range of features including customizable templates, secure eSigning, and document tracking. These features enhance the user experience when completing the Form 433 A OIC sp Rev 4 Collection Information Statement For Wage Earners And, ensuring that all necessary information is captured accurately.

-

How does airSlate SignNow ensure the security of the Form 433 A OIC sp Rev 4 Collection Information Statement For Wage Earners And?

Security is a top priority at airSlate SignNow. We use advanced encryption and secure cloud storage to protect your data when completing and submitting the Form 433 A OIC sp Rev 4 Collection Information Statement For Wage Earners And, ensuring that your sensitive information remains confidential.

-

Can I access airSlate SignNow on mobile devices for the Form 433 A OIC sp Rev 4 Collection Information Statement For Wage Earners And?

Absolutely! airSlate SignNow is mobile-friendly, allowing you to access and manage the Form 433 A OIC sp Rev 4 Collection Information Statement For Wage Earners And from your smartphone or tablet. This flexibility ensures that you can complete your documents anytime, anywhere.

Get more for Form 433 A OIC sp Rev 4 Collection Information Statement For Wage Earners And

Find out other Form 433 A OIC sp Rev 4 Collection Information Statement For Wage Earners And

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy