Form 433 a OIC Sp Rev 4 Collection Information Statement for Wage Earners and 2023

Understanding the Form 433 A OIC sp Rev 4 Collection Information Statement For Wage Earners And

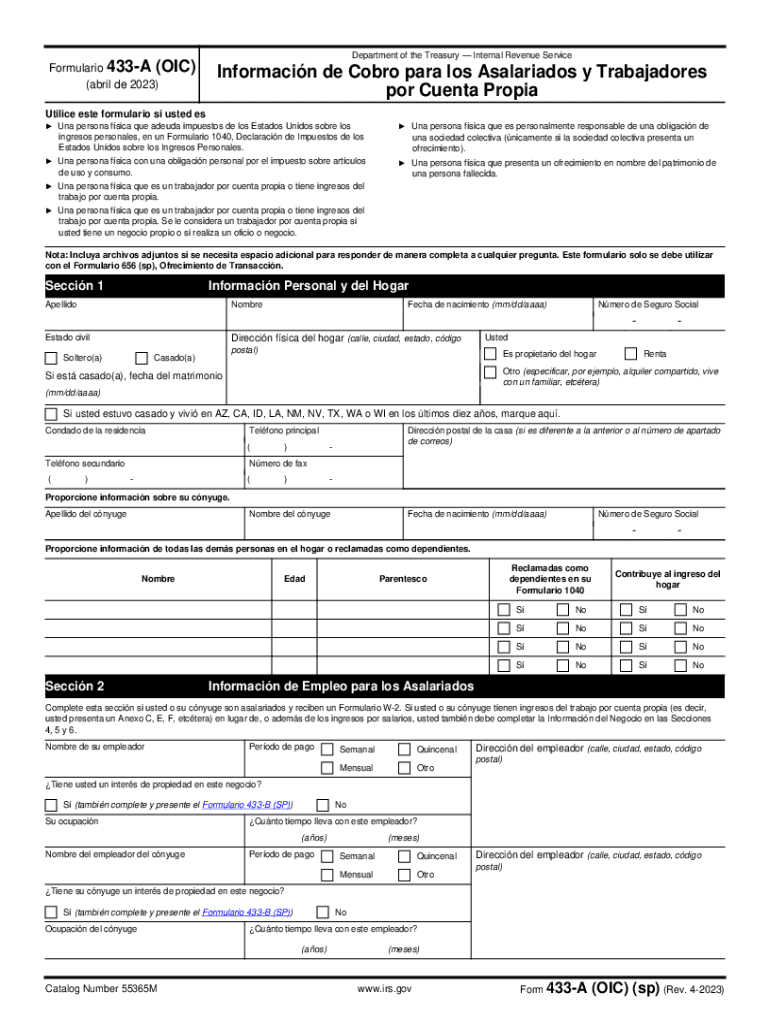

The Form 433 A OIC sp Rev 4 is a crucial document used by wage earners when applying for an Offer in Compromise (OIC) with the IRS. This form collects detailed information about the taxpayer's financial situation, including income, expenses, assets, and liabilities. It is designed to help the IRS determine the taxpayer's ability to pay their tax debt. Accurate completion of this form is essential, as it directly impacts the outcome of the OIC application.

Steps to Complete the Form 433 A OIC sp Rev 4 Collection Information Statement For Wage Earners And

Completing the Form 433 A OIC sp Rev 4 involves several key steps:

- Gather Financial Information: Collect all necessary documents, including pay stubs, bank statements, and expense records.

- Fill Out Personal Information: Provide your name, address, Social Security number, and other identifying details at the beginning of the form.

- Report Income: Detail all sources of income, including wages, bonuses, and any other earnings.

- List Monthly Expenses: Include all regular expenses such as housing, utilities, food, transportation, and healthcare.

- Disclose Assets: Provide information about assets, including real estate, vehicles, and savings accounts.

- Review and Sign: Carefully review all entries for accuracy before signing the form.

How to Obtain the Form 433 A OIC sp Rev 4 Collection Information Statement For Wage Earners And

The Form 433 A OIC sp Rev 4 can be obtained directly from the IRS website. It is available for download in PDF format, allowing you to print and fill it out manually. Additionally, tax professionals may have access to this form through their software platforms. Ensure you have the most current version to avoid any issues during submission.

Legal Use of the Form 433 A OIC sp Rev 4 Collection Information Statement For Wage Earners And

This form is legally required for individuals seeking to negotiate their tax debt through an Offer in Compromise. It must be submitted alongside the OIC application to provide the IRS with a comprehensive view of the taxpayer's financial situation. Failing to provide accurate information can lead to delays or denials of the application.

Key Elements of the Form 433 A OIC sp Rev 4 Collection Information Statement For Wage Earners And

Several key elements are essential when completing the Form 433 A OIC sp Rev 4:

- Personal Information: This includes your name, Social Security number, and contact details.

- Income Details: A thorough breakdown of all income sources.

- Monthly Expenses: A detailed account of necessary living expenses.

- Asset Disclosure: Information about all assets owned, including their value.

Filing Deadlines / Important Dates

When submitting the Form 433 A OIC sp Rev 4, it is important to be aware of any deadlines associated with your Offer in Compromise application. The IRS typically requires this form to be submitted along with the OIC application, and any delays in submission could affect the processing time. It is advisable to check the IRS website or consult a tax professional for the most current deadlines.

Quick guide on how to complete form 433 a oic sp rev 4 collection information statement for wage earners and

Easily Prepare Form 433 A OIC sp Rev 4 Collection Information Statement For Wage Earners And on Any Device

Online document administration has gained traction among companies and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, enabling you to find the right template and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Handle Form 433 A OIC sp Rev 4 Collection Information Statement For Wage Earners And on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to alter and electronically sign Form 433 A OIC sp Rev 4 Collection Information Statement For Wage Earners And effortlessly

- Obtain Form 433 A OIC sp Rev 4 Collection Information Statement For Wage Earners And and then click Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you would like to send your document: by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs with just a few clicks from your preferred device. Modify and electronically sign Form 433 A OIC sp Rev 4 Collection Information Statement For Wage Earners And and ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 433 a oic sp rev 4 collection information statement for wage earners and

Create this form in 5 minutes!

How to create an eSignature for the form 433 a oic sp rev 4 collection information statement for wage earners and

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 433 A OIC sp Rev 4 Collection Information Statement For Wage Earners And?

The Form 433 A OIC sp Rev 4 Collection Information Statement For Wage Earners And is a document used by the IRS to collect financial information from wage-earning individuals applying for an Offer in Compromise. It helps the IRS evaluate the ability of the taxpayer to pay their tax debts. By filling out this form accurately, taxpayers can facilitate the process of negotiating a settlement.

-

How does airSlate SignNow help in filling out the Form 433 A OIC sp Rev 4 Collection Information Statement For Wage Earners And?

With airSlate SignNow, you can easily access the Form 433 A OIC sp Rev 4 Collection Information Statement For Wage Earners And and fill it out online. Our user-friendly interface guides you through each field, ensuring that you provide all required information. This reduces the risk of errors and speeds up the submission process.

-

Is airSlate SignNow cost-effective for handling the Form 433 A OIC sp Rev 4 Collection Information Statement For Wage Earners And?

Absolutely! airSlate SignNow offers a cost-effective solution for managing the Form 433 A OIC sp Rev 4 Collection Information Statement For Wage Earners And. We provide various pricing plans that cater to different business needs, ensuring you get the best value while efficiently managing your documentation.

-

What features does airSlate SignNow offer for document management related to Form 433 A OIC sp Rev 4?

airSlate SignNow provides several features tailored to managing documents like the Form 433 A OIC sp Rev 4 Collection Information Statement For Wage Earners And, including eSignature capability, document templates, and secure cloud storage. These features ensure that your documents are easily accessible, securely stored, and legally binding once signed.

-

Can I integrate airSlate SignNow with other software for handling Form 433 A OIC sp Rev 4?

Yes, airSlate SignNow seamlessly integrates with various applications, allowing you to manage the Form 433 A OIC sp Rev 4 Collection Information Statement For Wage Earners And alongside your other business software. This integration streamlines your workflow, making it easier to track submissions and manage client communications.

-

What are the benefits of using airSlate SignNow for the Form 433 A OIC sp Rev 4?

Using airSlate SignNow for the Form 433 A OIC sp Rev 4 Collection Information Statement For Wage Earners And offers numerous benefits, including enhanced efficiency, reduced paperwork, and faster processing times. Our platform helps you stay organized and ensures you can submit all required data without any hassle, helping you achieve your tax settlement goals.

-

Is it safe to use airSlate SignNow for sensitive documents like Form 433 A OIC sp Rev 4?

Yes, airSlate SignNow prioritizes security and compliance, making it safe to handle sensitive documents such as the Form 433 A OIC sp Rev 4 Collection Information Statement For Wage Earners And. We implement robust encryption and adhere to strict data protection regulations, ensuring that your information is secure throughout the signing process.

Get more for Form 433 A OIC sp Rev 4 Collection Information Statement For Wage Earners And

Find out other Form 433 A OIC sp Rev 4 Collection Information Statement For Wage Earners And

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form