Schedule D Form 1120 Reporting Capital Gains and

Understanding the Schedule D Form 1120 for Reporting Capital Gains

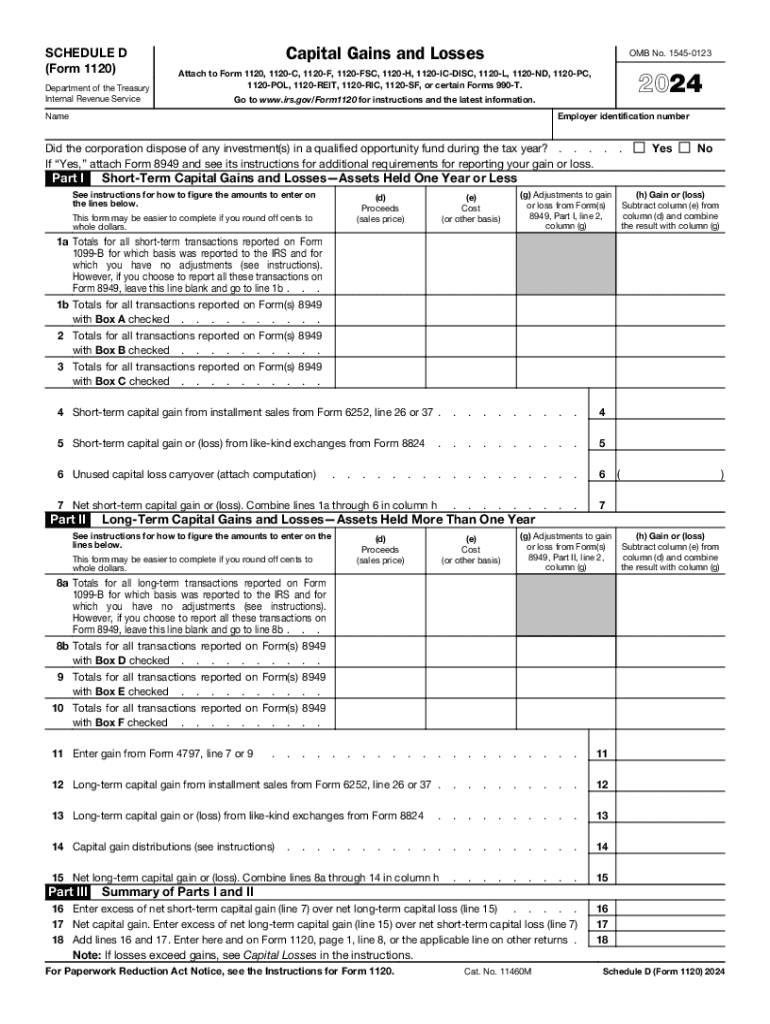

The Schedule D Form 1120 is essential for corporations to report capital gains and losses. This form helps businesses track their investment activities throughout the tax year. It is crucial to accurately report these gains and losses to comply with IRS regulations and ensure proper tax calculations.

Capital gains are profits from the sale of assets, while capital losses occur when assets are sold for less than their purchase price. Understanding how to report these figures on Schedule D is vital for maintaining clear financial records.

Steps to Complete the Schedule D Form 1120

Completing the Schedule D Form 1120 involves several key steps:

- Gather all relevant financial documents, including records of asset purchases and sales.

- Determine the capital gains and losses for the tax year by calculating the difference between the sale price and the purchase price of each asset.

- Fill out the appropriate sections of Schedule D, ensuring accuracy in reporting both short-term and long-term gains and losses.

- Transfer the totals from Schedule D to the main tax return form, ensuring consistency across all documents.

Review the completed form for any errors before submission to avoid potential penalties.

IRS Guidelines for Schedule D Form 1120

The IRS provides specific guidelines for completing Schedule D Form 1120. These guidelines detail the types of transactions that must be reported, including sales of stocks, bonds, and real estate. It is essential to follow these instructions closely to ensure compliance with tax laws.

Additionally, the IRS outlines the definitions of short-term and long-term capital gains, which are crucial for determining the correct tax rates. Familiarizing yourself with these guidelines will help streamline the filing process and reduce the risk of audits.

Examples of Using the Schedule D Form 1120

Practical examples can clarify how to use the Schedule D Form 1120 effectively. For instance, if a corporation sells stock for $10,000 that was purchased for $7,000, the capital gain is $3,000. This gain must be reported on Schedule D.

Conversely, if a corporation sells a piece of equipment for $5,000 that was originally bought for $8,000, the capital loss of $3,000 should also be reported. These examples illustrate the importance of accurately tracking and reporting both gains and losses to maintain compliance and optimize tax outcomes.

Filing Deadlines for Schedule D Form 1120

Filing deadlines for the Schedule D Form 1120 align with the corporate tax return deadlines. Generally, corporations must file their tax returns by the fifteenth day of the fourth month after the end of their tax year. For corporations operating on a calendar year, this typically means a deadline of April 15.

It is important to be aware of any extensions that may apply, as well as any changes in deadlines that may occur due to IRS updates or other regulatory changes.

Required Documents for Schedule D Form 1120

To complete the Schedule D Form 1120, several documents are necessary:

- Records of asset purchases and sales, including invoices and receipts.

- Statements from brokers or financial institutions detailing transactions.

- Prior year tax returns, which may provide context for current year reporting.

- Any relevant documentation related to capital losses, such as casualty loss reports.

Having these documents organized and accessible will facilitate a smoother filing process and help ensure accuracy in reporting.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule d form 1120 reporting capital gains and

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a capital loss carryover worksheet?

A capital loss carryover worksheet is a tool used to track and calculate capital losses that can be carried over to future tax years. This worksheet helps taxpayers maximize their deductions by accurately documenting losses that exceed the annual limit. Utilizing a capital loss carryover worksheet can simplify the tax filing process and ensure compliance with IRS regulations.

-

How can airSlate SignNow help with my capital loss carryover worksheet?

airSlate SignNow provides a user-friendly platform to create, send, and eSign your capital loss carryover worksheet. With our solution, you can easily collaborate with tax professionals and ensure that your worksheet is completed accurately and efficiently. This streamlines the process, allowing you to focus on maximizing your tax benefits.

-

Is there a cost associated with using the capital loss carryover worksheet feature?

airSlate SignNow offers competitive pricing plans that include access to various document management features, including the capital loss carryover worksheet. Our pricing is designed to be cost-effective for businesses of all sizes, ensuring you get the best value for your investment. You can choose a plan that fits your needs and budget.

-

What features does the capital loss carryover worksheet include?

The capital loss carryover worksheet includes features such as customizable templates, automated calculations, and secure eSigning capabilities. These features make it easy to create a comprehensive worksheet that meets your specific needs. Additionally, you can track changes and collaborate with others in real-time.

-

Can I integrate airSlate SignNow with other accounting software for my capital loss carryover worksheet?

Yes, airSlate SignNow offers integrations with various accounting software platforms, allowing you to seamlessly incorporate your capital loss carryover worksheet into your existing workflow. This integration enhances efficiency by reducing manual data entry and ensuring that all financial documents are synchronized. Check our integration options to find the best fit for your needs.

-

What are the benefits of using airSlate SignNow for my capital loss carryover worksheet?

Using airSlate SignNow for your capital loss carryover worksheet provides numerous benefits, including ease of use, enhanced collaboration, and secure document management. Our platform simplifies the process of preparing and signing your worksheet, ensuring that you can focus on maximizing your tax deductions. Additionally, our customer support team is available to assist you with any questions.

-

How secure is my capital loss carryover worksheet when using airSlate SignNow?

Security is a top priority at airSlate SignNow. Your capital loss carryover worksheet is protected with advanced encryption and secure cloud storage, ensuring that your sensitive financial information remains confidential. We comply with industry standards to provide a safe environment for all your documents.

Get more for Schedule D Form 1120 Reporting Capital Gains And

- Colorado resale certificate pdf form

- Benevolence intake form

- Dance team application form

- Apprenticeship report sheet form

- Confirmation of diagnosis form indiana

- Notice and acknowledgment of receipt for california state form

- Written authorization form

- Share trading and cash account application form advised clients

Find out other Schedule D Form 1120 Reporting Capital Gains And

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure