F1065 Schedule D JLv1 SCHEDULE D Form 1065 Capital

Understanding the IRS Schedule D

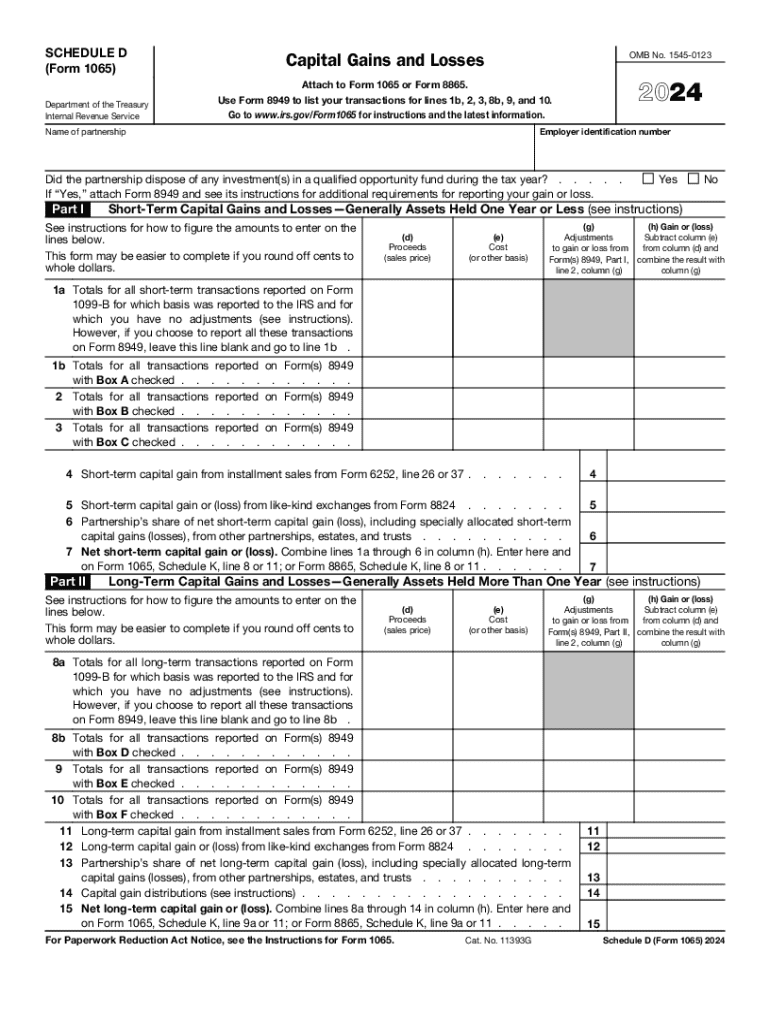

The IRS Schedule D is a form used by taxpayers to report capital gains and losses from the sale of securities and other assets. This form is essential for individuals and entities who have sold stocks, bonds, or other investments during the tax year. The information reported on Schedule D helps determine the overall tax liability related to these transactions. It is particularly relevant for partnerships, corporations, and individual taxpayers who need to report their capital gains and losses accurately.

Steps to Complete the IRS Schedule D

Completing the IRS Schedule D involves several steps to ensure accurate reporting of capital gains and losses. First, gather all relevant documentation, including records of purchases and sales of assets. Next, calculate the total capital gains and losses by subtracting the cost basis from the sale proceeds. Afterward, fill out the appropriate sections of Schedule D, detailing each transaction. Finally, transfer the totals to your main tax return form to reflect your overall tax situation. It is crucial to double-check all calculations for accuracy.

Key Elements of the IRS Schedule D

The IRS Schedule D includes several key elements that taxpayers must understand. These elements consist of sections for reporting short-term and long-term capital gains and losses. Short-term gains are typically from assets held for one year or less, while long-term gains come from assets held for more than one year. Additionally, taxpayers must provide information on specific transactions, including dates of acquisition and sale, the amount realized, and the cost basis. Understanding these elements is vital for accurate tax reporting.

IRS Guidelines for Schedule D

The IRS provides specific guidelines for completing Schedule D, which include instructions on how to report different types of transactions. Taxpayers must adhere to these guidelines to avoid errors and potential penalties. The IRS outlines the definitions of short-term and long-term capital gains, as well as the treatment of capital losses, including limitations on how much can be deducted in a given tax year. Familiarizing oneself with these guidelines is essential for compliance and accurate filing.

Filing Deadlines for Schedule D

Filing deadlines for the IRS Schedule D align with the general tax return deadlines. Typically, individual taxpayers must file their returns by April fifteenth of each year. However, if you are unable to meet this deadline, you may request an extension, which generally extends the filing period by six months. It is important to be aware of these deadlines to avoid late filing penalties and interest on any taxes owed.

Required Documents for Schedule D

To complete the IRS Schedule D accurately, certain documents are required. Taxpayers should gather records of all transactions involving capital assets, including brokerage statements, purchase receipts, and sales confirmations. Additionally, any documentation related to the cost basis of assets, such as improvements made or commissions paid, should also be included. Having these documents organized and accessible will facilitate a smoother filing process.

Penalties for Non-Compliance with Schedule D

Failure to comply with the reporting requirements of IRS Schedule D can result in significant penalties. If taxpayers do not report capital gains or losses accurately, they may face fines and interest on unpaid taxes. Additionally, the IRS may impose penalties for late filing or failure to file altogether. Understanding these potential consequences emphasizes the importance of accurate and timely reporting on Schedule D.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the f1065 schedule d jlv1 schedule d form 1065 capital

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IRS Schedule D and why is it important?

The IRS Schedule D is a tax form used to report capital gains and losses from the sale of securities. Understanding how to accurately fill out the IRS Schedule D is crucial for taxpayers to ensure compliance and avoid penalties. Properly reporting your capital gains can also help you maximize your tax benefits.

-

How can airSlate SignNow help with IRS Schedule D documentation?

airSlate SignNow provides a seamless way to eSign and send documents related to your IRS Schedule D. With our user-friendly platform, you can easily manage your tax documents, ensuring they are signed and submitted on time. This helps streamline your tax preparation process and reduces the risk of errors.

-

Is airSlate SignNow cost-effective for managing IRS Schedule D forms?

Yes, airSlate SignNow offers a cost-effective solution for managing IRS Schedule D forms. Our pricing plans are designed to fit various business needs, allowing you to choose the best option for your budget. With our platform, you can save time and money while ensuring your tax documents are handled efficiently.

-

What features does airSlate SignNow offer for IRS Schedule D users?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all of which are beneficial for IRS Schedule D users. These features help you create, send, and manage your tax documents with ease. Additionally, our platform ensures that your documents are stored securely and are easily accessible.

-

Can I integrate airSlate SignNow with other tax software for IRS Schedule D?

Absolutely! airSlate SignNow can be integrated with various tax software solutions to enhance your IRS Schedule D filing process. This integration allows for seamless data transfer and document management, making it easier to prepare and submit your tax forms. You can streamline your workflow and reduce the chances of errors.

-

What are the benefits of using airSlate SignNow for IRS Schedule D?

Using airSlate SignNow for your IRS Schedule D offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to eSign documents quickly, ensuring that your tax filings are submitted on time. Additionally, you can track the status of your documents in real-time, providing peace of mind.

-

How secure is airSlate SignNow for handling IRS Schedule D documents?

airSlate SignNow prioritizes security, ensuring that your IRS Schedule D documents are protected. We use advanced encryption and secure storage solutions to safeguard your sensitive information. You can trust that your tax documents are handled with the highest level of security and confidentiality.

Get more for F1065 Schedule D JLv1 SCHEDULE D Form 1065 Capital

Find out other F1065 Schedule D JLv1 SCHEDULE D Form 1065 Capital

- How To Sign Arkansas Lease Renewal

- Sign Georgia Forbearance Agreement Now

- Sign Arkansas Lease Termination Letter Mobile

- Sign Oregon Lease Termination Letter Easy

- How To Sign Missouri Lease Renewal

- Sign Colorado Notice of Intent to Vacate Online

- How Can I Sign Florida Notice of Intent to Vacate

- How Do I Sign Michigan Notice of Intent to Vacate

- Sign Arizona Pet Addendum to Lease Agreement Later

- How To Sign Pennsylvania Notice to Quit

- Sign Connecticut Pet Addendum to Lease Agreement Now

- Sign Florida Pet Addendum to Lease Agreement Simple

- Can I Sign Hawaii Pet Addendum to Lease Agreement

- Sign Louisiana Pet Addendum to Lease Agreement Free

- Sign Pennsylvania Pet Addendum to Lease Agreement Computer

- Sign Rhode Island Vacation Rental Short Term Lease Agreement Safe

- Sign South Carolina Vacation Rental Short Term Lease Agreement Now

- How Do I Sign Georgia Escrow Agreement

- Can I Sign Georgia Assignment of Mortgage

- Sign Kentucky Escrow Agreement Simple