Form 990 Schedule C Simplifying Nonprofit Reporting

Understanding the Form 990 Schedule C for Nonprofits

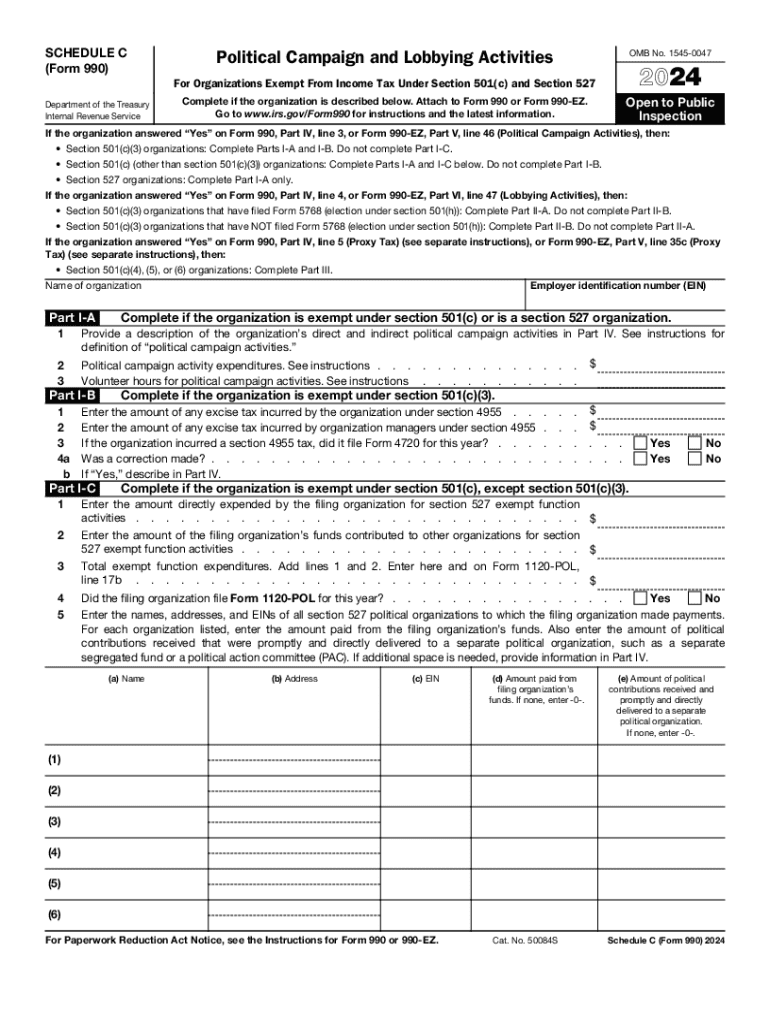

The Form 990 Schedule C is a crucial document for nonprofits, providing transparency in their financial reporting. This form simplifies the reporting process for organizations by detailing their governance, management, and financial practices. Understanding its purpose helps nonprofits comply with IRS regulations and maintain public trust.

Nonprofits must report their activities, including revenue sources and expenditures, to ensure accountability. The Schedule C specifically addresses issues like governance policies and procedures, which are essential for demonstrating compliance with federal regulations.

Steps to Complete the Form 990 Schedule C

Completing the Form 990 Schedule C involves several key steps to ensure accuracy and compliance. Start by gathering all necessary financial records, including income statements, balance sheets, and previous tax returns. This information will provide a comprehensive view of the organization's financial health.

Next, carefully fill out each section of the form, providing detailed information about governance practices, management policies, and financial activities. It's important to be thorough and precise, as inaccuracies can lead to compliance issues. After completing the form, review it for errors and ensure all required signatures are present before submission.

Filing Deadlines for the Form 990 Schedule C

Timely filing of the Form 990 Schedule C is essential for compliance. Nonprofits typically must submit this form by the fifteenth day of the fifth month after the end of their fiscal year. For organizations operating on a calendar year, this means the deadline is May 15. If additional time is needed, nonprofits can file for an extension, allowing for up to six additional months to submit the form.

Staying aware of these deadlines helps organizations avoid penalties and maintain good standing with the IRS. It is advisable to mark these dates on the calendar to ensure timely preparation and submission.

Required Documents for the Form 990 Schedule C

To complete the Form 990 Schedule C accurately, several documents are required. These include financial statements, previous 990 forms, and any governance policies the organization has in place. Collecting these documents beforehand streamlines the process and ensures that all necessary information is available.

Additionally, organizations should have documentation related to their revenue sources and expenditures. This includes donor agreements, grant contracts, and invoices. Having these documents organized will facilitate a smoother completion of the form.

IRS Guidelines for the Form 990 Schedule C

The IRS provides specific guidelines for completing the Form 990 Schedule C, which organizations must adhere to for compliance. These guidelines outline the necessary information required, including details about governance structures, financial practices, and any changes from previous years.

Nonprofits should regularly review these guidelines to stay updated on any changes or additional requirements. Familiarity with IRS expectations helps organizations prepare accurate and compliant submissions, reducing the risk of penalties.

Penalties for Non-Compliance with the Form 990 Schedule C

Failure to comply with the Form 990 Schedule C requirements can result in significant penalties for nonprofits. The IRS may impose fines for late filings, inaccuracies, or failure to provide necessary information. These penalties can vary based on the severity of the non-compliance and can have financial implications for the organization.

To avoid these penalties, nonprofits should prioritize timely and accurate submissions. Regular training and updates on IRS requirements can help organizations maintain compliance and avoid costly mistakes.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 990 schedule c simplifying nonprofit reporting

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IRS 990 campaign and how can airSlate SignNow assist with it?

The IRS 990 campaign involves filing annual tax returns for tax-exempt organizations. airSlate SignNow simplifies this process by allowing users to easily eSign and send necessary documents securely, ensuring compliance and timely submissions.

-

How does airSlate SignNow enhance the IRS 990 campaign filing process?

With airSlate SignNow, organizations can streamline their IRS 990 campaign by automating document workflows. This reduces the time spent on paperwork and minimizes errors, making the filing process more efficient and reliable.

-

What are the pricing options for using airSlate SignNow for the IRS 990 campaign?

airSlate SignNow offers flexible pricing plans tailored to different organizational needs. Whether you are a small nonprofit or a large organization, you can find a plan that fits your budget while effectively managing your IRS 990 campaign.

-

Can airSlate SignNow integrate with other tools for managing the IRS 990 campaign?

Yes, airSlate SignNow integrates seamlessly with various accounting and document management tools. This integration allows for a more cohesive workflow when handling the IRS 990 campaign, ensuring that all necessary data is easily accessible.

-

What features does airSlate SignNow offer to support the IRS 990 campaign?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking. These tools are designed to support organizations in efficiently managing their IRS 990 campaign and ensuring compliance with IRS regulations.

-

How can airSlate SignNow improve collaboration during the IRS 990 campaign?

airSlate SignNow enhances collaboration by allowing multiple stakeholders to review and sign documents in real-time. This feature is particularly beneficial during the IRS 990 campaign, as it ensures that all necessary approvals are obtained quickly and efficiently.

-

Is airSlate SignNow user-friendly for those unfamiliar with the IRS 990 campaign?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to navigate, even if they are not familiar with the IRS 990 campaign. The intuitive interface helps users manage their documents without any steep learning curve.

Get more for Form 990 Schedule C Simplifying Nonprofit Reporting

- Model m 110l microfluidizer processor user manual form

- Ocfs 3909 form

- How to fill challan form

- California prenuptial agreement template word form

- Ihop employee handbook form

- Rules and regulations for the chili cook off abc of oklahoma abcokla form

- Texas uil form 4 uiltexas

- Pickleball tournament registration form martinsburg berkeley mbcparks rec

Find out other Form 990 Schedule C Simplifying Nonprofit Reporting

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe