Form 8815

What is the Form 8815

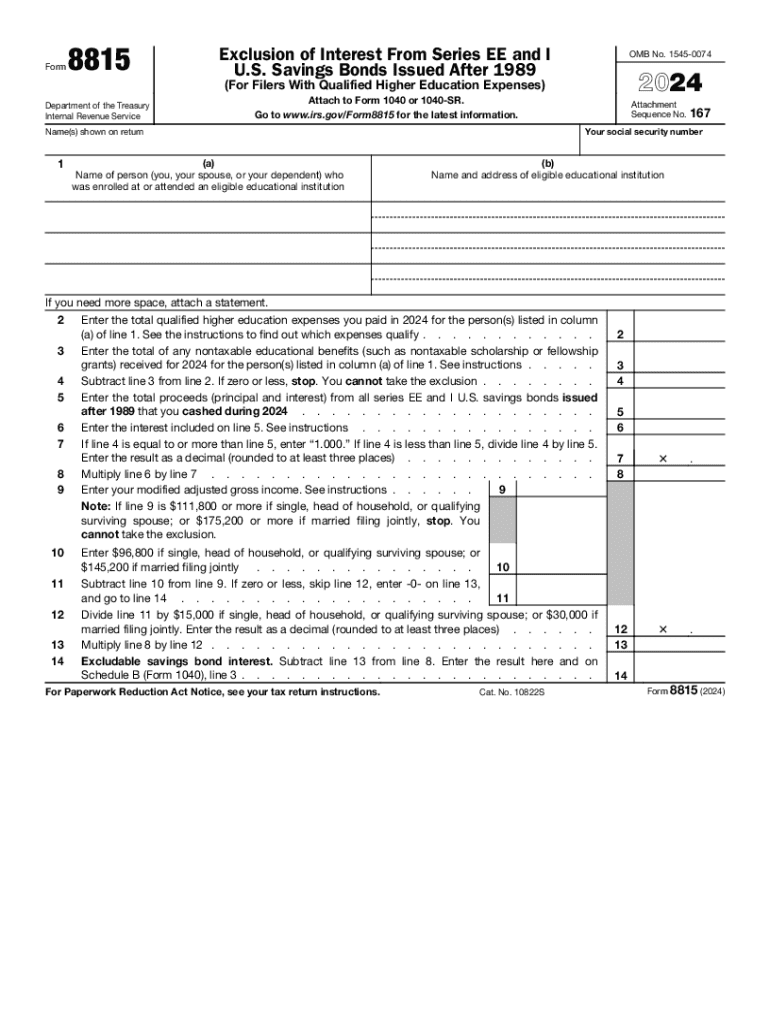

The Form 8815, also known as the Exclusion of Interest from Series EE and I U.S. Savings Bonds, is a tax form used by individuals to report the interest earned on certain U.S. savings bonds. This form allows eligible taxpayers to exclude interest from their gross income when they redeem these bonds, provided they meet specific criteria. The primary purpose of Form 8815 is to help taxpayers take advantage of tax benefits associated with the redemption of Series EE and I bonds, particularly when the funds are used for qualified education expenses.

How to use the Form 8815

To effectively use Form 8815, taxpayers must first determine their eligibility based on income and usage of the bond proceeds. The form requires detailed information about the taxpayer's filing status, the amount of interest earned, and the qualified education expenses incurred. Taxpayers should complete the form alongside their federal income tax return, ensuring that all relevant information is accurately reported. It is essential to maintain records of the bonds and any related expenses, as these may be necessary for verification by the IRS.

Steps to complete the Form 8815

Completing Form 8815 involves several key steps:

- Gather necessary documents, including the savings bond value chart and records of education expenses.

- Determine your eligibility based on income limits and the purpose of bond redemption.

- Fill out the form by providing your personal information, including your Social Security number and filing status.

- Report the total interest earned from the savings bonds and the amount of qualified education expenses.

- Review the completed form for accuracy before submitting it with your tax return.

IRS Guidelines

The IRS provides specific guidelines regarding the use of Form 8815. Taxpayers should refer to the IRS instructions for Form 8815 to understand the eligibility criteria, income limits, and the types of expenses that qualify for exclusion. It is crucial to stay updated on any changes to tax laws that may affect the use of this form. Failure to comply with IRS guidelines may result in penalties or the disallowance of the interest exclusion.

Required Documents

When completing Form 8815, taxpayers must have several documents on hand to ensure accurate reporting. Required documents include:

- Records of the Series EE or I bonds, including purchase dates and amounts.

- Documentation of qualified education expenses, such as tuition statements or receipts.

- Any previous tax returns that may provide context for income levels.

Filing Deadlines / Important Dates

Form 8815 must be filed along with your federal income tax return by the standard tax filing deadline, which is typically April 15 each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to keep track of any changes in deadlines that may occur due to legislation or IRS announcements. Filing on time helps avoid penalties and ensures that taxpayers can take advantage of the interest exclusion.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8815 765375240

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a series ee savings bond value chart?

A series ee savings bond value chart is a tool that helps you determine the current value of your series ee savings bonds based on their issue date and interest rates. This chart is essential for investors looking to understand the growth of their bonds over time and make informed financial decisions.

-

How can I find the current value of my series ee savings bonds?

You can find the current value of your series ee savings bonds by referring to the series ee savings bond value chart available on the U.S. Department of the Treasury's website. This chart provides updated values based on the bond's issue date and the interest it has accrued.

-

What factors affect the value of series ee savings bonds?

The value of series ee savings bonds is influenced by several factors, including the bond's issue date, the interest rate at which it was issued, and the length of time it has been held. The series ee savings bond value chart reflects these factors, allowing you to see how your investment grows over time.

-

Are series ee savings bonds a good investment?

Yes, series ee savings bonds can be a good investment for those looking for a low-risk savings option. They offer a fixed interest rate and are backed by the U.S. government, making them a safe choice for long-term savings. The series ee savings bond value chart can help you track your investment's performance.

-

How often do series ee savings bonds earn interest?

Series ee savings bonds earn interest monthly, and the interest is compounded semiannually. This means that the value of your bonds increases over time, which you can track using the series ee savings bond value chart to see how much your investment has grown.

-

Can I redeem my series ee savings bonds before maturity?

Yes, you can redeem your series ee savings bonds before they signNow maturity, but doing so may result in a loss of interest if they are redeemed within the first five years. The series ee savings bond value chart can help you determine the value at the time of redemption.

-

What is the maximum amount I can invest in series ee savings bonds?

As of 2023, individuals can purchase up to $10,000 in series ee savings bonds per calendar year. This limit applies to electronic bonds purchased through the TreasuryDirect website. The series ee savings bond value chart can help you understand the potential growth of your investment within this limit.

Get more for Form 8815

- Fia card services na and ba master trust ii agreements form

- Simply optometry patient history form

- Fall protection equipment form

- Boat transfer papers qld form

- Test audit form

- Aabb standards 32nd edition pdf download form

- Blank will forms

- For information on how hm land registry processes your personal information see our personal information

Find out other Form 8815

- Sign Oregon Legal LLC Operating Agreement Computer

- Sign Pennsylvania Legal Moving Checklist Easy

- Sign Pennsylvania Legal Affidavit Of Heirship Computer

- Sign Connecticut Life Sciences Rental Lease Agreement Online

- Sign Connecticut Life Sciences Affidavit Of Heirship Easy

- Sign Tennessee Legal LLC Operating Agreement Online

- How To Sign Tennessee Legal Cease And Desist Letter

- How Do I Sign Tennessee Legal Separation Agreement

- Sign Virginia Insurance Memorandum Of Understanding Easy

- Sign Utah Legal Living Will Easy

- Sign Virginia Legal Last Will And Testament Mobile

- How To Sign Vermont Legal Executive Summary Template

- How To Sign Vermont Legal POA

- How Do I Sign Hawaii Life Sciences Business Plan Template

- Sign Life Sciences PPT Idaho Online

- Sign Life Sciences PPT Idaho Later

- How Do I Sign Hawaii Life Sciences LLC Operating Agreement

- Sign Idaho Life Sciences Promissory Note Template Secure

- How To Sign Wyoming Legal Quitclaim Deed

- Sign Wisconsin Insurance Living Will Now