Forma 12153

What is the Forma 12153

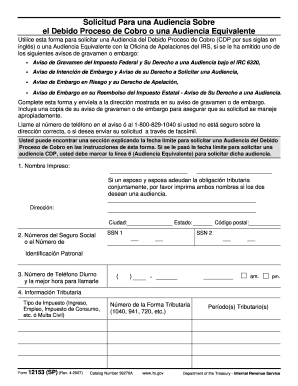

The Forma 12153 is a specific document used primarily for tax-related purposes in the United States. It serves as a request for certain tax information from the Internal Revenue Service (IRS). This form is essential for individuals or businesses that need to clarify their tax obligations or seek specific tax-related guidance. Understanding the purpose and requirements of the Forma 12153 is crucial for ensuring compliance with IRS regulations.

How to use the Forma 12153

Using the Forma 12153 involves several straightforward steps. First, gather all necessary information, including your personal details and specific tax questions. Next, accurately fill out the form, ensuring that all sections are completed to avoid delays. Once completed, submit the form to the appropriate IRS office, either electronically or by mail, depending on your preference and the specific instructions provided with the form. It is important to keep a copy of the submitted form for your records.

Steps to complete the Forma 12153

Completing the Forma 12153 requires careful attention to detail. Follow these steps:

- Begin by downloading the form from the IRS website or accessing it through a trusted tax software.

- Fill in your name, address, and taxpayer identification number accurately.

- Clearly state the purpose of your request and provide any relevant details that may assist the IRS in processing your inquiry.

- Review the completed form for accuracy and completeness.

- Submit the form according to the instructions provided, ensuring you choose the correct submission method.

Legal use of the Forma 12153

The legal use of the Forma 12153 is governed by IRS regulations. It is vital to ensure that the information provided is truthful and accurate, as submitting false information can lead to penalties. The form is designed to facilitate communication between taxpayers and the IRS, helping individuals and businesses clarify their tax situations. Proper use of the form can aid in avoiding misunderstandings and potential legal issues related to tax compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Forma 12153 can vary depending on the specific circumstances of the request. Generally, it is advisable to submit the form as soon as the need arises to ensure timely processing. Keeping track of important tax dates, such as the annual tax filing deadline, can help ensure that the Forma 12153 is submitted within a suitable timeframe. Always refer to the IRS guidelines for the most current deadlines related to tax forms.

Required Documents

When completing the Forma 12153, certain documents may be required to support your request. These can include:

- Proof of identity, such as a driver's license or Social Security card.

- Previous tax returns that may be relevant to your inquiry.

- Any correspondence received from the IRS related to your tax situation.

Having these documents ready can streamline the process and help ensure that your request is processed efficiently.

Quick guide on how to complete forma 12153

Complete [SKS] effortlessly on any device

Managing documents online has become increasingly common among companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the resources you need to create, alter, and electronically sign your documents swiftly without hold-ups. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

How to alter and electronically sign [SKS] with ease

- Obtain [SKS] and click on Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Choose how you wish to send your form—via email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign [SKS] and ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Forma 12153

Create this form in 5 minutes!

How to create an eSignature for the forma 12153

How to make an electronic signature for your Forma 12153 in the online mode

How to generate an electronic signature for your Forma 12153 in Chrome

How to make an electronic signature for putting it on the Forma 12153 in Gmail

How to generate an electronic signature for the Forma 12153 right from your mobile device

How to create an electronic signature for the Forma 12153 on iOS

How to generate an eSignature for the Forma 12153 on Android OS

People also ask

-

What is Forma 12153?

Forma 12153 is a specialized document management and e-signature solution offered by airSlate SignNow. It enables businesses to easily send, sign, and manage their documents online. This platform provides a user-friendly interface that simplifies the entire signing process.

-

How much does Forma 12153 cost?

The pricing for Forma 12153 varies based on the features and the number of users. airSlate SignNow offers flexible subscription plans that cater to different business needs, ensuring cost-effectiveness. You can find detailed pricing information on our website to determine which plan fits your budget.

-

What features does Forma 12153 provide?

Forma 12153 includes a robust set of features such as customizable templates, advanced security options, and real-time tracking of document status. Users can also leverage integrations with popular business applications to streamline their workflows. This makes it an ideal solution for businesses looking to enhance their document management processes.

-

How can Forma 12153 benefit my business?

Using Forma 12153 can signNowly reduce the time and resources spent on traditional document signing methods. It empowers your team with quick and efficient tools for document creation, distribution, and signing, thereby improving overall productivity. Additionally, it ensures compliance with legal standards for electronic signatures.

-

Is Forma 12153 suitable for small businesses?

Yes, Forma 12153 is designed to be scalable and suitable for businesses of all sizes, including small enterprises. Its cost-effective plans and user-friendly interface make it a perfect choice for small businesses looking to optimize their document processes. With the features offered, even startups can benefit from efficient e-signature solutions.

-

Can I integrate Forma 12153 with other software?

Absolutely! Forma 12153 supports various integrations with popular tools such as CRM systems, cloud storage, and project management software. This allows businesses to streamline their workflows and smoothly incorporate the e-signature process into their existing systems. Check our integrations page for a complete list of compatible applications.

-

How secure is Forma 12153?

Security is a top priority with Forma 12153. It employs industry-standard encryption to protect your documents and user data during the signing process. Additionally, compliance with regulations such as eIDAS and ESIGN ensures your documents are legally binding and secure.

Get more for Forma 12153

- About pack 399 form

- Bahamas customs clearance form

- My healthehealth belgium be form

- Homeschool lesson plans form

- Expressionism in the glass menagerie form

- Images for is it truecertified organizational ombudsman practitioner certification application namemailing form

- Social skills group data sheet autism pdc form

- Acfrogcgjze9z1ojsr1 iwt3loosyzv6wk ql jfnwtnzctvfio pa thv9tyq8mbkgehec9dpy form

Find out other Forma 12153

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free

- eSign Colorado Real estate investment proposal template Simple

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now

- eSignature Missouri Hold Harmless (Indemnity) Agreement Later

- eSignature Ohio Hold Harmless (Indemnity) Agreement Mobile

- eSignature California Letter of Intent Free