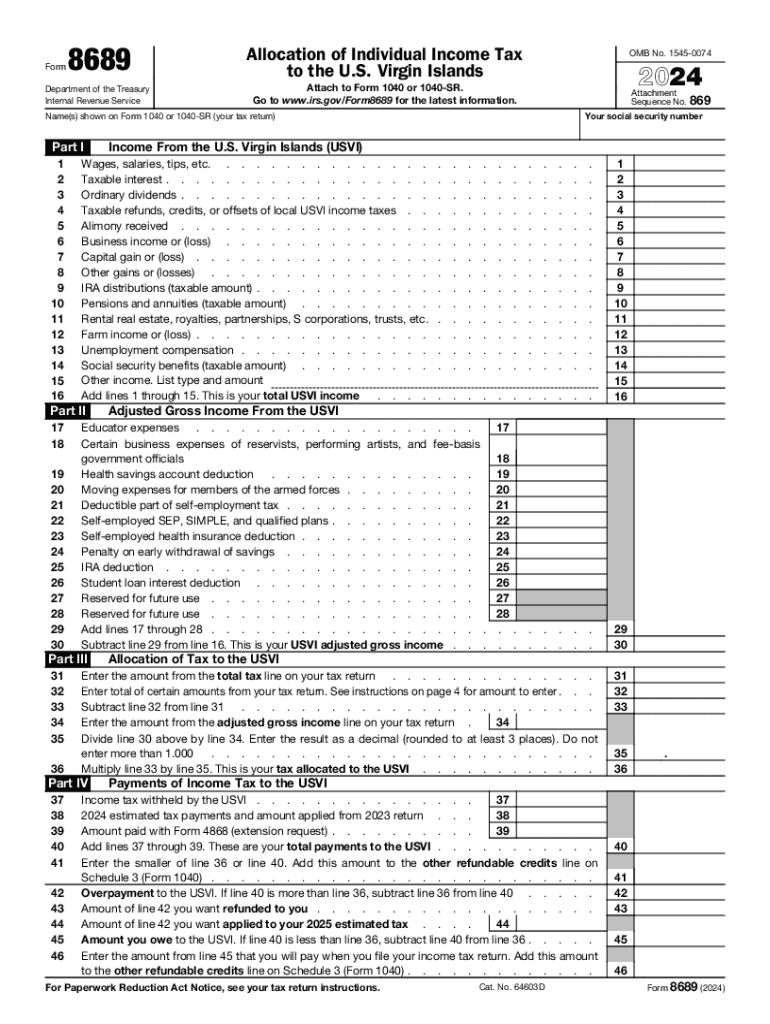

Desktop Form 8689 Allocation of Individual Income Tax

What is IRS Form 8594?

IRS Form 8594, also known as the Asset Acquisition Statement, is used for reporting the purchase price allocation when a business acquires assets from another business. This form is essential for tax purposes, as it helps both the buyer and seller report the transaction accurately. The form requires detailed information about the assets acquired, including their fair market value and the total purchase price, which is crucial for determining tax implications.

Steps to Complete IRS Form 8594

Completing IRS Form 8594 involves several key steps:

- Begin by entering the names and identifying information of the buyer and seller.

- List the assets acquired in the transaction, including tangible and intangible assets.

- Assign a fair market value to each asset based on the purchase price allocation.

- Calculate the total purchase price and ensure it matches the sum of the allocated values.

- Sign and date the form to certify the accuracy of the information provided.

Filing Deadlines and Important Dates

It is important to be aware of the deadlines for submitting IRS Form 8594. Generally, this form must be filed with the tax return for the year in which the asset acquisition occurred. For most taxpayers, this means filing by April 15 of the following year, unless an extension has been granted. Keeping track of these deadlines helps avoid penalties and ensures compliance with IRS regulations.

Required Documents for IRS Form 8594

When preparing to file IRS Form 8594, gather the necessary documents to support the information reported on the form. Required documents typically include:

- Purchase agreements outlining the terms of the asset acquisition.

- Valuation reports for the assets acquired, if applicable.

- Financial statements reflecting the fair market value of the assets.

- Any correspondence with the IRS regarding the transaction.

IRS Guidelines for Form 8594

The IRS provides specific guidelines for completing Form 8594, which include instructions on how to allocate the purchase price among different asset categories. It is essential to follow these guidelines closely to ensure compliance and avoid potential issues during an audit. The IRS emphasizes the importance of accurate reporting and may require additional documentation to substantiate the values assigned to each asset.

Penalties for Non-Compliance

Failure to file IRS Form 8594 or inaccuracies in the information reported can lead to significant penalties. The IRS may impose fines for late submissions or incorrect allocations, which can affect both the buyer and seller. Understanding these potential penalties highlights the importance of diligent record-keeping and accurate reporting when completing the form.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the desktop form 8689 allocation of individual income tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the IRS Form 8594 instructions?

The IRS Form 8594 instructions provide detailed guidance on how to complete the form, which is used for asset acquisitions. Understanding these instructions is crucial for ensuring compliance with tax regulations. airSlate SignNow can help streamline the process of signing and submitting these forms electronically.

-

How can airSlate SignNow assist with IRS Form 8594?

airSlate SignNow simplifies the process of completing and eSigning IRS Form 8594. With our platform, you can easily upload the form, fill it out, and send it for signatures, all while ensuring that you follow the IRS Form 8594 instructions accurately. This saves time and reduces the risk of errors.

-

Is there a cost associated with using airSlate SignNow for IRS Form 8594?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our cost-effective solutions allow you to manage documents, including IRS Form 8594, without breaking the bank. You can choose a plan that best fits your requirements and budget.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides a range of features designed for efficient document management, including templates, automated workflows, and secure eSigning. These features ensure that you can handle IRS Form 8594 instructions and other documents seamlessly. Our user-friendly interface makes it easy for anyone to navigate.

-

Can I integrate airSlate SignNow with other software for IRS Form 8594?

Absolutely! airSlate SignNow offers integrations with various software applications, enhancing your workflow for managing IRS Form 8594. Whether you use CRM systems or accounting software, our platform can connect with them to streamline your document processes.

-

What are the benefits of using airSlate SignNow for IRS Form 8594?

Using airSlate SignNow for IRS Form 8594 offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that you can follow the IRS Form 8594 instructions accurately while enjoying a hassle-free eSigning experience. This ultimately saves you time and resources.

-

How secure is airSlate SignNow for handling IRS Form 8594?

Security is a top priority at airSlate SignNow. We implement advanced encryption and compliance measures to protect your documents, including IRS Form 8594. You can trust that your sensitive information is safe while you follow the IRS Form 8594 instructions and manage your documents.

Get more for Desktop Form 8689 Allocation Of Individual Income Tax

Find out other Desktop Form 8689 Allocation Of Individual Income Tax

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors