Radicar 1040 Pr Online Form

What is the Radicar 1040 Pr Online

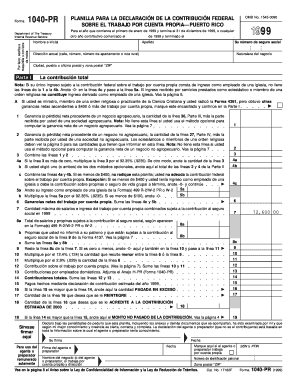

The Radicar 1040 Pr online is a digital version of the tax form used by residents of Puerto Rico to report their income and calculate their tax liability. This form is essential for individuals who need to file their taxes with the Internal Revenue Service (IRS) while also complying with local tax regulations. The online format allows users to complete and submit the form electronically, streamlining the filing process and reducing the likelihood of errors that can occur with paper submissions.

How to use the Radicar 1040 Pr Online

Using the Radicar 1040 Pr online involves several straightforward steps. First, access the online platform where the form is hosted. Next, gather all necessary financial documents, including W-2s, 1099s, and any other relevant income statements. Once you have your documents ready, begin filling out the form by entering your personal information, income details, and applicable deductions. After completing the form, review all entries for accuracy before submitting it electronically. This process ensures that your tax return is filed correctly and on time.

Steps to complete the Radicar 1040 Pr Online

Completing the Radicar 1040 Pr online involves a series of methodical steps:

- Access the online tax filing platform.

- Gather all necessary documents, including income statements and deduction records.

- Input your personal information, including your Social Security number and address.

- Enter your total income and any applicable deductions or credits.

- Review the completed form for accuracy.

- Submit the form electronically.

Following these steps will help ensure that your Radicar 1040 Pr is completed accurately and efficiently.

Legal use of the Radicar 1040 Pr Online

The Radicar 1040 Pr online is legally binding when completed and submitted according to established regulations. For the submission to be considered valid, it must comply with the IRS guidelines and local tax laws. Using a secure electronic signature, such as those provided by reputable eSignature platforms, can enhance the legal standing of your submission. It is crucial to ensure that all information provided is truthful and accurate to avoid potential legal issues.

Required Documents

To successfully complete the Radicar 1040 Pr online, several documents are required:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Records of other income sources, such as interest or dividends.

- Documentation for any deductions or credits you plan to claim, such as mortgage interest or educational expenses.

Having these documents ready will facilitate a smoother filing process and help ensure accuracy in your tax return.

Filing Deadlines / Important Dates

Filing deadlines for the Radicar 1040 Pr online typically align with the IRS tax calendar. Generally, the deadline to file your tax return is April 15 of each year, but this may vary based on specific circumstances or changes in legislation. It is important to stay informed about any updates regarding deadlines to avoid penalties for late submissions. Marking these dates on your calendar can help you stay organized and ensure timely filing.

Quick guide on how to complete 1040pr ingles form

Complete Radicar 1040 Pr Online effortlessly on any device

Managing documents online has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed forms, as you can obtain the necessary document and securely store it online. airSlate SignNow offers all the tools you require to create, modify, and electronically sign your documents promptly without delays. Administer Radicar 1040 Pr Online on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The simplest method to modify and eSign Radicar 1040 Pr Online with ease

- Obtain Radicar 1040 Pr Online and click Get Form to begin.

- Use the tools we offer to fill out your form.

- Highlight important sections of the documents or redact sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device of your choice. Modify and eSign Radicar 1040 Pr Online to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1040pr ingles form

How to create an eSignature for your 1040pr Ingles Form online

How to create an electronic signature for your 1040pr Ingles Form in Chrome

How to make an eSignature for putting it on the 1040pr Ingles Form in Gmail

How to create an eSignature for the 1040pr Ingles Form from your smartphone

How to generate an electronic signature for the 1040pr Ingles Form on iOS devices

How to generate an electronic signature for the 1040pr Ingles Form on Android OS

People also ask

-

What is the process for filing a 1040 online using airSlate SignNow?

Filing a 1040 online with airSlate SignNow is straightforward. First, you can upload your tax documents, fill out the 1040 form, and then electronically sign it for submission. Our user-friendly interface guides you through each step, ensuring your online filing is seamless and efficient.

-

How much does it cost to eSign a 1040 online with airSlate SignNow?

The pricing for eSigning a 1040 online with airSlate SignNow is competitive and scalable based on your business needs. We offer various subscription plans that cater to individual users and enterprises. Check our website for the latest pricing and to find a plan that suits your requirements.

-

What features does airSlate SignNow offer for managing 1040 online submissions?

airSlate SignNow provides a suite of features for managing your 1040 online submissions, including templates, automated workflows, and secure storage. These tools make it easy to prepare, send, and eSign your tax documents efficiently while ensuring compliance with the latest regulations.

-

Can I integrate airSlate SignNow with other tax software for filing a 1040 online?

Yes, airSlate SignNow offers integrations with various tax software, making it easier to file your 1040 online. This integration allows you to pull in necessary data from your tax software, saving time and reducing errors during the filing process. Check our integration options for more details.

-

Is airSlate SignNow secure for sending and signing my 1040 online?

Absolutely! airSlate SignNow prioritizes security, utilizing advanced encryption to protect your sensitive information during the transmission of your 1040 online. We comply with industry standards and regulations to ensure your documents remain confidential and secure.

-

What are the benefits of using airSlate SignNow for 1040 online filings?

Using airSlate SignNow for 1040 online filings offers numerous benefits, including speed, efficiency, and cost-effectiveness. Our platform simplifies the signing process, helps avoid paperwork errors, and speeds up tax preparation and submission, allowing you to focus on other priorities.

-

Can I track the status of my 1040 online submission with airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your 1040 online submissions in real-time. You will receive notifications throughout the process, keeping you informed and allowing you to manage your filings proactively. This feature enhances transparency and accountability.

Get more for Radicar 1040 Pr Online

- Cdn2 sportngin comattachmentsdocumenthuron little league player registration form player

- Indochinaalterations formplease bring this form

- Yacht food preference sheet form

- Energy star qualified homes version 3 inspection form

- F104 proficiency testing data submission form

- Divisional science olympiad ru ac form

- Riding lawn mower maintenance log form

- Scout rank worksheetpdf orgsites form

Find out other Radicar 1040 Pr Online

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free

- How To eSign Indiana Legal Residential Lease Agreement

- eSign Iowa Legal Separation Agreement Easy

- How To eSign New Jersey Life Sciences LLC Operating Agreement

- eSign Tennessee Insurance Rental Lease Agreement Later

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP