Form 1040 SR Sp U S Tax Return for Seniors Spanish Version

What is the Form 1040 SR sp U S Tax Return For Seniors Spanish Version

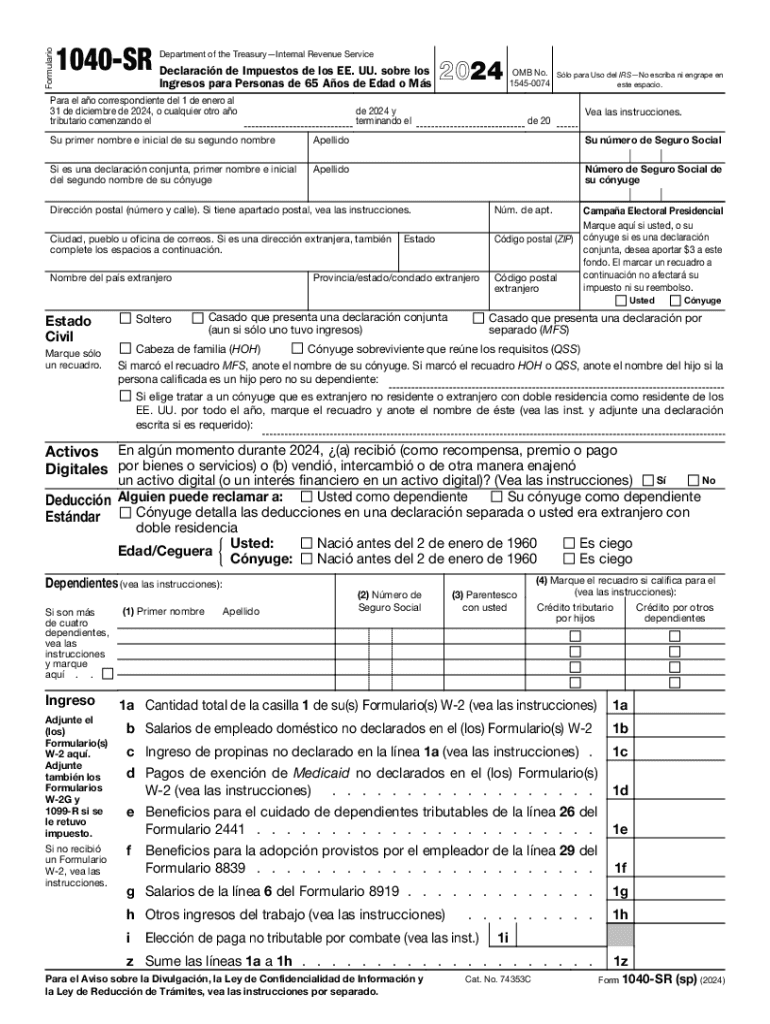

The Form 1040 SR sp U S Tax Return For Seniors Spanish Version is a simplified tax return designed specifically for senior taxpayers aged sixty-five and older. This form allows seniors to report their income and claim tax deductions and credits in a format that is accessible in Spanish. It includes features such as larger print and a straightforward layout, making it easier for seniors to navigate their tax filing obligations. The Spanish version ensures that non-English speakers can understand and complete their tax returns accurately.

How to obtain the Form 1040 SR sp U S Tax Return For Seniors Spanish Version

To obtain the Form 1040 SR sp U S Tax Return For Seniors Spanish Version, individuals can visit the official IRS website, where the form is available for download. Additionally, seniors can request a paper copy by calling the IRS or visiting local IRS offices. Many community organizations and libraries also provide copies of this form, ensuring accessibility for all seniors who may need assistance in obtaining it.

Steps to complete the Form 1040 SR sp U S Tax Return For Seniors Spanish Version

Completing the Form 1040 SR sp U S Tax Return For Seniors Spanish Version involves several key steps:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information, including name, address, and Social Security number.

- Report income by entering amounts from various sources on the appropriate lines.

- Claim deductions and credits, ensuring to follow the instructions for each line.

- Review the completed form for accuracy before signing and dating it.

- Choose a submission method, either electronically or by mail.

Legal use of the Form 1040 SR sp U S Tax Return For Seniors Spanish Version

The Form 1040 SR sp U S Tax Return For Seniors Spanish Version is legally recognized by the IRS for filing federal income taxes. It is essential for seniors to use this form if they meet the eligibility criteria, as it ensures compliance with tax laws. Filing this form correctly helps seniors avoid penalties and ensures they receive any refunds or credits they may be entitled to based on their income and tax situation.

Key elements of the Form 1040 SR sp U S Tax Return For Seniors Spanish Version

Key elements of the Form 1040 SR sp U S Tax Return For Seniors Spanish Version include:

- Identification section for personal information.

- Income reporting sections for various types of income.

- Deductions and credits applicable to seniors.

- Signature section for taxpayer verification.

- Instructions in Spanish to guide users through the process.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1040 SR sp U S Tax Return For Seniors Spanish Version typically align with the general tax filing deadlines set by the IRS. For most taxpayers, the deadline is April fifteenth of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Seniors should also be aware of any extensions available, which can provide additional time to file without penalties.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1040 sr sp u s tax return for seniors spanish version 770493945

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 1040 SR sp U S Tax Return For Seniors Spanish Version?

The Form 1040 SR sp U S Tax Return For Seniors Spanish Version is a simplified tax return form designed specifically for seniors. It allows older taxpayers to report their income and claim deductions in a user-friendly format. This version is tailored for Spanish-speaking seniors, ensuring they can easily navigate their tax obligations.

-

How can I access the Form 1040 SR sp U S Tax Return For Seniors Spanish Version?

You can access the Form 1040 SR sp U S Tax Return For Seniors Spanish Version through the airSlate SignNow platform. Our easy-to-use interface allows you to fill out and eSign the form online, making the process efficient and straightforward. Simply visit our website to get started.

-

Is there a cost associated with using the Form 1040 SR sp U S Tax Return For Seniors Spanish Version?

Yes, there is a cost associated with using the Form 1040 SR sp U S Tax Return For Seniors Spanish Version on airSlate SignNow. However, our pricing is competitive and designed to provide a cost-effective solution for seniors. We offer various plans to suit different needs, ensuring you get the best value for your tax preparation.

-

What features does the airSlate SignNow platform offer for the Form 1040 SR sp U S Tax Return For Seniors Spanish Version?

The airSlate SignNow platform offers several features for the Form 1040 SR sp U S Tax Return For Seniors Spanish Version, including eSigning, document storage, and real-time collaboration. These features streamline the tax filing process, making it easier for seniors to complete their returns efficiently. Additionally, our platform is designed to be user-friendly, catering to all levels of tech-savviness.

-

How does the Form 1040 SR sp U S Tax Return For Seniors Spanish Version benefit seniors?

The Form 1040 SR sp U S Tax Return For Seniors Spanish Version benefits seniors by simplifying the tax filing process and providing clear instructions in Spanish. This ensures that seniors can accurately report their income and claim deductions without confusion. Moreover, the digital format allows for easy access and submission, saving time and reducing stress.

-

Can I integrate the Form 1040 SR sp U S Tax Return For Seniors Spanish Version with other software?

Yes, the airSlate SignNow platform allows for integration with various accounting and tax software. This means you can easily import and export data related to the Form 1040 SR sp U S Tax Return For Seniors Spanish Version, enhancing your overall tax preparation experience. Our integrations are designed to streamline your workflow and improve efficiency.

-

What support options are available for users of the Form 1040 SR sp U S Tax Return For Seniors Spanish Version?

Users of the Form 1040 SR sp U S Tax Return For Seniors Spanish Version can access a variety of support options through airSlate SignNow. We offer comprehensive online resources, including FAQs and tutorials, as well as customer support via chat and email. Our team is dedicated to helping seniors navigate their tax filing process smoothly.

Get more for Form 1040 SR sp U S Tax Return For Seniors Spanish Version

- Wss westport form

- Job search contact log form

- Medical school deferral application ut southwestern medical peds swmed form

- Check request formpdf utah pta

- Mid continent university transcript request form

- Service police vulnerable check form

- Apiary prodiction records form

- Independent contractor waiver of workers compensation agreement form

Find out other Form 1040 SR sp U S Tax Return For Seniors Spanish Version

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors