Notice and Acknowledgement of Pay Rate and Payday Notice for Employees Paid a Weekly Rate or a Salary for a Fixed Number of Hour 2022-2026

Understanding the Notice and Acknowledgement of Pay Rate and Payday

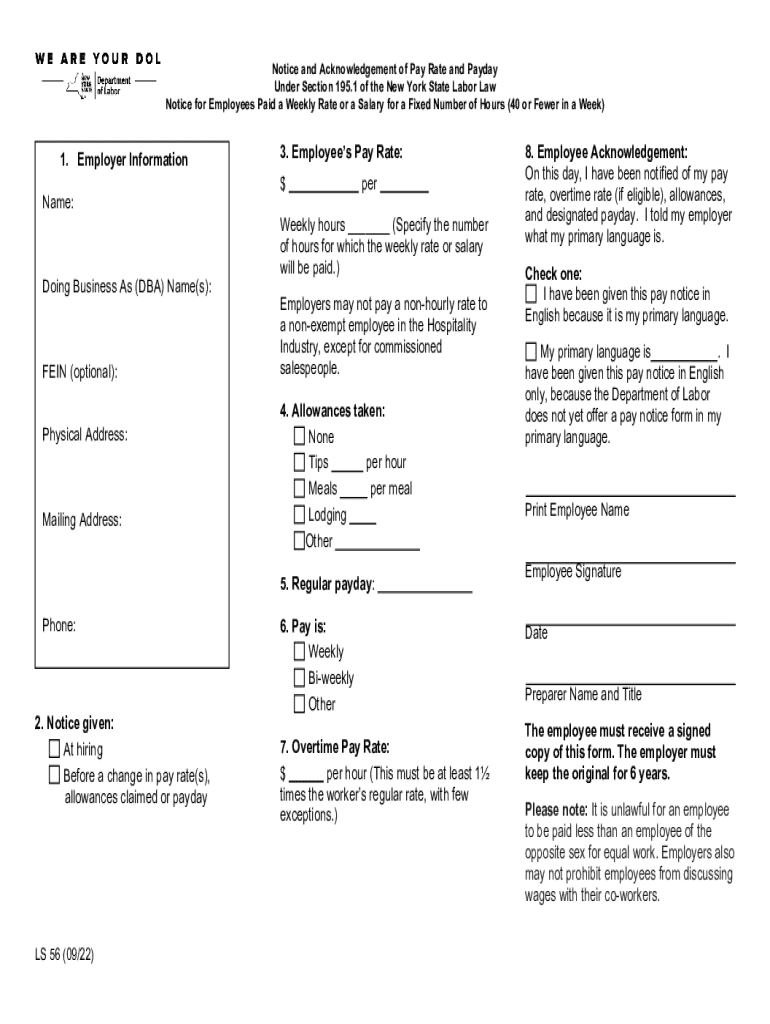

The Notice and Acknowledgement of Pay Rate and Payday is a crucial document for employees who are paid a weekly rate or a salary for a fixed number of hours, specifically 40 or fewer in a week. This notice serves to inform employees about their pay structure, including the rate of pay and the scheduled payday. It ensures transparency between employers and employees, helping to foster trust and clarity in the workplace.

This notice is particularly important in the United States, where labor laws require employers to provide clear information regarding compensation. By receiving this notice, employees can better understand their earnings, which aids in financial planning and management.

Steps to Complete the Notice and Acknowledgement of Pay Rate and Payday

Completing the Notice and Acknowledgement of Pay Rate and Payday involves several key steps:

- Gather necessary information, including employee details, pay rate, and payday schedule.

- Fill out the form accurately, ensuring all fields are completed to avoid any misunderstandings.

- Review the completed notice with the employee to confirm understanding and agreement.

- Obtain the employee's signature to acknowledge receipt of the notice.

- Keep a copy of the signed notice for your records, and provide a copy to the employee.

Following these steps ensures compliance with labor regulations and promotes a clear understanding of pay practices.

Key Elements of the Notice and Acknowledgement of Pay Rate and Payday

Several key elements must be included in the Notice and Acknowledgement of Pay Rate and Payday to ensure it meets legal requirements:

- Employee Name: The full name of the employee receiving the notice.

- Pay Rate: The agreed-upon rate of pay, whether hourly or salary.

- Payday Schedule: Specific days when employees will receive their paychecks.

- Work Hours: The fixed number of hours the employee is expected to work each week.

- Employer Information: The name and contact details of the employer or company.

Including these elements ensures that the notice is comprehensive and legally compliant, helping to prevent disputes regarding pay.

Legal Use of the Notice and Acknowledgement of Pay Rate and Payday

The legal use of the Notice and Acknowledgement of Pay Rate and Payday is governed by federal and state labor laws. Employers are required to provide this notice to employees upon hiring and whenever there is a change in pay rate or payday schedule. Failure to provide this notice can lead to legal repercussions, including fines or penalties.

Employers must ensure that the notice is distributed in a timely manner, allowing employees to understand their pay structure and rights. This legal requirement underscores the importance of transparency in employer-employee relationships.

How to Obtain the Notice and Acknowledgement of Pay Rate and Payday

Employers can obtain the Notice and Acknowledgement of Pay Rate and Payday through various means. Many state labor departments provide templates that can be downloaded and customized. Additionally, employers may create their own version, ensuring it includes all required elements as per state and federal regulations.

It is advisable for employers to keep updated on any changes in labor laws that may affect the content or distribution of the notice. Regularly reviewing legal resources or consulting with a legal expert can help ensure compliance.

Create this form in 5 minutes or less

Find and fill out the correct notice and acknowledgement of pay rate and payday notice for employees paid a weekly rate or a salary for a fixed number of

Create this form in 5 minutes!

How to create an eSignature for the notice and acknowledgement of pay rate and payday notice for employees paid a weekly rate or a salary for a fixed number of

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Notice And Acknowledgement Of Pay Rate And Payday LS56?

The Notice And Acknowledgement Of Pay Rate And Payday Notice For Employees Paid A Weekly Rate Or A Salary For A Fixed Number Of Hours 40 Or Fewer In A Week LS56 is a legal document that informs employees about their pay rate and payday schedule. It ensures transparency and compliance with labor laws, helping both employers and employees understand their payment terms.

-

How can airSlate SignNow help with the LS56 notice?

airSlate SignNow provides an efficient platform to create, send, and eSign the Notice And Acknowledgement Of Pay Rate And Payday Notice For Employees Paid A Weekly Rate Or A Salary For A Fixed Number Of Hours 40 Or Fewer In A Week LS56. Our user-friendly interface simplifies the process, ensuring that your documents are legally compliant and securely stored.

-

What are the benefits of using airSlate SignNow for LS56 notices?

Using airSlate SignNow for the Notice And Acknowledgement Of Pay Rate And Payday Notice For Employees Paid A Weekly Rate Or A Salary For A Fixed Number Of Hours 40 Or Fewer In A Week LS56 streamlines your documentation process. It saves time, reduces paperwork, and enhances accuracy, allowing you to focus on your core business operations.

-

Is airSlate SignNow cost-effective for small businesses?

Yes, airSlate SignNow offers a cost-effective solution for small businesses needing to manage the Notice And Acknowledgement Of Pay Rate And Payday Notice For Employees Paid A Weekly Rate Or A Salary For A Fixed Number Of Hours 40 Or Fewer In A Week LS56. Our pricing plans are designed to fit various budgets while providing essential features for document management.

-

Can I integrate airSlate SignNow with other software?

Absolutely! airSlate SignNow seamlessly integrates with various software applications, enhancing your workflow. This means you can easily manage the Notice And Acknowledgement Of Pay Rate And Payday Notice For Employees Paid A Weekly Rate Or A Salary For A Fixed Number Of Hours 40 Or Fewer In A Week LS56 alongside your existing tools.

-

How secure is the information shared through airSlate SignNow?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and security protocols to protect your data, including the Notice And Acknowledgement Of Pay Rate And Payday Notice For Employees Paid A Weekly Rate Or A Salary For A Fixed Number Of Hours 40 Or Fewer In A Week LS56. You can trust that your sensitive information is safe with us.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow offers a range of features for effective document management, including eSigning, templates, and automated workflows. These features make it easy to handle the Notice And Acknowledgement Of Pay Rate And Payday Notice For Employees Paid A Weekly Rate Or A Salary For A Fixed Number Of Hours 40 Or Fewer In A Week LS56 efficiently and accurately.

Get more for Notice And Acknowledgement Of Pay Rate And Payday Notice For Employees Paid A Weekly Rate Or A Salary For A Fixed Number Of Hour

- Notice of option for recording oregon form

- Oregon documents form

- General durable power of attorney for property and finances or financial effective upon disability oregon form

- Essential legal life documents for baby boomers oregon form

- General durable power of attorney for property and finances or financial effective immediately oregon form

- Revocation of general durable power of attorney oregon form

- Essential legal life documents for newlyweds oregon form

- Oregon legal documents form

Find out other Notice And Acknowledgement Of Pay Rate And Payday Notice For Employees Paid A Weekly Rate Or A Salary For A Fixed Number Of Hour

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free

- How Can I Sign Connecticut Plumbing LLC Operating Agreement

- Sign Illinois Plumbing Business Plan Template Fast

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding