Form 1040 ES Espanol Contribuciones Federales Estimadas Del Trabajo Por Cuenta Propia Y Sobre El Empleo De Empleados Dom

What is the Form 1040 ES Espanol Contribuciones Federales Estimadas Del Trabajo Por Cuenta Propia Y Sobre El Empleo De Empleados Dom

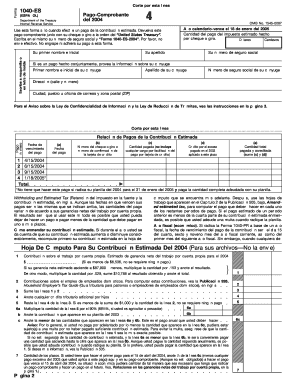

The Form 1040 ES Español Contribuciones Federales Estimadas Del Trabajo Por Cuenta Propia Y Sobre El Empleo De Empleados is a crucial document for individuals who are self-employed or have employees. This form is used to calculate and pay estimated federal income taxes on a quarterly basis. It is particularly relevant for those who do not have taxes withheld from their income, ensuring that they meet their tax obligations throughout the year.

How to use the Form 1040 ES Espanol Contribuciones Federales Estimadas Del Trabajo Por Cuenta Propia Y Sobre El Empleo De Empleados Dom

Using the Form 1040 ES Español involves several steps. First, individuals must determine their expected income for the year to estimate their tax liability. Next, they will fill out the form, which includes sections for reporting income, deductions, and credits. Once completed, the form can be submitted online or by mail, along with the estimated tax payment. Keeping accurate records of income and expenses is essential for completing this form accurately.

Steps to complete the Form 1040 ES Espanol Contribuciones Federales Estimadas Del Trabajo Por Cuenta Propia Y Sobre El Empleo De Empleados Dom

Completing the Form 1040 ES Español involves several key steps:

- Gather necessary financial documents, including records of income and expenses.

- Estimate your total income for the year to determine your tax liability.

- Fill out the form, ensuring all information is accurate and complete.

- Calculate your estimated tax payments based on your income and deductions.

- Submit the form and payment by the due date to avoid penalties.

Legal use of the Form 1040 ES Espanol Contribuciones Federales Estimadas Del Trabajo Por Cuenta Propia Y Sobre El Empleo De Empleados Dom

The Form 1040 ES Español is legally binding when completed and submitted in accordance with IRS guidelines. It is essential to provide accurate information to avoid legal repercussions. E-signatures are recognized as valid under federal law, making it easier to submit the form electronically. Compliance with tax laws ensures that individuals meet their obligations and avoid potential penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1040 ES Español are critical for avoiding penalties. Estimated tax payments are typically due on the 15th of April, June, September, and January of the following year. It is important to mark these dates on your calendar and ensure that payments are made on time to maintain compliance with federal tax regulations.

Form Submission Methods (Online / Mail / In-Person)

The Form 1040 ES Español can be submitted through various methods. Individuals have the option to file online, which is often the quickest and most efficient method. Alternatively, the form can be printed and mailed to the appropriate IRS address. Some individuals may also choose to submit the form in person at local IRS offices, depending on their preference and circumstances.

Quick guide on how to complete 2004 form 1040 es espanol contribuciones federales estimadas del trabajo por cuenta propia y sobre el empleo de empleados

Effortlessly Prepare [SKS] on Any Device

Managing documents online has gained popularity among both organizations and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documentation, as you can easily locate the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly without any hold-ups. Manage [SKS] on any device using airSlate SignNow's applications for Android or iOS and enhance your document-related processes today.

The Easiest Method to Edit and Electronically Sign [SKS] Seamlessly

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools provided to finalize your document.

- Highlight important sections of the documents or redact sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all details and then click the Done button to save your modifications.

- Select your preferred delivery method for your form, whether by email, SMS, invite link, or downloading it to your computer.

Eliminate concerns about lost or misplaced files, cumbersome form searches, or errors that require printing new document copies. airSlate SignNow meets your needs in document management with just a few clicks from any device you choose. Edit and electronically sign [SKS] to ensure smooth communication throughout your form preparation procedure with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 1040 ES Espanol Contribuciones Federales Estimadas Del Trabajo Por Cuenta Propia Y Sobre El Empleo De Empleados Dom

Create this form in 5 minutes!

How to create an eSignature for the 2004 form 1040 es espanol contribuciones federales estimadas del trabajo por cuenta propia y sobre el empleo de empleados

How to create an electronic signature for your 2004 Form 1040 Es Espanol Contribuciones Federales Estimadas Del Trabajo Por Cuenta Propia Y Sobre El Empleo De Empleados online

How to make an electronic signature for your 2004 Form 1040 Es Espanol Contribuciones Federales Estimadas Del Trabajo Por Cuenta Propia Y Sobre El Empleo De Empleados in Chrome

How to make an eSignature for signing the 2004 Form 1040 Es Espanol Contribuciones Federales Estimadas Del Trabajo Por Cuenta Propia Y Sobre El Empleo De Empleados in Gmail

How to create an electronic signature for the 2004 Form 1040 Es Espanol Contribuciones Federales Estimadas Del Trabajo Por Cuenta Propia Y Sobre El Empleo De Empleados from your smartphone

How to create an eSignature for the 2004 Form 1040 Es Espanol Contribuciones Federales Estimadas Del Trabajo Por Cuenta Propia Y Sobre El Empleo De Empleados on iOS devices

How to generate an electronic signature for the 2004 Form 1040 Es Espanol Contribuciones Federales Estimadas Del Trabajo Por Cuenta Propia Y Sobre El Empleo De Empleados on Android OS

People also ask

-

¿Qué es el Form 1040 ES Español Contribuciones Federales Estimadas Del Trabajo Por Cuenta Propia Y Sobre El Empleo De Empleados Dom?

El Form 1040 ES Español Contribuciones Federales Estimadas Del Trabajo Por Cuenta Propia Y Sobre El Empleo De Empleados Dom es un formulario utilizado por los contribuyentes para calcular y pagar sus impuestos estimados trimestralmente. Este formulario es esencial para los trabajadores por cuenta propia y los empleadores que deben cumplir con sus obligaciones fiscales de manera anticipada.

-

¿Cuáles son las características principales de airSlate SignNow relacionadas con el Form 1040 ES Español?

airSlate SignNow ofrece características como la firma electrónica segura, la posibilidad de enviar documentos y el seguimiento en tiempo real del estado de los formularios. Estas herramientas facilitan el manejo del Form 1040 ES Español Contribuciones Federales Estimadas Del Trabajo Por Cuenta Propia Y Sobre El Empleo De Empleados Dom de manera eficiente y organizada.

-

¿Cómo puede airSlate SignNow beneficiar a los contribuyentes que usan el Form 1040 ES Español?

El uso de airSlate SignNow permite a los contribuyentes gestionar el Form 1040 ES Español Contribuciones Federales Estimadas Del Trabajo Por Cuenta Propia Y Sobre El Empleo De Empleados Dom de forma rápida y sencilla. Al facilitar la firma y envío de documentos, reduce el tiempo de espera y garantiza que todos los formularios se presenten a tiempo.

-

¿airSlate SignNow ofrece integraciones con otros software para la gestión de impuestos?

Sí, airSlate SignNow se integra con diversas aplicaciones de gestión financiera y fiscal, lo que permite a los usuarios manejar el Form 1040 ES Español Contribuciones Federales Estimadas Del Trabajo Por Cuenta Propia Y Sobre El Empleo De Empleados Dom directamente desde sus plataformas preferidas. Esto mejora la eficiencia y la precisión en la gestión de documentos.

-

¿Cuál es el costo de utilizar airSlate SignNow para manejar el Form 1040 ES Español?

El costo de airSlate SignNow varía según el plan elegido, pero ofrece opciones asequibles que se adaptan a las necesidades de individuos y empresas. Invertir en este servicio puede ser una excelente manera de optimizar el manejo del Form 1040 ES Español Contribuciones Federales Estimadas Del Trabajo Por Cuenta Propia Y Sobre El Empleo De Empleados Dom.

-

¿Es seguro utilizar airSlate SignNow para enviar el Form 1040 ES Español?

Sí, airSlate SignNow prioriza la seguridad de sus usuarios utilizando encriptación avanzada y cumplimiento con las normativas de privacidad. Esto garantiza que el manejo del Form 1040 ES Español Contribuciones Federales Estimadas Del Trabajo Por Cuenta Propia Y Sobre El Empleo De Empleados Dom se realice de manera segura y confidencial.

-

¿Proporciona airSlate SignNow soporte al cliente para usuarios del Form 1040 ES Español?

Claro, airSlate SignNow ofrece soporte al cliente dedicado para ayudar a los usuarios con sus consultas relacionadas con el Form 1040 ES Español Contribuciones Federales Estimadas Del Trabajo Por Cuenta Propia Y Sobre El Empleo De Empleados Dom. Puede contactar al equipo de soporte a través de varios canales para obtener asistencia rápida y eficiente.

Get more for Form 1040 ES Espanol Contribuciones Federales Estimadas Del Trabajo Por Cuenta Propia Y Sobre El Empleo De Empleados Dom

- Referral fee agreement new form

- Pointe community center form

- We encourage and support the nations affirmative form

- Redacted this settlement agreement is entered into thisday of form

- Oregon residential real estate sales disclosure statement form

- Oregon sample forms multifamily nw

- Pacific screening application form

- Housing stability planattach to applicationapp form

Find out other Form 1040 ES Espanol Contribuciones Federales Estimadas Del Trabajo Por Cuenta Propia Y Sobre El Empleo De Empleados Dom

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online

- Can I eSignature Utah Non-disclosure agreement PDF

- eSignature Rhode Island Rental agreement lease Easy

- eSignature New Hampshire Rental lease agreement Simple

- eSignature Nebraska Rental lease agreement forms Fast

- eSignature Delaware Rental lease agreement template Fast

- eSignature West Virginia Rental lease agreement forms Myself

- eSignature Michigan Rental property lease agreement Online

- Can I eSignature North Carolina Rental lease contract

- eSignature Vermont Rental lease agreement template Online

- eSignature Vermont Rental lease agreement template Now

- eSignature Vermont Rental lease agreement template Free