Form KW 3 City of Kettering Annual Withholding Reconciliation and

Understanding the KW-3 City of Kettering Annual Withholding Reconciliation Form

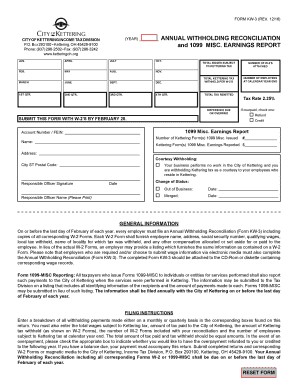

The KW-3 form is an essential document for employers in Kettering, Ohio, used to report annual withholding taxes. This form summarizes the total income tax withheld from employees throughout the year. It is crucial for ensuring compliance with local tax regulations and helps the city assess the tax contributions made by businesses operating within its jurisdiction.

Employers must accurately complete this form to reflect the total amounts withheld, ensuring that they meet their tax obligations. The KW-3 serves as a reconciliation tool to align the amounts reported on employee W-2 forms with the total withholding reported to the city.

Steps to Complete the KW-3 City of Kettering Annual Withholding Reconciliation Form

Filling out the KW-3 form involves several key steps to ensure accuracy and compliance. Begin by gathering necessary documentation, including all W-2 forms issued to employees. This will provide the total withholding amounts needed for the reconciliation.

Next, input the total wages paid to employees and the total amount of city income tax withheld. Ensure that these figures match the totals reported on the W-2 forms. After entering all required information, review the form for any discrepancies before submission. This careful review helps avoid potential penalties for incorrect filings.

How to Obtain the KW-3 City of Kettering Annual Withholding Reconciliation Form

The KW-3 form can be obtained through the City of Kettering's official website or directly from the local tax department. Employers may also find the form available at tax preparation offices or through various accounting software that supports local tax filings.

It is advisable to download the most recent version of the form to ensure compliance with any updates in tax regulations. Keeping a digital copy can facilitate easier completion and submission in the future.

Filing Deadlines for the KW-3 City of Kettering Annual Withholding Reconciliation Form

Timely filing of the KW-3 form is critical to avoid penalties. The deadline for submitting the form typically aligns with the federal tax filing deadline, which is April fifteenth of each year. Employers should ensure that the form is filed on or before this date to remain compliant with local tax laws.

It is important to check for any updates or changes to the filing deadlines, as local regulations may vary or change from year to year.

Legal Use of the KW-3 City of Kettering Annual Withholding Reconciliation Form

The KW-3 form is legally required for all employers in Kettering who withhold city income tax from their employees' wages. Proper use of this form helps ensure that employers fulfill their tax obligations and contribute to local funding.

Failure to file the KW-3 form or inaccuracies in reporting can lead to penalties, including fines or interest on unpaid taxes. Therefore, understanding the legal implications of this form is crucial for all businesses operating in Kettering.

Key Elements of the KW-3 City of Kettering Annual Withholding Reconciliation Form

Key elements of the KW-3 form include the employer's name, address, and identification number, as well as the total wages paid and total city income tax withheld. Additionally, the form requires information about the number of employees and the total amount of tax remitted throughout the year.

Each section of the form must be completed accurately to ensure that the information reported aligns with the employer's records. This attention to detail is essential for maintaining compliance with city tax regulations.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form kw 3 city of kettering annual withholding reconciliation and

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the OH annual withholding reconciliation form?

The OH annual withholding reconciliation form is a document that employers in Ohio must file to reconcile their annual withholding tax obligations. It ensures that the amounts withheld from employee wages match the amounts reported to the state. Using airSlate SignNow, you can easily eSign and send this form securely.

-

How can airSlate SignNow help with the OH annual withholding reconciliation form?

airSlate SignNow simplifies the process of completing and submitting the OH annual withholding reconciliation form. Our platform allows you to fill out the form electronically, eSign it, and send it directly to the appropriate tax authorities. This streamlines your workflow and reduces the risk of errors.

-

Is there a cost associated with using airSlate SignNow for the OH annual withholding reconciliation form?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our plans are designed to be cost-effective, ensuring that you can manage your OH annual withholding reconciliation form and other documents without breaking the bank. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the OH annual withholding reconciliation form?

airSlate SignNow provides a range of features to assist with the OH annual withholding reconciliation form, including customizable templates, secure eSigning, and document tracking. These features enhance your efficiency and ensure that your forms are completed accurately and on time.

-

Can I integrate airSlate SignNow with other software for the OH annual withholding reconciliation form?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to streamline your workflow when handling the OH annual withholding reconciliation form. Whether you use accounting software or HR platforms, our integrations help you manage your documents seamlessly.

-

What are the benefits of using airSlate SignNow for the OH annual withholding reconciliation form?

Using airSlate SignNow for the OH annual withholding reconciliation form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are stored securely and can be accessed anytime, making tax season less stressful.

-

Is airSlate SignNow user-friendly for completing the OH annual withholding reconciliation form?

Yes, airSlate SignNow is designed with user-friendliness in mind. The intuitive interface allows users of all skill levels to easily navigate the platform and complete the OH annual withholding reconciliation form without any hassle. You can get started quickly and efficiently.

Get more for Form KW 3 City Of Kettering Annual Withholding Reconciliation And

- Chapter 12 section 2 the mongol conquests worksheet answers form

- Routine diabetes encounter form

- Sbi chpa form

- Responsible pharmacist notice 226479645 form

- Optavia fuelings list pdf 466539296 form

- Wholesale buyer agreement form

- Gentle procedures toronto form

- Work education agreement work education agreement form

Find out other Form KW 3 City Of Kettering Annual Withholding Reconciliation And

- How To Electronic signature West Virginia Pharmacy Services Agreement

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe