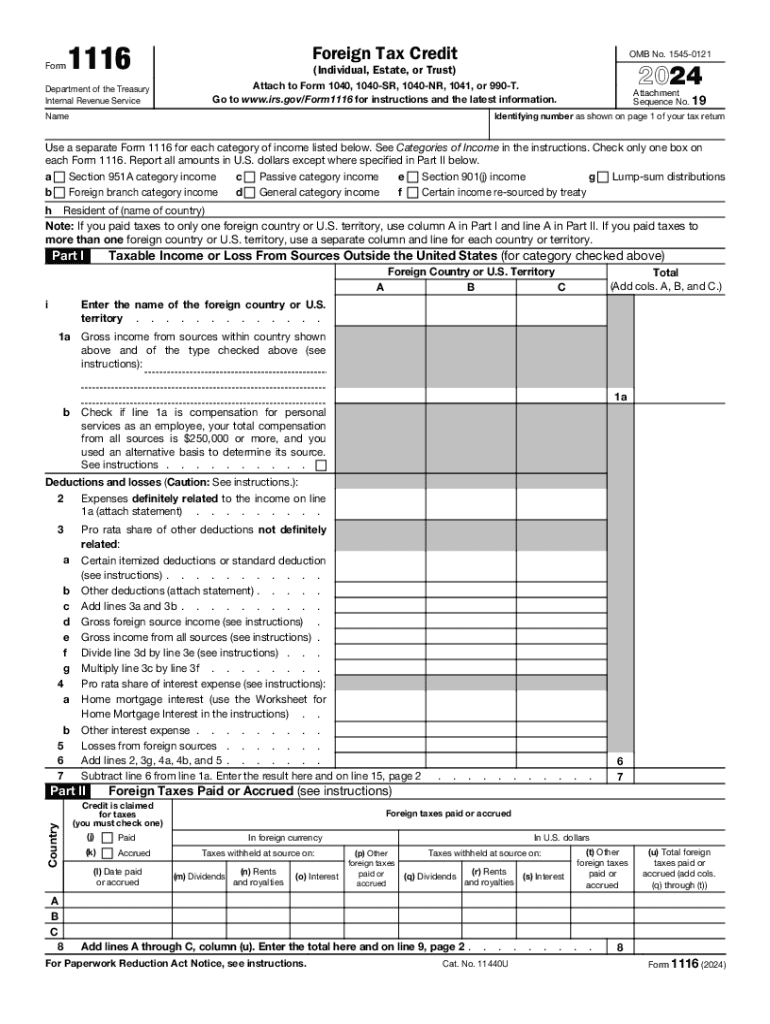

Form 1116 Foreign Tax Credit Individual, Estate, or Trust 2024

What is the Form 1116 Foreign Tax Credit Individual, Estate, Or Trust

The Form 1116 is a tax form used by U.S. taxpayers, including individuals, estates, and trusts, to claim the Foreign Tax Credit. This credit allows taxpayers to reduce their U.S. tax liability by the amount of foreign taxes paid or accrued on income earned outside the United States. The purpose of the form is to prevent double taxation on income that is subject to both U.S. and foreign taxes. By filing this form, taxpayers can ensure they receive credit for taxes paid to foreign governments, which can significantly lower their overall tax burden.

How to use the Form 1116 Foreign Tax Credit Individual, Estate, Or Trust

To use Form 1116, taxpayers must first determine their eligibility for the Foreign Tax Credit. This involves identifying foreign income and the corresponding taxes paid. Once eligibility is established, taxpayers can complete the form by providing details about the foreign income, the foreign taxes paid, and any adjustments necessary to calculate the credit. It is essential to follow IRS guidelines closely to ensure accurate reporting and compliance. The completed form is then submitted with the taxpayer's annual tax return.

Steps to complete the Form 1116 Foreign Tax Credit Individual, Estate, Or Trust

Completing Form 1116 involves several key steps:

- Gather documentation of foreign income and taxes paid.

- Determine the type of income (general category or passive category) to apply the correct calculations.

- Fill out the form by entering the required information, including foreign tax amounts and income sources.

- Calculate the allowable credit based on the foreign taxes and U.S. tax liability.

- Review the completed form for accuracy before submission.

Eligibility Criteria

To qualify for the Foreign Tax Credit using Form 1116, taxpayers must meet specific criteria. They must have foreign income that is subject to foreign taxes, and they must have actually paid or accrued those taxes. Additionally, the foreign taxes must be imposed on income that is also subject to U.S. tax. There are limits on the amount of credit that can be claimed, which depend on the taxpayer's total foreign income and U.S. tax liability. Certain types of income, such as those from controlled foreign corporations, may have different eligibility requirements.

Filing Deadlines / Important Dates

Form 1116 must be filed along with the taxpayer's annual income tax return, which is typically due on April 15 of each year. If the taxpayer is unable to file by this date, they may request an extension, which generally extends the deadline by six months. However, any taxes owed must still be paid by the original due date to avoid penalties and interest. It is crucial to keep track of these deadlines to ensure compliance and maximize the benefits of the Foreign Tax Credit.

Required Documents

When completing Form 1116, taxpayers need to gather several key documents to support their claims. These include:

- Documentation of foreign income, such as foreign bank statements or pay stubs.

- Proof of foreign taxes paid, such as tax receipts or statements from foreign tax authorities.

- Any relevant forms or schedules that detail the source of foreign income.

Having these documents readily available will facilitate the accurate completion of the form and help ensure that the taxpayer can substantiate their claims if audited by the IRS.

Create this form in 5 minutes or less

Find and fill out the correct form 1116 foreign tax credit individual estate or trust 771193624

Create this form in 5 minutes!

How to create an eSignature for the form 1116 foreign tax credit individual estate or trust 771193624

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 1116 Foreign Tax Credit Individual, Estate, Or Trust?

Form 1116 Foreign Tax Credit Individual, Estate, Or Trust is a tax form used by U.S. taxpayers to claim a credit for foreign taxes paid on income. This form helps reduce the double taxation of income earned abroad, making it essential for individuals, estates, or trusts with foreign income. Understanding how to properly fill out this form can signNowly benefit your tax situation.

-

How can airSlate SignNow help with Form 1116 Foreign Tax Credit Individual, Estate, Or Trust?

airSlate SignNow provides an efficient platform for preparing and eSigning documents related to Form 1116 Foreign Tax Credit Individual, Estate, Or Trust. With our user-friendly interface, you can easily manage your tax documents and ensure they are signed and submitted on time. This streamlines the process, allowing you to focus on maximizing your tax credits.

-

What features does airSlate SignNow offer for managing Form 1116?

airSlate SignNow offers features such as document templates, eSignature capabilities, and secure cloud storage specifically designed for managing Form 1116 Foreign Tax Credit Individual, Estate, Or Trust. These features ensure that your documents are organized, easily accessible, and compliant with tax regulations. Additionally, our platform allows for collaboration with tax professionals for added assurance.

-

Is there a cost associated with using airSlate SignNow for Form 1116?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs when managing Form 1116 Foreign Tax Credit Individual, Estate, Or Trust. Our plans are designed to be cost-effective, providing excellent value for the features and support offered. You can choose a plan that best fits your budget and requirements.

-

Can I integrate airSlate SignNow with other software for Form 1116?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, enhancing your workflow for Form 1116 Foreign Tax Credit Individual, Estate, Or Trust. This integration allows for easy data transfer and ensures that all your documents are synchronized, making tax preparation more efficient and less prone to errors.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for your tax documents, including Form 1116 Foreign Tax Credit Individual, Estate, Or Trust, offers numerous benefits. You gain access to a secure, easy-to-use platform that simplifies document management and eSigning. This not only saves time but also enhances the accuracy and compliance of your tax submissions.

-

How secure is airSlate SignNow when handling Form 1116?

Security is a top priority at airSlate SignNow. When handling Form 1116 Foreign Tax Credit Individual, Estate, Or Trust, we employ advanced encryption and security protocols to protect your sensitive information. Our platform is designed to ensure that your documents are safe from unauthorized access while maintaining compliance with industry standards.

Get more for Form 1116 Foreign Tax Credit Individual, Estate, Or Trust

- Crossword puzzle for june 10 form

- Track sheet 24 studio docs form

- Appearance bond 38397447 form

- Halifax mortgage deed form

- Printable cardiac rehab forms

- Migration ampamp update form individual first bank of

- Emergency contact formbus runs

- Icici bank letterhead fill online printable fillable blank form

Find out other Form 1116 Foreign Tax Credit Individual, Estate, Or Trust

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online