About Form 1116, Foreign Tax Credit Individual, EstateAbout Form 1116, Foreign Tax Credit Individual, Estate2020 IRS 1040 and 10 2022

Understanding Form 1116: Foreign Tax Credit

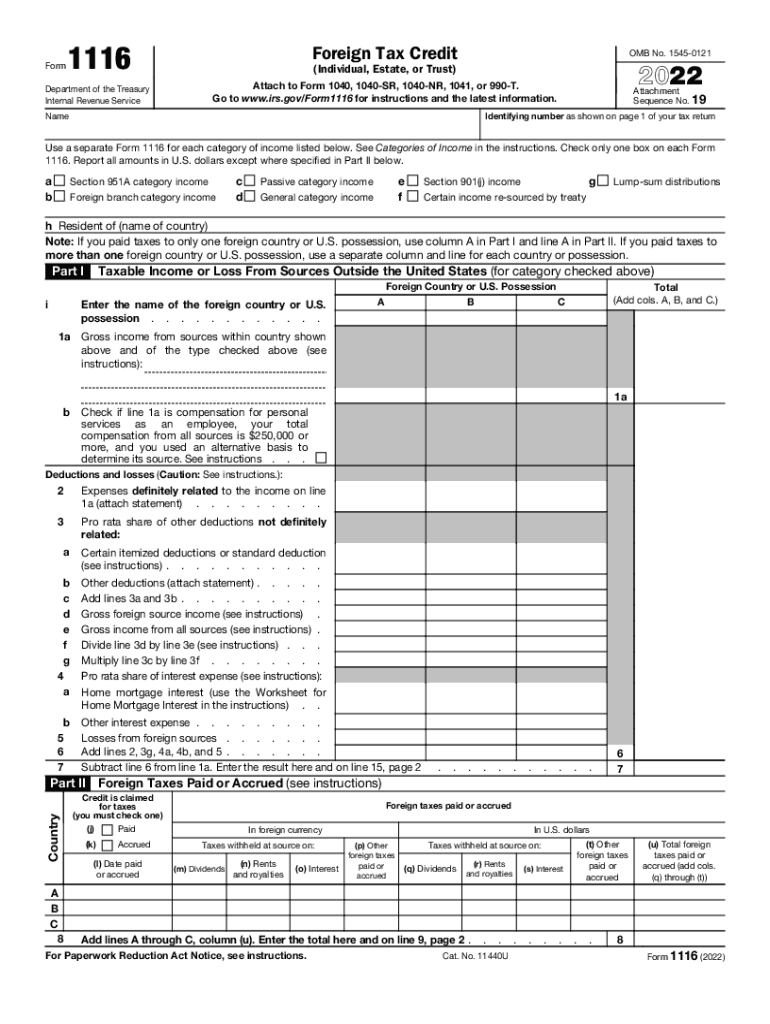

Form 1116 is utilized by U.S. taxpayers to claim the foreign tax credit, which helps reduce the double taxation of income earned abroad. This form is specifically designed for individuals, estates, and trusts who have paid foreign taxes on income that is also subject to U.S. taxation. The foreign tax credit can be a valuable tool for taxpayers who have foreign income, as it allows them to offset their U.S. tax liability with taxes paid to foreign governments.

Steps to Complete Form 1116

Completing Form 1116 involves several key steps to ensure accurate reporting of foreign taxes paid. Taxpayers should start by gathering necessary documentation, including proof of foreign income and taxes paid. The form consists of various sections that require detailed information about the foreign income, the taxes paid, and the calculation of the credit. It is crucial to follow the instructions carefully to avoid errors that could lead to delays or penalties.

Eligibility Criteria for Claiming the Foreign Tax Credit

To qualify for the foreign tax credit using Form 1116, taxpayers must meet specific eligibility criteria. Generally, the foreign taxes must be imposed on income that is also subject to U.S. tax. Additionally, taxpayers must have a valid foreign tax liability and must not have claimed a refund or credit for the same taxes on their U.S. return. Understanding these criteria is essential for ensuring that the credit can be claimed appropriately.

Required Documents for Filing Form 1116

When filing Form 1116, certain documents are essential to substantiate the claim for the foreign tax credit. Taxpayers should include documentation such as foreign tax returns, receipts for taxes paid, and any relevant statements from foreign tax authorities. These documents serve as proof of the foreign income and taxes paid, which are necessary for the IRS to process the claim accurately.

Legal Use of Form 1116

Form 1116 is legally binding when completed and submitted according to IRS guidelines. It is important to ensure that all information provided is accurate and truthful, as any discrepancies could lead to audits or penalties. The form must be filed with the taxpayer's federal income tax return, and it is subject to the same legal standards as other tax filings. Taxpayers should retain copies of the form and supporting documents for their records.

Filing Deadlines for Form 1116

Taxpayers must be aware of the filing deadlines associated with Form 1116 to avoid penalties. Typically, Form 1116 is due on the same date as the taxpayer's federal income tax return. For individuals, this is usually April 15, unless an extension is filed. It is essential to keep track of these deadlines, especially for those with foreign income, to ensure compliance with IRS regulations.

Quick guide on how to complete about form 1116 foreign tax credit individual estateabout form 1116 foreign tax credit individual estate2020 irs 1040 and 1040

Complete About Form 1116, Foreign Tax Credit Individual, EstateAbout Form 1116, Foreign Tax Credit Individual, Estate2020 IRS 1040 And 10 effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents quickly without delays. Handle About Form 1116, Foreign Tax Credit Individual, EstateAbout Form 1116, Foreign Tax Credit Individual, Estate2020 IRS 1040 And 10 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to edit and eSign About Form 1116, Foreign Tax Credit Individual, EstateAbout Form 1116, Foreign Tax Credit Individual, Estate2020 IRS 1040 And 10 without hassle

- Locate About Form 1116, Foreign Tax Credit Individual, EstateAbout Form 1116, Foreign Tax Credit Individual, Estate2020 IRS 1040 And 10 and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important parts of your documents or mask sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and holds the same legal significance as a traditional wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Choose how you wish to submit your form, via email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Modify and eSign About Form 1116, Foreign Tax Credit Individual, EstateAbout Form 1116, Foreign Tax Credit Individual, Estate2020 IRS 1040 And 10 and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about form 1116 foreign tax credit individual estateabout form 1116 foreign tax credit individual estate2020 irs 1040 and 1040

Create this form in 5 minutes!

People also ask

-

What is the significance of the number 1116 in airSlate SignNow?

The number 1116 is often related to specific document formats and compliance standards within airSlate SignNow. Understanding how 1116 documents operate can help users streamline their eSigning processes effectively.

-

How does airSlate SignNow pricing structure accommodate users needing 1116 solutions?

airSlate SignNow offers flexible pricing plans tailored for businesses needing 1116 document solutions. By selecting the appropriate plan, users can manage their eSignature requirements without overspending while enjoying premium features.

-

What features does airSlate SignNow offer for 1116 document management?

airSlate SignNow provides a variety of features to manage 1116 documents, including customizable templates, automated workflows, and real-time tracking. These tools enable users to ensure compliance and enhance their document handling processes.

-

How can 1116 be integrated with other software in airSlate SignNow?

airSlate SignNow supports seamless integrations with multiple software applications, enhancing the management of 1116 documents. Businesses can connect their signNow account with CRM, ERP, and other systems for streamlined operations.

-

What benefits does airSlate SignNow provide for eSigning 1116 documents?

Using airSlate SignNow for eSigning 1116 documents offers numerous benefits such as enhanced security, quicker turnaround times, and reduced paper usage. These advantages not only save costs but also promote environmentally friendly practices.

-

Is there a mobile application for managing 1116 documents in airSlate SignNow?

Yes, airSlate SignNow has a user-friendly mobile application that allows you to manage, send, and eSign 1116 documents on the go. This mobility enhances your productivity and enables faster responses from your clients.

-

How does airSlate SignNow ensure the security of 1116 documents?

airSlate SignNow implements advanced security measures, including encryption and secure data storage, to protect 1116 documents. Users can rest assured that their sensitive information is safe and complies with industry regulations.

Get more for About Form 1116, Foreign Tax Credit Individual, EstateAbout Form 1116, Foreign Tax Credit Individual, Estate2020 IRS 1040 And 10

- Letter from landlord to tenant returning security deposit less deductions nevada form

- Letter from tenant to landlord containing notice of failure to return security deposit and demand for return nevada form

- Letter from tenant to landlord containing notice of wrongful deductions from security deposit and demand for return nevada form

- Letter from tenant to landlord containing request for permission to sublease nevada form

- Nevada damages form

- Letter from landlord to tenant that sublease granted rent paid by subtenant old tenant released from liability for rent nevada form

- Letter from tenant to landlord about landlords refusal to allow sublease is unreasonable nevada form

- Nv landlord form

Find out other About Form 1116, Foreign Tax Credit Individual, EstateAbout Form 1116, Foreign Tax Credit Individual, Estate2020 IRS 1040 And 10

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF