BUS428 Business Tax Return Form

What is the BUS428 Business Tax Return

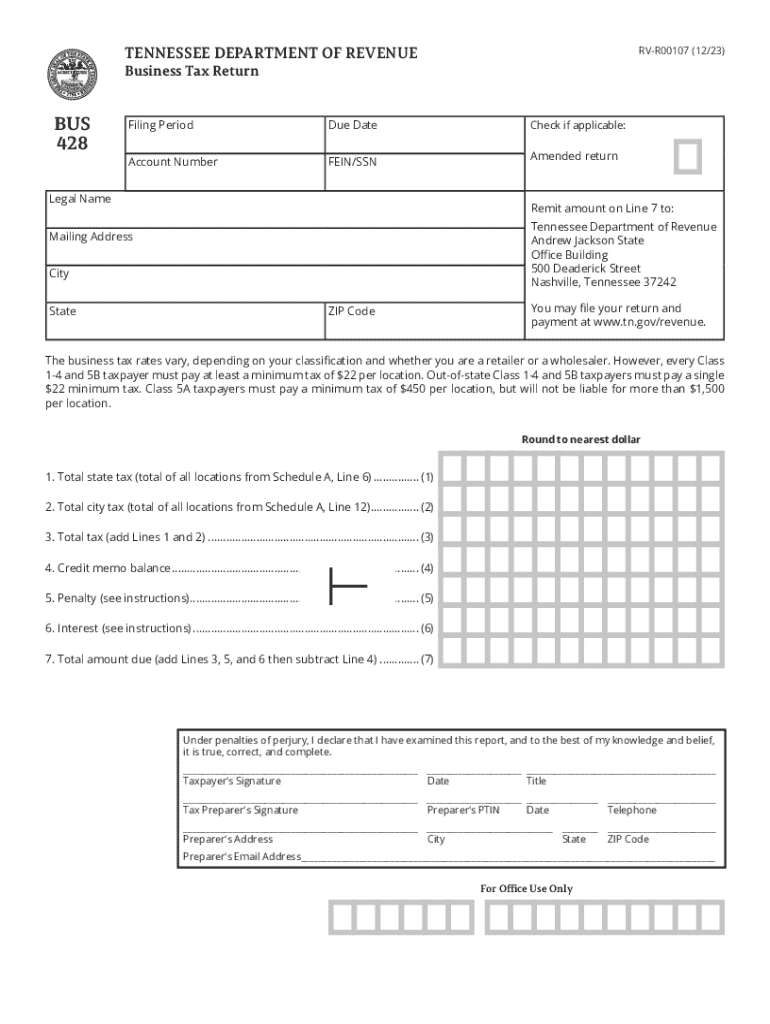

The BUS428 Business Tax Return is a crucial document used by businesses in Tennessee to report their revenue and calculate the state business tax. This form is specifically designed for entities such as corporations, limited liability companies (LLCs), and partnerships operating within the state. Understanding the purpose of the BUS428 is essential for compliance with state tax regulations and for ensuring that businesses accurately report their earnings.

Steps to complete the BUS428 Business Tax Return

Completing the BUS428 Business Tax Return involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and expense reports. Second, accurately calculate your gross receipts and any allowable deductions. Next, fill out the BUS428 form, ensuring that all sections are completed thoroughly. Finally, review the form for any errors before submission. This careful process helps avoid penalties and ensures that your tax obligations are met.

Key elements of the BUS428 Business Tax Return

The BUS428 form includes several key elements that businesses must address. These elements typically encompass the business's name, address, and federal employer identification number (EIN). Additionally, the form requires detailed reporting of gross receipts, deductions, and the resulting taxable income. Understanding these components is vital for accurate reporting and compliance with Tennessee tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the BUS428 Business Tax Return are critical for businesses to note. Typically, the form must be submitted by the 15th day of the fourth month following the close of the business's fiscal year. For businesses operating on a calendar year, this means the deadline is April 15. Missing this deadline can result in penalties and interest on any unpaid taxes, making timely filing essential for all businesses.

Form Submission Methods

Businesses can submit the BUS428 Business Tax Return through various methods to accommodate different preferences. The form can be filed online through the Tennessee Department of Revenue's website, which offers a streamlined process for electronic submissions. Alternatively, businesses may choose to mail the completed form to the appropriate state office or deliver it in person. Each method has its own benefits, and businesses should select the one that best fits their needs.

Penalties for Non-Compliance

Non-compliance with the BUS428 Business Tax Return requirements can lead to significant penalties. Businesses that fail to file on time may incur late fees, which can accumulate over time. Additionally, underreporting income or failing to pay the correct amount of tax can result in further penalties and interest charges. Understanding these potential consequences emphasizes the importance of timely and accurate filing.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the bus428 business tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is tn bus 428 and how does it work?

The tn bus 428 is a digital solution provided by airSlate SignNow that allows users to send and eSign documents efficiently. It streamlines the signing process, making it easy for businesses to manage their paperwork electronically. With tn bus 428, you can quickly create, send, and track documents, ensuring a seamless experience.

-

What are the pricing options for tn bus 428?

airSlate SignNow offers competitive pricing for the tn bus 428, catering to businesses of all sizes. You can choose from various plans based on your needs, whether you require basic features or advanced functionalities. Each plan is designed to provide value while ensuring you have access to essential eSigning tools.

-

What features does tn bus 428 offer?

The tn bus 428 includes a range of features such as customizable templates, real-time tracking, and secure cloud storage. Additionally, it supports multiple file formats and allows for in-person signing, making it versatile for different business needs. These features enhance productivity and simplify document management.

-

How can tn bus 428 benefit my business?

Using tn bus 428 can signNowly improve your business's efficiency by reducing the time spent on document handling. It minimizes the need for physical paperwork, leading to faster turnaround times and improved customer satisfaction. Moreover, the cost-effective nature of tn bus 428 helps businesses save on operational expenses.

-

Is tn bus 428 secure for sensitive documents?

Yes, tn bus 428 prioritizes security, employing advanced encryption and compliance with industry standards. This ensures that your sensitive documents are protected throughout the signing process. You can confidently use tn bus 428 for all your important business transactions.

-

Can tn bus 428 integrate with other software?

Absolutely! tn bus 428 is designed to integrate seamlessly with various software applications, enhancing your workflow. Whether you use CRM systems, project management tools, or cloud storage services, tn bus 428 can connect with them to streamline your document processes.

-

How easy is it to use tn bus 428 for new users?

tn bus 428 is user-friendly and designed for individuals with varying levels of technical expertise. The intuitive interface allows new users to quickly learn how to send and eSign documents without extensive training. With helpful tutorials and customer support, getting started with tn bus 428 is a breeze.

Get more for BUS428 Business Tax Return

- Caddo parish jrotc permission slip form

- Dog adoption questionnaire template 101849919 form

- Gti form 13

- School scholarship online form

- Notice to remove illegally parked vehicle to txssaweb form

- Calstrs permissive membership form

- Michigan adjustments of capital gains and losses mi 1040d 771784754 form

- Handyman agreement template form

Find out other BUS428 Business Tax Return

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online