Form 709 United States Gift and Generation Skipping Transfer Tax Return

What is the Form 709 United States Gift and Generation Skipping Transfer Tax Return

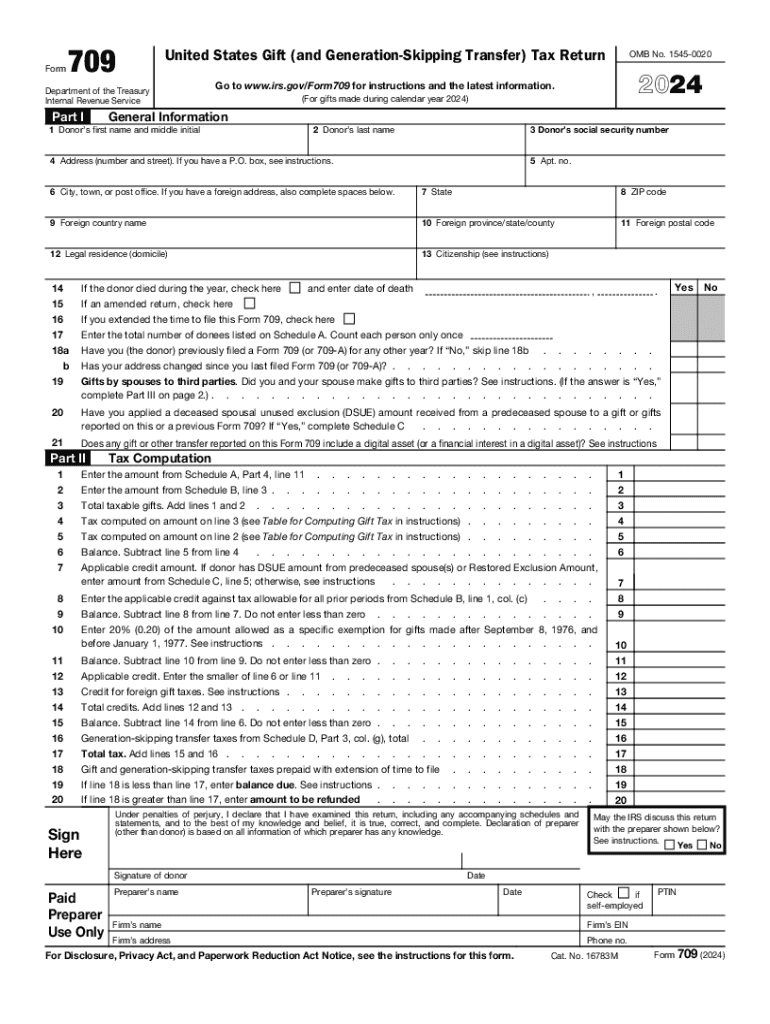

The Form 709 is a federal tax document used to report gifts made during the tax year that exceed the annual exclusion limit. This form is essential for individuals who have made significant gifts to others, as it helps determine the amount of gift tax owed. Additionally, it is used to report generation-skipping transfers, which involve gifts made to beneficiaries who are two or more generations below the donor. Understanding this form is crucial for individuals planning their estate and managing their tax obligations effectively.

Steps to complete the Form 709 United States Gift and Generation Skipping Transfer Tax Return

Completing the Form 709 involves several key steps:

- Gather Information: Collect details about all gifts made during the year, including the recipient's information and the value of each gift.

- Determine Exclusions: Identify any gifts that fall under the annual exclusion limit, which allows you to gift a certain amount without incurring tax.

- Complete the Form: Fill out the form accurately, ensuring that all required sections are completed, including Part 1 for general information and Part 2 for specific gifts.

- Calculate Tax Liability: Use the provided instructions to determine if any gift tax is owed based on the total gifts reported.

- Review and Sign: Carefully review the completed form for accuracy before signing and dating it.

How to obtain the Form 709 United States Gift and Generation Skipping Transfer Tax Return

The Form 709 can be obtained directly from the Internal Revenue Service (IRS) website. It is available as a fillable PDF, allowing users to complete the form digitally. Additionally, individuals can request a paper version of the form by contacting the IRS or visiting local IRS offices. It is important to ensure that you are using the correct version of the form for the applicable tax year, as updates may occur annually.

Filing Deadlines / Important Dates

The deadline for filing Form 709 is typically April fifteenth of the year following the tax year in which the gifts were made. If you are unable to meet this deadline, you may file for an extension, which extends the deadline to October fifteenth. However, it is essential to note that any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Key elements of the Form 709 United States Gift and Generation Skipping Transfer Tax Return

Key elements of the Form 709 include:

- Donor Information: Personal details of the individual making the gifts.

- Recipient Information: Names and details of all recipients of the gifts.

- Gift Details: A comprehensive list of all gifts made, including their values and dates.

- Tax Computation: Sections that guide the taxpayer in calculating any applicable gift tax based on the total gifts reported.

IRS Guidelines

The IRS provides specific guidelines for completing and filing Form 709. These guidelines include instructions on what constitutes a gift, details about the annual exclusion limit, and information on generation-skipping transfers. It is advisable to consult the IRS instructions accompanying the form to ensure compliance with all requirements and to understand potential tax implications. Familiarity with these guidelines can help taxpayers avoid common pitfalls and ensure accurate reporting.

Handy tips for filling out Form 709 United States Gift and Generation Skipping Transfer Tax Return online

Quick steps to complete and e-sign Form 709 United States Gift and Generation Skipping Transfer Tax Return online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing forms can be. Get access to a HIPAA and GDPR compliant solution for optimum simpleness. Use signNow to electronically sign and share Form 709 United States Gift and Generation Skipping Transfer Tax Return for collecting e-signatures.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 709 united states gift and generation skipping transfer tax return 771468824

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an IRS Form 709 fillable PDF?

The IRS Form 709 fillable PDF is a tax form used to report gifts and generation-skipping transfers. This interactive PDF allows users to enter information directly into the form, making it easier to complete and submit. Using a fillable PDF can help ensure that all necessary information is accurately provided.

-

How can I access the IRS Form 709 fillable PDF?

You can access the IRS Form 709 fillable PDF directly from the IRS website or through platforms like airSlate SignNow. By using airSlate SignNow, you can easily fill out, sign, and send the form electronically, streamlining the process for your convenience.

-

Is there a cost associated with using the IRS Form 709 fillable PDF on airSlate SignNow?

While the IRS Form 709 fillable PDF itself is free to download, using airSlate SignNow may involve subscription fees depending on the features you choose. However, the platform offers a cost-effective solution for eSigning and managing documents, making it a valuable investment for businesses.

-

What features does airSlate SignNow offer for the IRS Form 709 fillable PDF?

airSlate SignNow provides a range of features for the IRS Form 709 fillable PDF, including eSigning, document sharing, and secure storage. Additionally, users can track the status of their documents and receive notifications when they are signed. These features enhance the overall efficiency of managing tax forms.

-

Can I integrate airSlate SignNow with other applications for handling the IRS Form 709 fillable PDF?

Yes, airSlate SignNow offers integrations with various applications, allowing you to streamline your workflow when handling the IRS Form 709 fillable PDF. You can connect it with CRM systems, cloud storage services, and other productivity tools to enhance your document management process.

-

What are the benefits of using airSlate SignNow for the IRS Form 709 fillable PDF?

Using airSlate SignNow for the IRS Form 709 fillable PDF offers numerous benefits, including time savings, improved accuracy, and enhanced security. The platform simplifies the eSigning process, ensuring that your documents are signed quickly and securely, which is crucial for tax-related submissions.

-

Is it easy to fill out the IRS Form 709 fillable PDF on airSlate SignNow?

Absolutely! airSlate SignNow provides an intuitive interface that makes filling out the IRS Form 709 fillable PDF straightforward. Users can easily navigate through the form, enter their information, and utilize helpful features like auto-fill and error-checking to ensure accuracy.

Get more for Form 709 United States Gift and Generation Skipping Transfer Tax Return

- Instructions nyc gov form

- Client waiver form the pilates connection

- Cloze ing in on science matter and energy form

- Deed poll affidavit form

- Www revenue ieenvrtvrtvpd2 vehicle purchase details form revenue

- Dd form 2910 8 quotreporting preference statement for dod

- Naval medical forces development command form

- What happens if a potential candidate literally collapses form

Find out other Form 709 United States Gift and Generation Skipping Transfer Tax Return

- eSignature Minnesota Mortgage Quote Request Simple

- eSignature New Jersey Mortgage Quote Request Online

- Can I eSignature Kentucky Temporary Employment Contract Template

- eSignature Minnesota Email Cover Letter Template Fast

- How To eSignature New York Job Applicant Rejection Letter

- How Do I eSignature Kentucky Executive Summary Template

- eSignature Hawaii CV Form Template Mobile

- eSignature Nevada CV Form Template Online

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online