Acic Form 2014-2026

What is the Acic Form

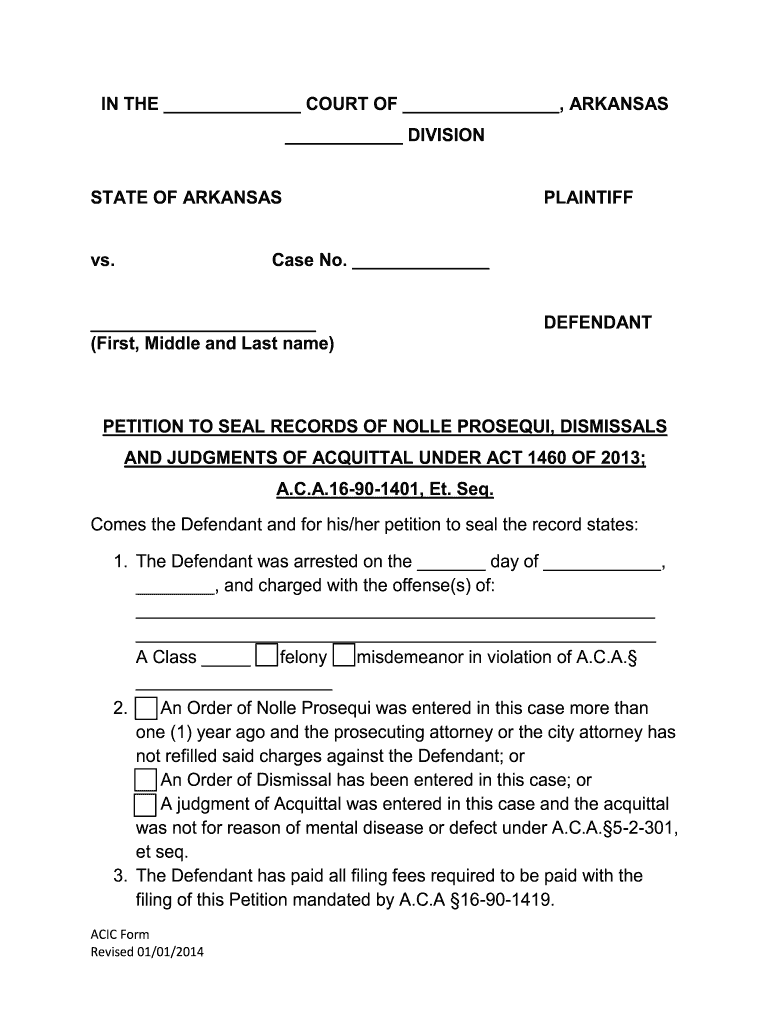

The Acic form is a legal document used primarily in Arkansas for various purposes, including petitions related to sealing records. It is essential for individuals seeking to have certain legal records expunged or sealed from public view. This form is crucial for ensuring that personal information remains confidential and is not accessible to the public, which can be particularly important for those who have had previous legal issues.

How to use the Acic Form

Using the Acic form involves several steps. First, individuals must identify the specific purpose for which they are filing the form, such as requesting a record sealing. Next, they should gather all necessary information and documents required to complete the form accurately. Once completed, the form can be submitted to the appropriate legal authority for processing. It is advisable to keep copies of all submitted documents for personal records.

Steps to complete the Acic Form

Completing the Acic form requires careful attention to detail. Here are the steps to follow:

- Obtain the latest version of the Acic form from a reliable source.

- Fill out the form with accurate personal information, including your name, address, and any relevant case numbers.

- Provide details about the records you wish to seal, including the nature of the offense and the date it occurred.

- Review the form for any errors or omissions before submission.

- Sign and date the form to certify its accuracy.

Legal use of the Acic Form

The legal use of the Acic form is governed by state laws that dictate when and how individuals can petition to seal or expunge records. It is important to understand the legal implications of filing this form, as improper use may lead to delays or denials. Consulting with a legal professional can provide clarity on eligibility and the specific requirements needed for a successful petition.

Required Documents

When filing the Acic form, several supporting documents may be required. These can include:

- A copy of the original court judgment or order.

- Proof of identity, such as a driver's license or state ID.

- Any additional documentation that supports the request for sealing or expungement.

Ensuring that all required documents are submitted with the Acic form can significantly enhance the chances of a favorable outcome.

Form Submission Methods

The Acic form can typically be submitted through various methods, including:

- Online submission via designated state portals.

- Mailing the completed form to the appropriate court or legal authority.

- In-person submission at the relevant courthouse.

Each method may have specific requirements or guidelines, so it is important to verify the preferred submission method for your situation.

Quick guide on how to complete petition to seal records of nolle prosequi dismissals and acic

Complete and submit your Acic Form swiftly

Effective tools for online document exchange and endorsement are now vital for optimizing processes and the continuous enhancement of your forms. When handling legal documents and signing a Acic Form, the right signature solution can help you conserve signNow time and resources with every submission.

Search, fill in, modify, endorse, and distribute your legal paperwork with airSlate SignNow. This platform has everything you need to create efficient document submission workflows. Its vast library of legal forms and intuitive navigation can assist you in locating your Acic Form instantly, and the editor featuring our signature capability will enable you to finalize and authorize it without delay.

Sign your Acic Form in a few straightforward steps

- Locate the Acic Form you need in our library using search or catalog sections.

- Review the form details and preview it to ensure it meets your requirements and legal standards.

- Click Obtain form to open it for modification.

- Complete the form using the extensive toolbar.

- Check the details you entered and click the Sign feature to endorse your document.

- Choose one of three options to affix your signature.

- Finish editing and save the document in your storage, and then download it to your device or share it right away.

Streamline every stage of your document preparation and approval process with airSlate SignNow. Experience a more effective online solution that covers all aspects of handling your documentation.

Create this form in 5 minutes or less

FAQs

-

Why should it be so complicated just figuring out how much tax to pay? (record keeping, software, filling out forms . . . many times cost much more than the amount of taxes due) The cost of compliance makes the U.S. uncompetitive and costs jobs and lowers our standard of living.

Taxes can be viewed as having 4 uses (or purposes) in our (and most) governments:Revenue generation (to pay for public services).Fiscal policy control (e.g., If the government wishes to reduce the money supply in order to reduce the risk of inflation, they can raise interest rates, sell fewer bonds, burn money, or raise taxes. In the last case, this represents excess tax revenue over the actual spending needs of the government).Wealth re-distribution. One argument for this is that the earnings of a country can be perceived as belonging to all of its citizens since the we all have a stake in the resources of the country (natural resources, and intangibles such as culture, good citizenship, civic duties). Without some tax policy complexity, the free market alone does not re-distribute wealth according to this "shared" resources concept. However, this steps into the boundary of Purpose # 4...A way to implement Social Policy (and similar government mandated policies, such as environmental policy, health policy, savings and debt policy, etc.). As Government spending can be use to implement policies (e.g., spending money on public health care, environmental cleanup, education, etc.), it is equivalent to provide tax breaks (income deductions or tax credits) for the private sector to act in certain ways -- e.g., spend money on R&D, pay for their own education or health care, avoid spending money on polluting cars by having a higher sales tax on these cars or offering a credit for trade-ins [ref: Cash for Clunkers]).Uses # 1 & 2 are rather straight-forward, and do not require a complex tax code to implement. Flat income and/or consumption (sales) taxes can easily be manipulated up or down overall for these top 2 uses. Furthermore, there is clarity when these uses are invoked. For spending, we publish a budget. For fiscal policy manipulation, the official economic agency (The Fed) publishes their outlook and agenda.Use # 3 is controversial because there is no Constitutional definition for the appropriate level of wealth re-distribution, and the very concept of wealth re-distribution is considered by some to be inappropriate and unconstitutional. Thus, the goal of wealth re-distribution is pretty much hidden in with the actions and policies of Use #4 (social policy manipulation).Use # 4, however, is where the complexity enters the Taxation system. Policy implementation through taxation (or through spending) occurs via legislation. Legislation (law making) is inherently complex and subject to gross manipulation by special interests during formation and amendments. Legislation is subject to interpretation, is prone to errors (leading to loopholes) and both unintentional or intentional (criminal / fraudulent) avoidance.The record keeping and forms referred to in the question are partially due to the basic formula for calculating taxes (i.e., percentage of income, cost of property, amount of purchase for a sales tax, ...). However, it is the complexity (and associated opportunities for exploitation) of taxation legislation for Use # 4 (Social Policy implementation) that naturally leads to complexity in the reporting requirements for the tax system.

-

Which ITR form should I fill for payments received from the USA to a salaried individual in India for freelancing work, and how should I declare this in ITR? There is no TDS record of this payment as it is outside India.

You can use ITR-1 to show it as Income from Other SOurcesIf you want to claim expense against this income, then you are better off showing it in ITR-2 again as Income from Other Sources. In this case dont claim too many expenses against Income from Other Sources because that usually triggers a scrutinyIf this is going to be regular, then you will need to fill ITR-3 and show this as Income from Business/Profession. The negative of this ITR is that it is quite voluminous and you will have to prepare a Balance Sheet and Profit and loss account even if your income from this source exceeds an amount as low as Rs. 1,20,000/-.

-

How much will a doctor with a physical disability and annual net income of around Rs. 2.8 lakhs pay in income tax? Which ITR form is to be filled out?

For disability a deduction of ₹75,000/- is available u/s 80U.Rebate u/s87AFor AY 17–18, rebate was ₹5,000/- or income tax which ever is lower for person with income less than ₹5,00,000/-For AY 18–19, rebate is ₹2,500/- or income tax whichever is lower for person with income less than 3,50,000/-So, for an income of 2.8 lakhs, taxable income after deduction u/s 80U will remain ₹2,05,000/- which is below the slab rate and hence will not be taxable for any of the above said AY.For ITR,If doctor is practicing himself i.e. He has a professional income than ITR 4 should be filedIf doctor is getting any salary than ITR 1 should be filed.:)

Create this form in 5 minutes!

How to create an eSignature for the petition to seal records of nolle prosequi dismissals and acic

How to make an electronic signature for the Petition To Seal Records Of Nolle Prosequi Dismissals And Acic online

How to generate an eSignature for your Petition To Seal Records Of Nolle Prosequi Dismissals And Acic in Chrome

How to create an electronic signature for signing the Petition To Seal Records Of Nolle Prosequi Dismissals And Acic in Gmail

How to make an electronic signature for the Petition To Seal Records Of Nolle Prosequi Dismissals And Acic right from your mobile device

How to generate an electronic signature for the Petition To Seal Records Of Nolle Prosequi Dismissals And Acic on iOS devices

How to generate an electronic signature for the Petition To Seal Records Of Nolle Prosequi Dismissals And Acic on Android OS

People also ask

-

What is an Acic Form and how can airSlate SignNow help?

An Acic Form is a specific document often used in various business processes. With airSlate SignNow, you can easily create, send, and eSign Acic Forms, streamlining your workflow and ensuring that your documents are handled efficiently and securely.

-

How much does it cost to use airSlate SignNow for Acic Forms?

airSlate SignNow offers competitive pricing plans tailored for businesses of all sizes. You can choose from monthly or annual subscriptions that provide full access to features for handling Acic Forms, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for managing Acic Forms?

airSlate SignNow includes a variety of features designed for Acic Forms, such as customizable templates, advanced eSignature options, and real-time document tracking. These tools help streamline the signing process and enhance collaboration among team members.

-

Can I integrate airSlate SignNow with other software for Acic Forms?

Yes, airSlate SignNow seamlessly integrates with various software applications, making it easy to manage your Acic Forms alongside other business tools. This integration capability enhances your overall workflow by connecting essential applications in one place.

-

What are the benefits of using airSlate SignNow for Acic Forms?

Using airSlate SignNow for Acic Forms offers numerous benefits, including improved efficiency, reduced paper usage, and enhanced security. The platform allows you to manage your documents digitally, ensuring faster turnaround times and better compliance.

-

Is airSlate SignNow secure for handling Acic Forms?

Absolutely! airSlate SignNow prioritizes the security of your Acic Forms with end-to-end encryption and compliance with industry standards. You can trust that your documents are safe and protected throughout the signing process.

-

Can multiple users sign Acic Forms with airSlate SignNow?

Yes, airSlate SignNow allows multiple users to sign Acic Forms easily. You can send documents to various recipients, track their signing status, and ensure that everyone involved can contribute efficiently to the process.

Get more for Acic Form

- Insurance trust form

- Agreement between company 497336560 form

- Sample employment agreement contract form

- Wellcraft master dealer agreement form

- Dealer agreement form

- Sample common shares purchase agreement between visible genetics inc and investors form

- Registration company form

- Corporation shares stock form

Find out other Acic Form

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement