Form 8736 Rev 10 Application for Automatic Extension of Time to File US Return for a Partnership REMIC or for Certain Trusts

Understanding the Form 8736 Rev 10

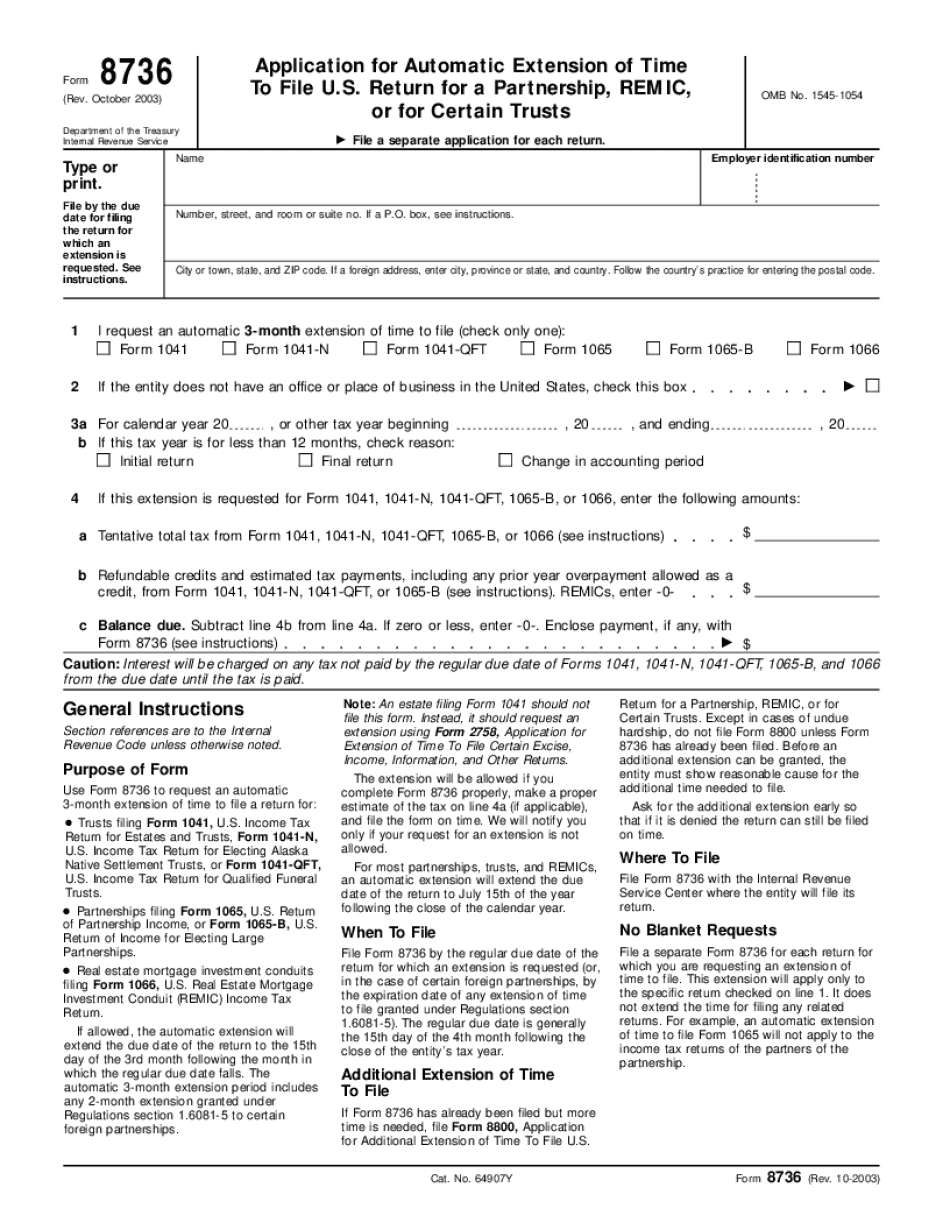

The Form 8736 Rev 10 is an official document used to apply for an automatic extension of time to file a U.S. return for various entities, including partnerships, Real Estate Mortgage Investment Conduits (REMICs), and certain trusts. This form is essential for those who need additional time to prepare their tax returns without incurring penalties for late filing. By submitting this form, eligible entities can secure an extension, allowing them to gather necessary documentation and ensure accurate reporting of their financial activities.

How to Complete the Form 8736 Rev 10

Completing the Form 8736 Rev 10 involves several key steps. First, ensure that you have all necessary information regarding your partnership, REMIC, or trust, including the entity's name, address, and Employer Identification Number (EIN). Next, accurately fill out the form, providing details about the type of extension requested and the reason for the delay in filing. It is crucial to review the form for accuracy before submission to avoid complications. Once completed, the form must be submitted to the IRS by the specified deadline to ensure the extension is granted.

Obtaining the Form 8736 Rev 10

The Form 8736 Rev 10 can be obtained directly from the IRS website or through various tax preparation resources. It is available as a downloadable PDF, which allows for easy access and printing. For those who prefer digital methods, electronic filing options may also be available through authorized tax software, making it convenient to complete and submit the form online.

Key Elements of the Form 8736 Rev 10

Several important elements must be included when filling out the Form 8736 Rev 10. These include the entity's legal name, address, and EIN, as well as the specific type of entity applying for the extension. Additionally, the form requires a signature from an authorized representative of the entity, affirming the accuracy of the information provided. It is also essential to indicate the tax year for which the extension is being requested, ensuring clarity for IRS processing.

Filing Deadlines for Form 8736 Rev 10

Timely submission of the Form 8736 Rev 10 is critical to avoid penalties. The form must generally be filed by the original due date of the return for which the extension is sought. For most partnerships and trusts, this deadline aligns with the standard tax return due dates, which are typically March 15 for partnerships and April 15 for trusts. It is advisable to check for any updates or changes to these deadlines each tax year to ensure compliance.

Penalties for Non-Compliance

Failing to file the Form 8736 Rev 10 on time can result in significant penalties. If the extension is not filed by the deadline, the IRS may impose late filing penalties, which can accumulate quickly. Additionally, if the tax return itself is not filed within the extended timeframe, further penalties may apply. Understanding these consequences highlights the importance of timely and accurate submission of the form.

Digital Submission of Form 8736 Rev 10

For those looking to streamline their filing process, the digital version of the Form 8736 Rev 10 offers a convenient option. Submitting the form electronically can reduce processing time and minimize the risk of errors associated with paper submissions. Many tax software programs provide integrated features for completing and submitting this form, ensuring compliance with IRS requirements while enhancing efficiency.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8736 rev 10 application for automatic extension of time to file us return for a partnership remic or for certain trusts

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 8736 Rev 10 Application For Automatic Extension Of Time To File US Return For A Partnership REMIC Or For Certain Trusts?

The Form 8736 Rev 10 Application For Automatic Extension Of Time To File US Return For A Partnership REMIC Or For Certain Trusts is a document that allows partnerships, REMICs, and certain trusts to request an automatic extension for filing their U.S. tax returns. This form is essential for ensuring compliance with IRS regulations while providing additional time to prepare accurate filings.

-

How can airSlate SignNow help with the Form 8736 Rev 10 Application?

airSlate SignNow simplifies the process of completing and submitting the Form 8736 Rev 10 Application For Automatic Extension Of Time To File US Return For A Partnership REMIC Or For Certain Trusts. Our platform allows users to fill out the form electronically, eSign it, and send it directly to the IRS, ensuring a smooth and efficient filing process.

-

What are the pricing options for using airSlate SignNow for tax forms?

airSlate SignNow offers various pricing plans to accommodate different business needs, including options for individuals and teams. Each plan provides access to features that facilitate the completion of forms like the Form 8736 Rev 10 Application For Automatic Extension Of Time To File US Return For A Partnership REMIC Or For Certain Trusts, ensuring you get the best value for your investment.

-

Are there any integrations available with airSlate SignNow for tax preparation software?

Yes, airSlate SignNow integrates seamlessly with various tax preparation software, enhancing your workflow when dealing with forms like the Form 8736 Rev 10 Application For Automatic Extension Of Time To File US Return For A Partnership REMIC Or For Certain Trusts. This integration allows for easy data transfer and ensures that your documents are always up-to-date.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow provides a range of features designed for managing tax documents, including customizable templates, secure eSigning, and document tracking. These features are particularly useful for handling the Form 8736 Rev 10 Application For Automatic Extension Of Time To File US Return For A Partnership REMIC Or For Certain Trusts, making the process more efficient and organized.

-

How secure is the airSlate SignNow platform for filing tax forms?

The airSlate SignNow platform prioritizes security, employing advanced encryption and compliance measures to protect your sensitive information. When filing the Form 8736 Rev 10 Application For Automatic Extension Of Time To File US Return For A Partnership REMIC Or For Certain Trusts, you can trust that your data is safe and secure throughout the entire process.

-

Can I access airSlate SignNow on mobile devices?

Yes, airSlate SignNow is fully accessible on mobile devices, allowing you to manage and eSign documents like the Form 8736 Rev 10 Application For Automatic Extension Of Time To File US Return For A Partnership REMIC Or For Certain Trusts on the go. This flexibility ensures that you can handle your tax filings anytime, anywhere.

Get more for Form 8736 Rev 10 Application For Automatic Extension Of Time To File US Return For A Partnership REMIC Or For Certain Trusts

Find out other Form 8736 Rev 10 Application For Automatic Extension Of Time To File US Return For A Partnership REMIC Or For Certain Trusts

- Sign Idaho Legal Separation Agreement Online

- Sign Illinois Legal IOU Later

- Sign Illinois Legal Cease And Desist Letter Fast

- Sign Indiana Legal Cease And Desist Letter Easy

- Can I Sign Kansas Legal LLC Operating Agreement

- Sign Kansas Legal Cease And Desist Letter Now

- Sign Pennsylvania Insurance Business Plan Template Safe

- Sign Pennsylvania Insurance Contract Safe

- How Do I Sign Louisiana Legal Cease And Desist Letter

- How Can I Sign Kentucky Legal Quitclaim Deed

- Sign Kentucky Legal Cease And Desist Letter Fast

- Sign Maryland Legal Quitclaim Deed Now

- Can I Sign Maine Legal NDA

- How To Sign Maine Legal Warranty Deed

- Sign Maine Legal Last Will And Testament Fast

- How To Sign Maine Legal Quitclaim Deed

- Sign Mississippi Legal Business Plan Template Easy

- How Do I Sign Minnesota Legal Residential Lease Agreement

- Sign South Carolina Insurance Lease Agreement Template Computer

- Sign Missouri Legal Last Will And Testament Online