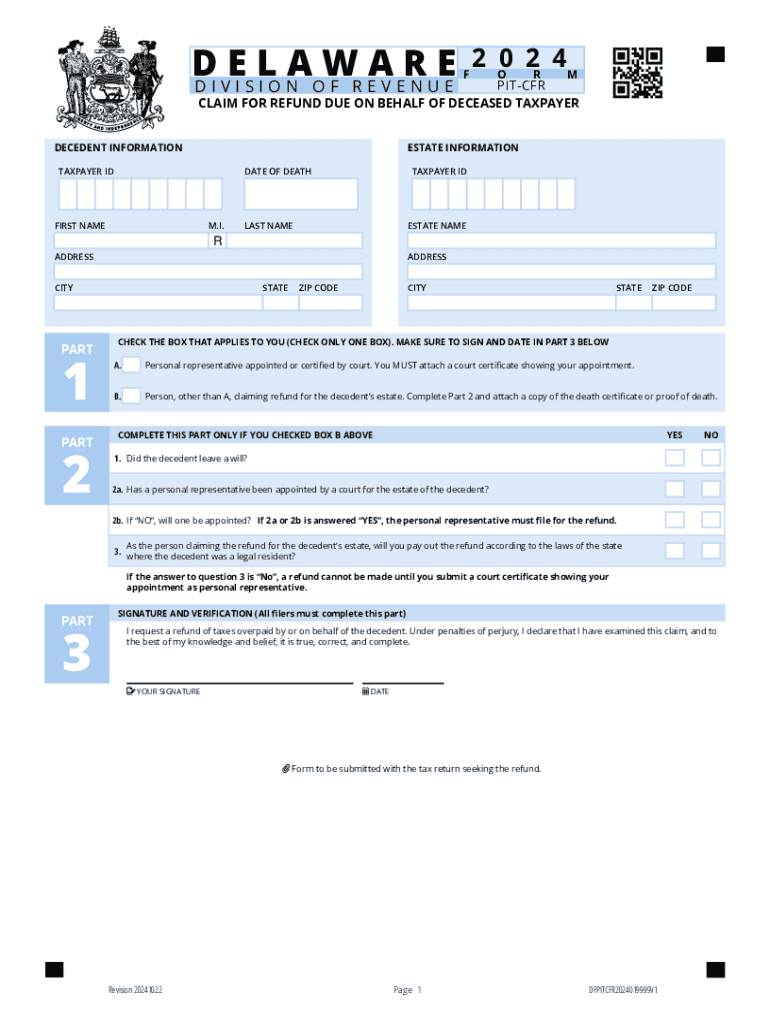

PIT CFR Form

What is the PIT CFR

The PIT CFR, or Personal Income Tax Common Federal Regulations, is a crucial form used by individuals in the United States to report their income and calculate their tax obligations. This form is essential for ensuring compliance with federal tax laws and is typically required for annual tax filings. The PIT CFR encompasses various income types, deductions, and credits that taxpayers can claim to reduce their taxable income. Understanding the elements of the PIT CFR is vital for accurate reporting and to avoid potential penalties.

How to use the PIT CFR

Using the PIT CFR involves several steps to ensure accurate completion and submission. Taxpayers must first gather all necessary financial documents, including W-2s, 1099s, and any records of deductions or credits. Next, individuals should carefully fill out the form, ensuring that all income sources are reported and that any applicable deductions are claimed. After completing the form, it should be reviewed for accuracy before submission, either electronically or by mail. Utilizing tax preparation software can simplify this process and help ensure compliance with IRS guidelines.

Steps to complete the PIT CFR

Completing the PIT CFR involves a systematic approach to ensure all information is accurately reported. The following steps outline the process:

- Gather all relevant financial documents, including income statements and receipts for deductions.

- Begin filling out the form, starting with personal identification information.

- Report all sources of income, ensuring to include wages, self-employment earnings, and investment income.

- Claim any eligible deductions, such as mortgage interest, student loan interest, or medical expenses.

- Review the completed form for accuracy and completeness.

- Submit the form electronically through approved channels or mail it to the appropriate IRS address.

Legal use of the PIT CFR

The PIT CFR must be used in accordance with federal tax laws and regulations. Taxpayers are legally obligated to report their income accurately and to claim only those deductions and credits for which they qualify. Misuse of the PIT CFR, such as falsifying income or claiming unqualified deductions, can result in penalties, including fines and interest on unpaid taxes. It is essential for individuals to understand their rights and responsibilities when using this form to maintain compliance with tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the PIT CFR are crucial for taxpayers to observe to avoid penalties. Typically, the deadline for submitting the PIT CFR is April fifteenth of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions they may apply for, which can provide additional time for filing, although any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Required Documents

To complete the PIT CFR accurately, several documents are necessary. Taxpayers should prepare the following:

- W-2 forms from employers, detailing annual wages and taxes withheld.

- 1099 forms for any freelance or contract work, showing income earned outside of traditional employment.

- Records of deductible expenses, such as receipts for medical expenses, charitable contributions, and mortgage interest.

- Any other relevant financial documents that may impact taxable income or deductions.

Examples of using the PIT CFR

Examples of situations where the PIT CFR is used can help clarify its application. For instance, a self-employed individual would report their business income and expenses on the PIT CFR, ensuring they claim all eligible deductions to lower their taxable income. Another example is a taxpayer who has received unemployment benefits, which must also be reported on the form. Each scenario illustrates the importance of accurately reporting all income sources and claiming appropriate deductions to comply with tax regulations.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pit cfr

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is PIT CFR and how does it relate to airSlate SignNow?

PIT CFR refers to the regulatory framework that governs the electronic signing of documents. airSlate SignNow complies with PIT CFR standards, ensuring that your eSignatures are legally binding and secure. This compliance helps businesses streamline their document workflows while adhering to necessary regulations.

-

How much does airSlate SignNow cost for businesses looking to implement PIT CFR solutions?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Our plans are designed to provide cost-effective solutions for managing eSignatures in compliance with PIT CFR. You can choose from monthly or annual subscriptions, ensuring you find the right fit for your budget.

-

What features does airSlate SignNow offer to support PIT CFR compliance?

airSlate SignNow includes features such as secure document storage, audit trails, and customizable workflows that support PIT CFR compliance. These features ensure that your electronic signatures are not only valid but also traceable and secure. This makes it easier for businesses to manage their documents while adhering to regulatory requirements.

-

Can airSlate SignNow integrate with other software to enhance PIT CFR processes?

Yes, airSlate SignNow offers seamless integrations with various software applications, enhancing your PIT CFR processes. Whether you use CRM systems, document management tools, or other business applications, our platform can connect with them to streamline your workflows. This integration capability helps improve efficiency and compliance.

-

What are the benefits of using airSlate SignNow for PIT CFR document management?

Using airSlate SignNow for PIT CFR document management provides numerous benefits, including increased efficiency, reduced paper usage, and enhanced security. Our platform allows businesses to send and eSign documents quickly, ensuring compliance with PIT CFR regulations. This not only saves time but also helps in maintaining a sustainable business practice.

-

Is airSlate SignNow user-friendly for those unfamiliar with PIT CFR?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to navigate, even if they are unfamiliar with PIT CFR. Our intuitive interface allows users to send and sign documents without extensive training. This accessibility ensures that all team members can efficiently manage their eSigning needs.

-

How does airSlate SignNow ensure the security of documents under PIT CFR?

airSlate SignNow employs advanced security measures to protect documents in compliance with PIT CFR. This includes encryption, secure access controls, and regular security audits. By prioritizing security, we ensure that your sensitive information remains confidential and protected throughout the signing process.

Get more for PIT CFR

- 061816 cccr n324 a form

- How to fill out a scca 233f form

- Ohio compensation form

- Ps form 8017 pdf uspscom

- Photography need help now please before you take a picture form

- 6 employee relations uspscom form

- Nebraska change request form 22 nebraska revenue

- Pharmacist led chronic disease management pharmacist led chronic disease management hsrd research va form

Find out other PIT CFR

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form