PayeeJoint Account 2019-2026

What is the PayeeJoint Account

The PayeeJoint Account is a financial arrangement that allows two or more individuals to jointly manage funds. This type of account is often used for shared expenses, such as household bills or joint investments. Each account holder has equal access to the funds and can make deposits or withdrawals as needed. The PayeeJoint Account is particularly useful for couples, business partners, or family members who want to streamline their financial transactions.

How to use the PayeeJoint Account

Using a PayeeJoint Account involves a few straightforward steps. First, all account holders must agree on the purpose of the account and how funds will be managed. Once the account is established, each holder can deposit money, write checks, or use debit cards linked to the account. Regular communication among account holders is essential to ensure transparency and avoid misunderstandings regarding expenditures. It is also important to keep track of transactions to maintain a clear record of account activity.

Steps to complete the PayeeJoint Account

To set up a PayeeJoint Account, follow these steps:

- Choose a financial institution that offers joint accounts.

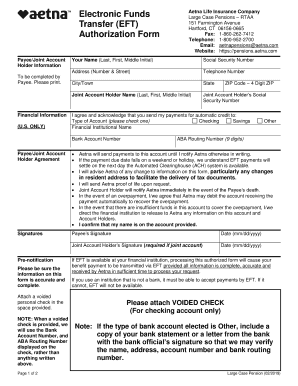

- Gather required documentation, including identification and Social Security numbers for all account holders.

- Visit a local branch or complete the application online, providing all necessary information.

- Decide on the account features, such as overdraft protection or linked savings accounts.

- Review the account agreement, ensuring all parties understand the terms and conditions.

- Make an initial deposit if required by the bank.

Legal use of the PayeeJoint Account

The PayeeJoint Account is legally recognized in the United States, allowing multiple individuals to share ownership of the funds. Each account holder has equal rights, which means that any holder can withdraw or manage the funds without the consent of the others. It is important to understand that this shared ownership can lead to complications, especially in cases of disputes or if one account holder passes away. Legal advice may be beneficial to navigate these situations effectively.

Eligibility Criteria

To open a PayeeJoint Account, all parties must meet certain eligibility criteria. Typically, account holders must be at least eighteen years old and possess valid identification, such as a driver's license or passport. Financial institutions may also require proof of residency and Social Security numbers. Additionally, all account holders should have a mutual understanding of the account's purpose and management to ensure a harmonious financial relationship.

Examples of using the PayeeJoint Account

PayeeJoint Accounts can be utilized in various scenarios, including:

- Couples managing household expenses, such as rent and utilities.

- Business partners sharing funds for operational costs.

- Family members pooling resources for a shared vacation or major purchase.

- Roommates splitting costs for groceries and shared living expenses.

Required Documents

When applying for a PayeeJoint Account, the following documents are typically required:

- Government-issued identification for all account holders.

- Social Security numbers or tax identification numbers.

- Proof of address, such as a utility bill or lease agreement.

- Any additional documentation requested by the financial institution.

Create this form in 5 minutes or less

Find and fill out the correct payeejoint account

Create this form in 5 minutes!

How to create an eSignature for the payeejoint account

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a PayeeJoint Account?

A PayeeJoint Account is a shared account designed for multiple users to manage funds collaboratively. This type of account allows all designated payees to access and manage the account, making it ideal for businesses or groups that need to handle shared finances efficiently.

-

How does airSlate SignNow support PayeeJoint Accounts?

airSlate SignNow provides a seamless way to manage documents related to PayeeJoint Accounts. With our eSigning capabilities, users can easily sign and send documents for joint account management, ensuring that all parties are on the same page and that transactions are secure.

-

What are the benefits of using a PayeeJoint Account?

Using a PayeeJoint Account offers several benefits, including shared access to funds, simplified financial management, and enhanced collaboration among users. This account type is particularly useful for businesses that require multiple stakeholders to have visibility and control over financial transactions.

-

Are there any fees associated with a PayeeJoint Account?

Fees for a PayeeJoint Account can vary depending on the financial institution. However, airSlate SignNow offers cost-effective solutions for document management and eSigning, which can help reduce overall operational costs associated with managing a PayeeJoint Account.

-

Can I integrate airSlate SignNow with my PayeeJoint Account?

Yes, airSlate SignNow can be integrated with various financial platforms that support PayeeJoint Accounts. This integration allows for streamlined document workflows, making it easier to manage agreements and transactions related to your joint account.

-

What features does airSlate SignNow offer for managing PayeeJoint Accounts?

airSlate SignNow offers features such as customizable templates, secure eSigning, and real-time document tracking, all of which are beneficial for managing PayeeJoint Accounts. These features enhance collaboration and ensure that all necessary documents are handled efficiently.

-

How can I ensure the security of my PayeeJoint Account documents?

With airSlate SignNow, your PayeeJoint Account documents are protected through advanced encryption and secure access controls. We prioritize the security of your sensitive information, ensuring that only authorized users can access and manage your documents.

Get more for PayeeJoint Account

- Illinoistemporary visitor drivers license tvdl flyer englsih form

- Statement of affirmation indiana department of natural form

- To farm vehicle compliance the texas department of public form

- Illinois parking program for persons with disabilities abuse complaint form

- S secretary of state this d m change form

- Please mail all required documentation to form

- Form vsd62 ampquotpersons with disabilities certification for

- Irs updates rules for vehicle mileage rate deductions form

Find out other PayeeJoint Account

- Sign Connecticut Life Sciences Rental Lease Agreement Online

- Sign Connecticut Life Sciences Affidavit Of Heirship Easy

- Sign Tennessee Legal LLC Operating Agreement Online

- How To Sign Tennessee Legal Cease And Desist Letter

- How Do I Sign Tennessee Legal Separation Agreement

- Sign Virginia Insurance Memorandum Of Understanding Easy

- Sign Utah Legal Living Will Easy

- Sign Virginia Legal Last Will And Testament Mobile

- How To Sign Vermont Legal Executive Summary Template

- How To Sign Vermont Legal POA

- How Do I Sign Hawaii Life Sciences Business Plan Template

- Sign Life Sciences PPT Idaho Online

- Sign Life Sciences PPT Idaho Later

- How Do I Sign Hawaii Life Sciences LLC Operating Agreement

- Sign Idaho Life Sciences Promissory Note Template Secure

- How To Sign Wyoming Legal Quitclaim Deed

- Sign Wisconsin Insurance Living Will Now

- Sign Wyoming Insurance LLC Operating Agreement Simple

- Sign Kentucky Life Sciences Profit And Loss Statement Now

- How To Sign Arizona Non-Profit Cease And Desist Letter