Governmental Employees Hotel Lodging Sales Use Tax Exemption Certificate 2009

What is the Governmental Employees Hotel Lodging Sales Use Tax Exemption Certificate

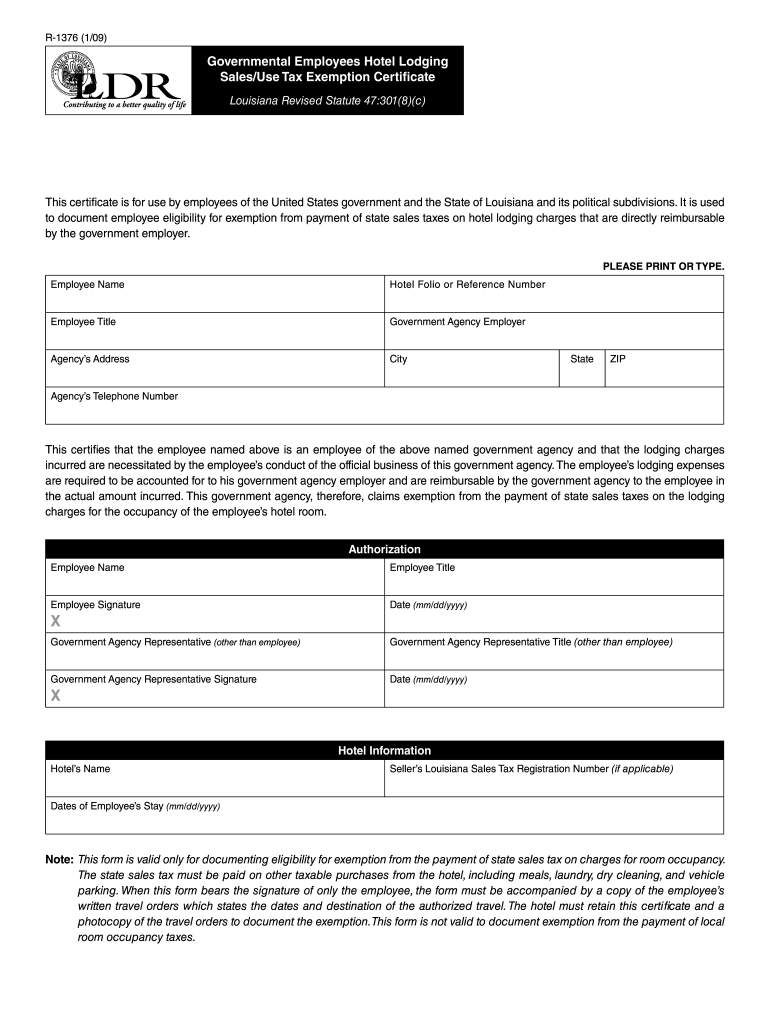

The Governmental Employees Hotel Lodging Sales Use Tax Exemption Certificate is a document that allows eligible governmental employees to exempt certain hotel lodging expenses from sales tax. This certificate is primarily used when traveling for official government business, ensuring that government entities can manage their budgets effectively by avoiding unnecessary tax costs. The exemption applies to accommodations that are directly related to the performance of government duties, helping to streamline travel expenses for public servants.

How to Use the Governmental Employees Hotel Lodging Sales Use Tax Exemption Certificate

To utilize the Governmental Employees Hotel Lodging Sales Use Tax Exemption Certificate, the employee must present the certificate to the hotel at the time of check-in. It is essential to ensure that the hotel accepts the certificate for tax exemption. The employee should fill out the certificate accurately, including their name, government agency, and the purpose of the stay. This process helps avoid any confusion regarding the tax-exempt status of the lodging expenses.

Steps to Complete the Governmental Employees Hotel Lodging Sales Use Tax Exemption Certificate

Completing the Governmental Employees Hotel Lodging Sales Use Tax Exemption Certificate involves several straightforward steps:

- Obtain the certificate from your government agency or download it from an official source.

- Fill in your name, the name of your government agency, and the address of the hotel.

- Specify the purpose of your travel and the dates of your stay.

- Sign and date the certificate to validate it.

- Present the completed certificate to the hotel at check-in.

Eligibility Criteria

Eligibility for using the Governmental Employees Hotel Lodging Sales Use Tax Exemption Certificate generally includes individuals who are employed by federal, state, or local government agencies. Employees must be traveling for official government business to qualify for the tax exemption. It is important for employees to check with their agency’s policies regarding travel and tax exemptions, as specific criteria may vary by jurisdiction.

Legal Use of the Governmental Employees Hotel Lodging Sales Use Tax Exemption Certificate

The legal use of the Governmental Employees Hotel Lodging Sales Use Tax Exemption Certificate requires adherence to state and federal laws governing tax exemptions. The certificate must only be used for legitimate government travel and cannot be applied to personal stays or non-official business. Misuse of the exemption certificate may lead to penalties, including fines or reimbursement of the exempted tax amounts.

Required Documents

When using the Governmental Employees Hotel Lodging Sales Use Tax Exemption Certificate, employees may need to provide additional documentation to support their claim for tax exemption. This may include:

- A valid government-issued identification card.

- Travel orders or documentation that confirms the purpose of the trip.

- Any additional forms required by the hotel or state regulations.

Create this form in 5 minutes or less

Find and fill out the correct governmental employees hotel lodging sales use tax exemption certificate

Create this form in 5 minutes!

How to create an eSignature for the governmental employees hotel lodging sales use tax exemption certificate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a tax exempt form and why is it important?

A tax exempt form is a document that allows organizations to make purchases without paying sales tax. This form is crucial for non-profit organizations and certain government entities to ensure compliance with tax regulations while saving money on purchases.

-

How can airSlate SignNow help with tax exempt forms?

airSlate SignNow provides an efficient platform for creating, sending, and eSigning tax exempt forms. With our user-friendly interface, businesses can streamline the process of managing these forms, ensuring they are completed accurately and securely.

-

Is there a cost associated with using airSlate SignNow for tax exempt forms?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our plans are designed to be cost-effective, allowing you to manage tax exempt forms without breaking the bank while enjoying all the essential features.

-

What features does airSlate SignNow offer for managing tax exempt forms?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking specifically for tax exempt forms. These features help ensure that your forms are processed efficiently and securely, enhancing your overall workflow.

-

Can I integrate airSlate SignNow with other software for tax exempt forms?

Absolutely! airSlate SignNow offers integrations with various software applications, making it easy to manage tax exempt forms alongside your existing tools. This flexibility allows for a seamless workflow and improved productivity.

-

How does airSlate SignNow ensure the security of my tax exempt forms?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure cloud storage to protect your tax exempt forms, ensuring that sensitive information remains confidential and accessible only to authorized users.

-

Can I track the status of my tax exempt forms with airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for your tax exempt forms. You can easily monitor the status of each form, ensuring that you are always informed about who has signed and when, which helps streamline your document management process.

Get more for Governmental Employees Hotel Lodging Sales Use Tax Exemption Certificate

- Title amp registration application title amp registration application form

- Forms you may need to collect on a civil judgment

- Bill of sale form oregon declaration of service form pdffiller

- Illinois what you need to know about truck navigation devices form

- Dl 17 12 19 form

- Renewal by mail license plate order form bdvr 160 renewal by mail license plate order form bdvr 160

- Fact sheet titles obtained by bond illinois secretary of state form

- Contact us dmvdepartment of revenue motor coloradogov form

Find out other Governmental Employees Hotel Lodging Sales Use Tax Exemption Certificate

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy