Instructions for Form 6900 Alaska Partnership

What is the Instructions For Form 6900 Alaska Partnership

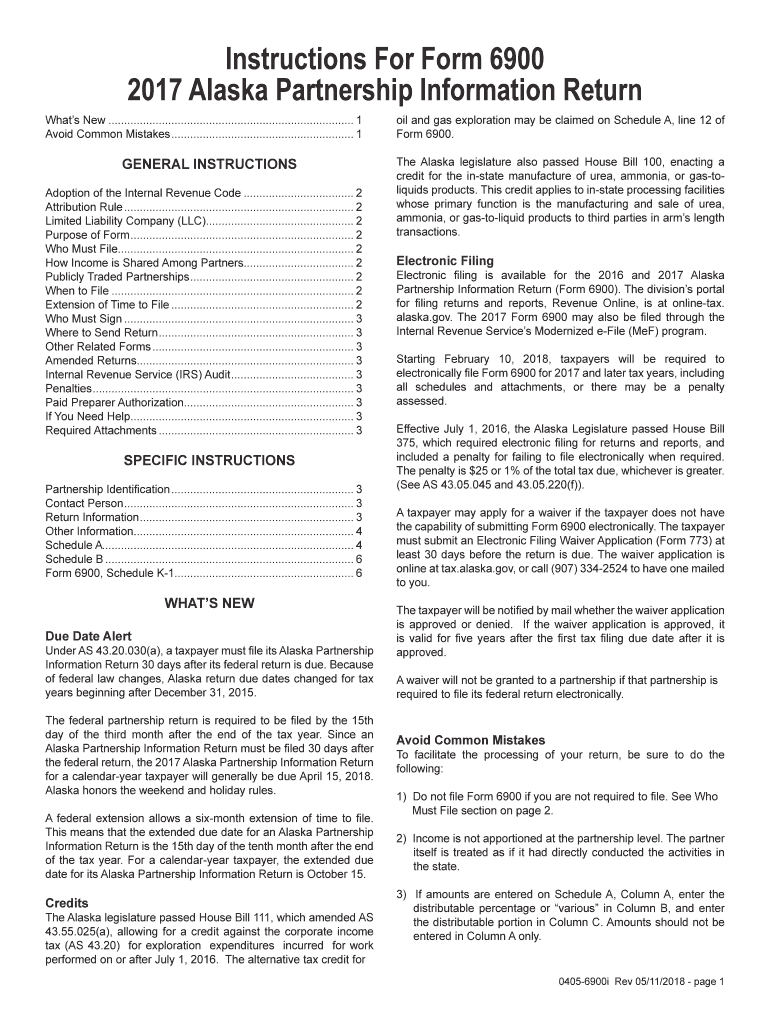

The Instructions For Form 6900 Alaska Partnership provide essential guidelines for partnerships operating in Alaska. This form is specifically designed for reporting income, deductions, and credits for partnerships that are subject to Alaska's tax regulations. By following these instructions, partnerships can ensure compliance with state tax laws and accurately report their financial activities.

Steps to complete the Instructions For Form 6900 Alaska Partnership

Completing the Instructions For Form 6900 involves several key steps:

- Gather necessary financial documents, including income statements and expense reports.

- Review the specific instructions for each section of the form to understand what information is required.

- Fill out the form accurately, ensuring all figures are correct and all required fields are completed.

- Double-check the form for any errors or omissions before submission.

- Submit the completed form by the designated deadline to avoid penalties.

Legal use of the Instructions For Form 6900 Alaska Partnership

The legal use of the Instructions For Form 6900 is crucial for partnerships to meet their tax obligations in Alaska. Partnerships must adhere to the guidelines outlined in the instructions to avoid legal repercussions. This includes accurate reporting of income and expenses, as well as timely submission of the form to the appropriate state tax authority.

Filing Deadlines / Important Dates

Partnerships must be aware of specific filing deadlines related to Form 6900. Typically, the form is due on the fifteenth day of the fourth month following the end of the partnership's tax year. It is essential to check for any updates or changes to these deadlines, as they can vary from year to year.

Required Documents

To complete the Instructions For Form 6900, partnerships need to gather several key documents, such as:

- Previous year’s tax returns

- Income statements

- Expense records

- Partnership agreements

- Any additional documentation that supports deductions or credits claimed

Who Issues the Form

The Instructions For Form 6900 are issued by the Alaska Department of Revenue. This department is responsible for overseeing tax compliance and ensuring that partnerships fulfill their tax obligations according to state law.

Create this form in 5 minutes or less

Related searches to Instructions For Form 6900 Alaska Partnership

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 6900 alaska partnership

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Instructions For Form 6900 Alaska Partnership?

The Instructions For Form 6900 Alaska Partnership provide detailed guidance on how to complete the form required for partnership tax filings in Alaska. This includes information on eligibility, required documentation, and filing deadlines to ensure compliance with state regulations.

-

How can airSlate SignNow assist with the Instructions For Form 6900 Alaska Partnership?

airSlate SignNow simplifies the process of completing and submitting the Instructions For Form 6900 Alaska Partnership by providing an intuitive platform for eSigning and document management. Users can easily fill out the form, gather necessary signatures, and submit it electronically, saving time and reducing errors.

-

What features does airSlate SignNow offer for managing the Instructions For Form 6900 Alaska Partnership?

airSlate SignNow offers features such as customizable templates, secure eSigning, and real-time collaboration, which are essential for managing the Instructions For Form 6900 Alaska Partnership. These tools help streamline the workflow, ensuring that all parties can contribute efficiently and securely.

-

Is there a cost associated with using airSlate SignNow for the Instructions For Form 6900 Alaska Partnership?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan provides access to features that can help with the Instructions For Form 6900 Alaska Partnership, ensuring that you get the best value for your investment.

-

Can I integrate airSlate SignNow with other software for the Instructions For Form 6900 Alaska Partnership?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, enhancing your ability to manage the Instructions For Form 6900 Alaska Partnership. This integration allows for better data management and workflow automation, making the process more efficient.

-

What are the benefits of using airSlate SignNow for the Instructions For Form 6900 Alaska Partnership?

Using airSlate SignNow for the Instructions For Form 6900 Alaska Partnership offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform ensures that your documents are handled securely and that you can track the signing process in real-time.

-

How does airSlate SignNow ensure the security of my Instructions For Form 6900 Alaska Partnership?

airSlate SignNow prioritizes security by employing advanced encryption and compliance measures to protect your Instructions For Form 6900 Alaska Partnership. This ensures that your sensitive information remains confidential and secure throughout the signing process.

Get more for Instructions For Form 6900 Alaska Partnership

- Manager managed llc operating agreement template form

- Manager managed operating agreement template form

- Member managed operating agreement template form

- Member managed llc operating agreement template form

- Multi member llc operating agreement template form

- Montana llc operating agreement template form

- Multi member operating agreement template form

- Multiple member llc operating agreement template form

Find out other Instructions For Form 6900 Alaska Partnership

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors