Authorization for Pre Tax Payroll Reduction CAFETE Form

What is the Authorization For Pre Tax Payroll Reduction CAFETE

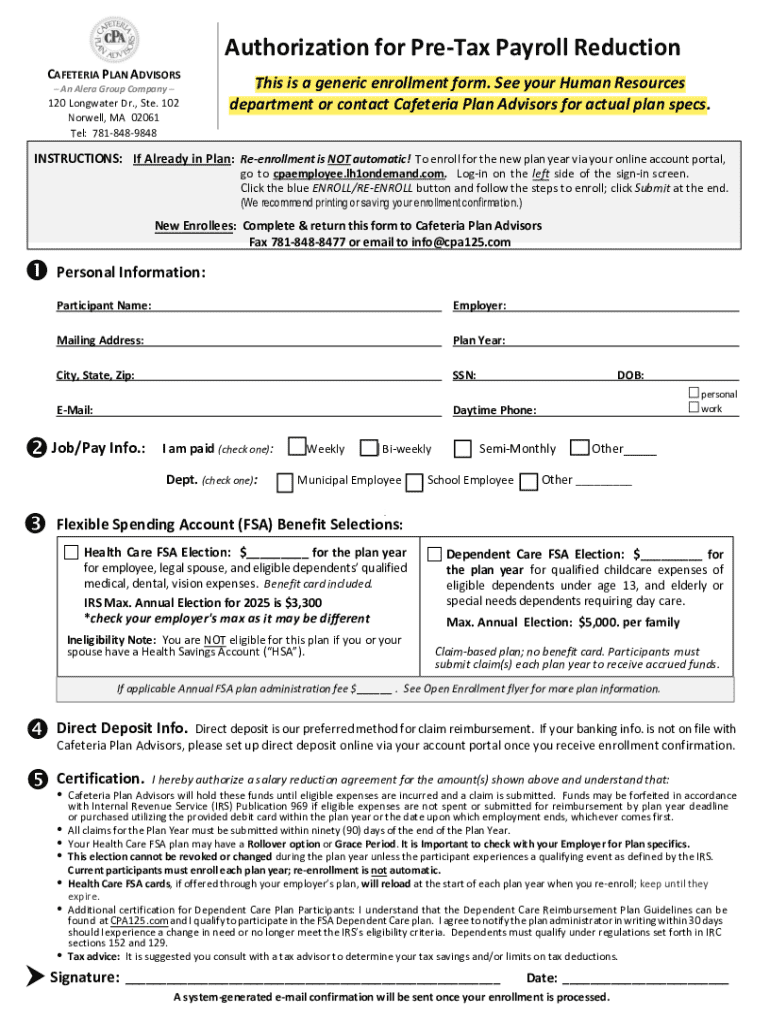

The Authorization For Pre Tax Payroll Reduction CAFETE is a crucial document used by employees in the United States to authorize their employers to reduce their taxable income through pre-tax payroll deductions. This form is particularly relevant for contributions to benefits such as health insurance, retirement plans, and flexible spending accounts. By completing this authorization, employees can lower their taxable income, ultimately resulting in potential tax savings. Understanding the specifics of this form is essential for both employees and employers to ensure compliance with tax regulations.

How to use the Authorization For Pre Tax Payroll Reduction CAFETE

Using the Authorization For Pre Tax Payroll Reduction CAFETE involves several straightforward steps. First, employees need to obtain the form from their employer or the relevant HR department. Once acquired, the employee should fill out the required fields, which typically include personal information, the specific deductions being authorized, and the effective date of the deductions. After completing the form, it should be submitted to the employer for processing. Employers will then implement the deductions as specified, ensuring that the employee benefits from the pre-tax savings.

Steps to complete the Authorization For Pre Tax Payroll Reduction CAFETE

Completing the Authorization For Pre Tax Payroll Reduction CAFETE involves a series of clear steps:

- Obtain the form from your employer or HR department.

- Fill in your personal details, including your name, employee ID, and contact information.

- Specify the type of pre-tax deductions you wish to authorize, such as health insurance or retirement contributions.

- Indicate the effective date for the deductions to begin.

- Review the completed form for accuracy.

- Submit the form to your employer or HR department for processing.

Following these steps ensures that the form is completed correctly and that the employee can take advantage of the tax benefits associated with pre-tax deductions.

Key elements of the Authorization For Pre Tax Payroll Reduction CAFETE

The Authorization For Pre Tax Payroll Reduction CAFETE contains several key elements that are vital for its effectiveness:

- Employee Information: This section includes personal details such as the employee's name, ID number, and contact information.

- Deduction Types: Employees must specify which pre-tax deductions they are authorizing, such as health insurance premiums or retirement savings plans.

- Effective Date: The form requires an effective date to indicate when the deductions will commence.

- Employee Signature: A signature is necessary to validate the authorization and confirm the employee's consent.

Understanding these elements helps ensure that the form is filled out accurately and complies with tax regulations.

Legal use of the Authorization For Pre Tax Payroll Reduction CAFETE

The Authorization For Pre Tax Payroll Reduction CAFETE must be used in accordance with federal and state tax laws. Employers are required to adhere to IRS guidelines when implementing pre-tax deductions, ensuring that they are applied correctly and that employees receive the intended tax benefits. Misuse of the form or failure to comply with legal requirements can result in penalties for both employers and employees. It is important for both parties to maintain accurate records of the deductions and to ensure that all information provided on the form is truthful and complete.

Eligibility Criteria

Eligibility to use the Authorization For Pre Tax Payroll Reduction CAFETE typically includes being an active employee of a company that offers pre-tax benefits. Employees must also meet any specific requirements set forth by their employer regarding participation in certain benefit plans. Additionally, employees should be aware of any limitations on the amount that can be deducted pre-tax, as these may vary based on the type of benefit and IRS regulations. Understanding these eligibility criteria is essential for employees looking to maximize their tax savings through pre-tax payroll reductions.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the authorization for pre tax payroll reduction cafete

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Authorization For Pre Tax Payroll Reduction CAFETE?

The Authorization For Pre Tax Payroll Reduction CAFETE is a document that allows employees to authorize deductions from their pre-tax payroll for specific benefits. This process helps employees save on taxes while ensuring compliance with IRS regulations. Using airSlate SignNow, you can easily create and manage these authorizations digitally.

-

How does airSlate SignNow simplify the Authorization For Pre Tax Payroll Reduction CAFETE process?

airSlate SignNow streamlines the Authorization For Pre Tax Payroll Reduction CAFETE process by providing an intuitive platform for document creation and electronic signatures. This eliminates the need for paper forms and manual processing, saving time and reducing errors. With our solution, you can quickly send, sign, and store these authorizations securely.

-

What are the benefits of using airSlate SignNow for Authorization For Pre Tax Payroll Reduction CAFETE?

Using airSlate SignNow for Authorization For Pre Tax Payroll Reduction CAFETE offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that all documents are legally binding and easily accessible. Additionally, you can track the status of each authorization in real-time.

-

Is there a cost associated with using airSlate SignNow for Authorization For Pre Tax Payroll Reduction CAFETE?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be cost-effective for businesses of all sizes. Our pricing plans are flexible and cater to various needs, ensuring that you only pay for what you use. Investing in our solution can lead to signNow savings in time and resources when managing Authorization For Pre Tax Payroll Reduction CAFETE.

-

Can I integrate airSlate SignNow with other software for managing Authorization For Pre Tax Payroll Reduction CAFETE?

Absolutely! airSlate SignNow offers seamless integrations with various HR and payroll software, making it easy to manage Authorization For Pre Tax Payroll Reduction CAFETE alongside your existing systems. This integration helps streamline workflows and ensures that all data is synchronized across platforms, enhancing overall efficiency.

-

How secure is the Authorization For Pre Tax Payroll Reduction CAFETE process with airSlate SignNow?

Security is a top priority at airSlate SignNow. Our platform uses advanced encryption and security protocols to protect your Authorization For Pre Tax Payroll Reduction CAFETE documents. Additionally, we comply with industry standards to ensure that your sensitive information remains confidential and secure.

-

What features does airSlate SignNow offer for managing Authorization For Pre Tax Payroll Reduction CAFETE?

airSlate SignNow provides a range of features for managing Authorization For Pre Tax Payroll Reduction CAFETE, including customizable templates, electronic signatures, and automated reminders. These features help streamline the entire process, making it easier for both employers and employees to manage their payroll deductions efficiently.

Get more for Authorization For Pre Tax Payroll Reduction CAFETE

Find out other Authorization For Pre Tax Payroll Reduction CAFETE

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later