Fill Out in Black Ink for a Faster Refund, File Y Form

Steps to complete the Massachusetts state tax form

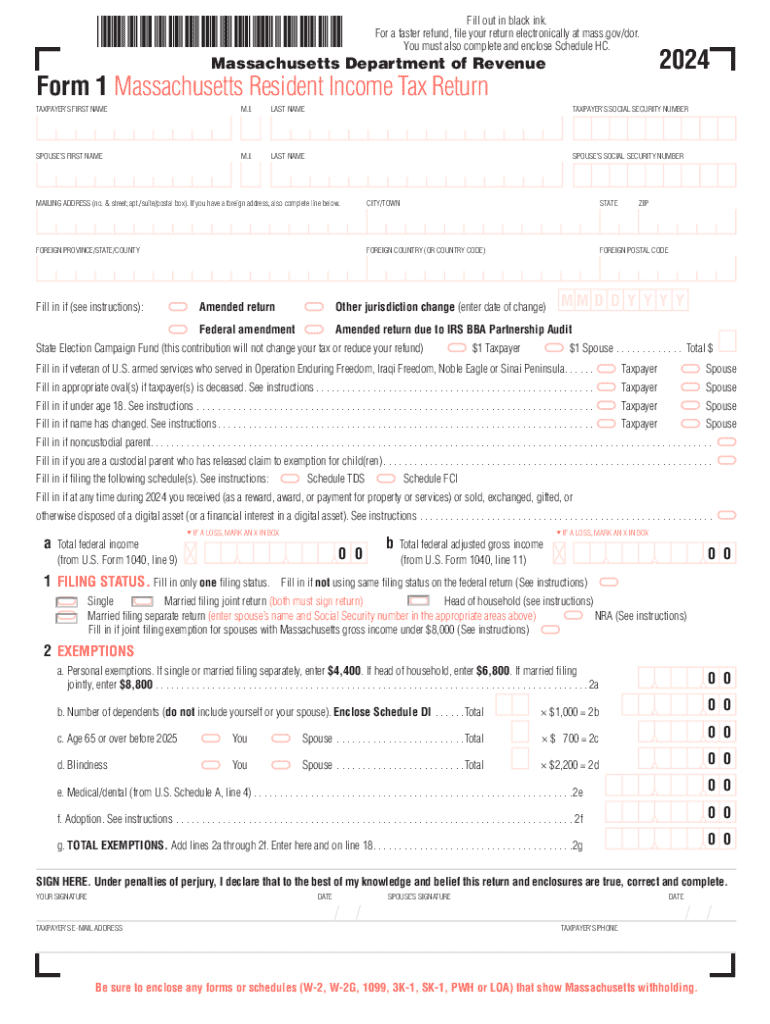

Completing the Massachusetts state tax form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documents, including W-2s, 1099s, and any other income statements. Ensure you have your Social Security number and any relevant tax identification numbers. Next, download the appropriate Massachusetts tax forms, such as the 2024 Massachusetts Form 1, from the official state website or a reliable source.

Once you have the forms, carefully read the instructions provided, particularly the Massachusetts Form 1 instructions, to understand the requirements for your specific situation. Fill out the form methodically, ensuring that all information is accurate and complete. It is advisable to use black ink for clarity and to facilitate faster processing. After completing the form, review it thoroughly for any errors or omissions before submission.

Filing deadlines and important dates for Massachusetts state tax

Staying informed about filing deadlines is crucial for timely tax submissions. For the 2024 tax year, the Massachusetts state tax return is typically due on April 15. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, if you require more time, you can file for an extension, but be aware that any taxes owed must still be paid by the original deadline to avoid penalties.

Keep track of other important dates, such as the deadline for estimated tax payments, which may apply to self-employed individuals or those with significant non-wage income. Mark these dates on your calendar to ensure compliance and avoid unnecessary penalties.

Required documents for filing Massachusetts state tax

When preparing to file your Massachusetts state tax return, it is essential to gather all required documents. Key documents include:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Records of other income sources, such as interest or dividends

- Documentation for any deductions or credits you plan to claim, such as receipts for medical expenses or educational costs

- Your prior year’s tax return, which can provide helpful information

Having these documents organized will streamline the filing process and help ensure that you do not miss any important information that could affect your tax liability.

Form submission methods for Massachusetts state tax

Massachusetts offers several methods for submitting your state tax return. You can file electronically using tax preparation software that is compatible with Massachusetts tax forms, which can expedite processing and reduce errors. Alternatively, you may choose to print your completed tax forms and mail them to the Massachusetts Department of Revenue. Ensure you send them to the correct address based on whether you are including a payment or not.

In-person filing is also an option, though it is less common. If you prefer this method, check for local tax assistance centers or offices where you can submit your forms directly. Regardless of the method chosen, ensure that you keep copies of all submitted documents for your records.

Legal use of the Massachusetts state tax form

The Massachusetts state tax form is a legal document that must be completed accurately and truthfully. Filing a false return can lead to severe penalties, including fines and potential criminal charges. It is important to understand the legal implications of the information you provide on the form. Always report your income honestly and claim only those deductions and credits for which you are eligible.

Furthermore, be aware of the state-specific rules and regulations that govern tax filings in Massachusetts. This knowledge will help ensure compliance and protect you from legal repercussions.

Examples of using the Massachusetts state tax form

Understanding how to use the Massachusetts state tax form can be aided by specific examples. For instance, if you are a resident with a full-time job, you will typically report your W-2 income on the Massachusetts Form 1. If you also have freelance income, that should be reported on a 1099 form, which you will also include in your total income calculations.

Another example is if you qualify for certain deductions, such as those for student loan interest or medical expenses. Documenting these accurately on your tax return can significantly affect your overall tax liability. Familiarizing yourself with these scenarios can help you navigate the form more effectively and ensure you maximize your potential refund.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fill out in black ink for a faster refund file y

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it benefit businesses in Massachusetts state?

airSlate SignNow is a powerful eSignature solution that enables businesses in Massachusetts state to send and sign documents electronically. This platform streamlines the signing process, reduces paperwork, and enhances efficiency, making it an ideal choice for organizations looking to improve their workflow.

-

How much does airSlate SignNow cost for businesses in Massachusetts state?

The pricing for airSlate SignNow varies based on the plan selected, with options designed to fit the needs of businesses in Massachusetts state. We offer flexible pricing tiers that cater to different business sizes and requirements, ensuring that you can find a cost-effective solution that meets your needs.

-

What features does airSlate SignNow offer for users in Massachusetts state?

airSlate SignNow provides a range of features tailored for users in Massachusetts state, including customizable templates, real-time tracking, and secure cloud storage. These features help businesses manage their documents efficiently while ensuring compliance with local regulations.

-

Can airSlate SignNow integrate with other software used by businesses in Massachusetts state?

Yes, airSlate SignNow offers seamless integrations with various software applications commonly used by businesses in Massachusetts state. This includes CRM systems, document management tools, and productivity platforms, allowing for a more cohesive workflow.

-

Is airSlate SignNow compliant with Massachusetts state laws regarding electronic signatures?

Absolutely! airSlate SignNow is fully compliant with Massachusetts state laws governing electronic signatures, ensuring that your signed documents are legally binding. This compliance provides peace of mind for businesses operating within the state.

-

How does airSlate SignNow enhance document security for users in Massachusetts state?

airSlate SignNow prioritizes document security for users in Massachusetts state by employing advanced encryption and secure access controls. This ensures that sensitive information remains protected throughout the signing process, giving businesses confidence in their document management.

-

What are the benefits of using airSlate SignNow for remote work in Massachusetts state?

Using airSlate SignNow for remote work in Massachusetts state allows businesses to maintain productivity and efficiency, even when teams are not physically present. The platform enables quick document turnaround and collaboration, making it easier for remote teams to operate smoothly.

Get more for Fill Out In Black Ink For A Faster Refund, File Y

- Form 12a200 kentucky individual income tax installment

- Schedule m 1500010018 form 740 42a740m department of revenue attach to form 740 revenue ky

- Declination of influenza vaccination my employer o form

- Last will and testament questionnaire wpafb af form

- Incite indiana 403472498 form

- Declination email for internal employees form

- Replacement diploma request university of rhode island uri form

- College reference form

Find out other Fill Out In Black Ink For A Faster Refund, File Y

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure