500X Georgia Form Rev 080124 Amended Individu 2024-2026

What is the Georgia Form 500X?

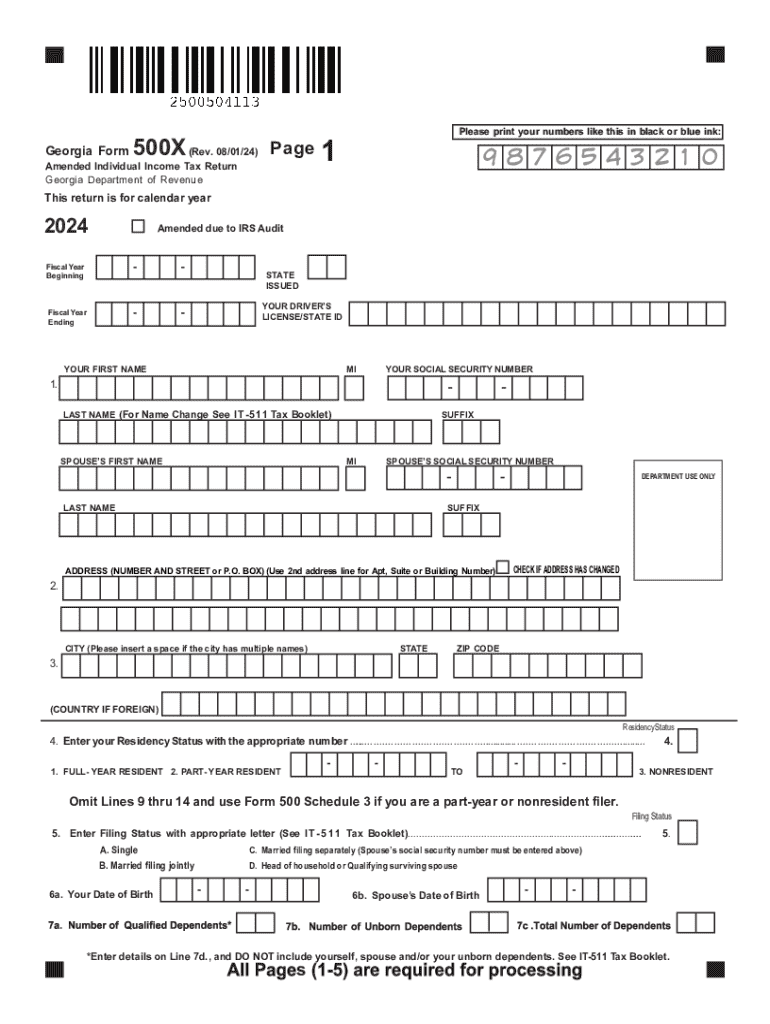

The Georgia Form 500X, also known as the Amended Individual Income Tax Return, is a crucial document for taxpayers who need to correct or amend their previously filed Georgia income tax returns. This form is specifically designed for individuals who have made errors or omissions in their original filings, allowing them to adjust their tax information and ensure compliance with state tax laws. The form is essential for maintaining accurate tax records and can help taxpayers avoid potential penalties associated with incorrect filings.

Steps to Complete the Georgia Form 500X

Completing the Georgia Form 500X involves several key steps to ensure accuracy and compliance. Begin by gathering all relevant documents, including your original tax return and any supporting documentation for the changes you are making. Next, clearly indicate the changes on the form, providing detailed explanations for each amendment. Be sure to include any additional income, deductions, or credits that were not reported initially. After filling out the form, review it thoroughly for any errors before submitting it to the Georgia Department of Revenue.

How to Obtain the Georgia Form 500X

The Georgia Form 500X can be easily obtained through the Georgia Department of Revenue's official website. Taxpayers can download a printable version of the form or access it digitally for completion. Additionally, the form may be available at local tax offices or through tax preparation services. Ensuring you have the most current version of the form is crucial, as updates may occur annually or biannually.

Key Elements of the Georgia Form 500X

Understanding the key elements of the Georgia Form 500X is essential for accurate completion. The form requires personal information, including your name, address, and Social Security number. It also includes sections for detailing the original amounts reported, the corrected amounts, and the reasons for the amendments. Taxpayers must provide any supporting documentation that verifies the changes being made, such as W-2 forms, 1099s, or receipts for deductions.

Filing Deadlines for the Georgia Form 500X

Filing deadlines for the Georgia Form 500X are critical to avoid penalties. Generally, the amended return must be filed within three years from the original due date of the return or within one year of the date the tax was paid, whichever is later. It is advisable to file the form as soon as discrepancies are identified to ensure timely processing and to minimize any potential interest or penalties that may accrue.

Form Submission Methods for the Georgia Form 500X

The Georgia Form 500X can be submitted through various methods to accommodate taxpayer preferences. Individuals can file the form electronically through approved tax software that supports Georgia tax forms. Alternatively, taxpayers may choose to print the completed form and mail it to the Georgia Department of Revenue. In-person submissions may also be possible at local tax offices, providing another option for those who prefer direct interaction.

Create this form in 5 minutes or less

Find and fill out the correct 500x georgia form rev 080124 amended individu

Create this form in 5 minutes!

How to create an eSignature for the 500x georgia form rev 080124 amended individu

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the pricing structure for airSlate SignNow?

airSlate SignNow offers a variety of pricing plans starting at just $500 per year for small businesses. This cost-effective solution provides access to essential features that streamline document signing and management. You can choose a plan that best fits your business needs and budget.

-

What features does airSlate SignNow offer?

With airSlate SignNow, users can enjoy features such as document templates, real-time tracking, and customizable workflows, all designed to enhance efficiency. The platform allows you to send and eSign documents seamlessly, making it a valuable tool for businesses looking to optimize their processes. These features are available at competitive pricing, starting from $500.

-

How can airSlate SignNow benefit my business?

airSlate SignNow empowers businesses by simplifying the document signing process, which can save time and reduce operational costs. By using this platform, you can enhance productivity and improve customer satisfaction through faster turnaround times. Investing in airSlate SignNow can be a smart decision for businesses looking to streamline their workflows for under $500.

-

Is airSlate SignNow easy to integrate with other tools?

Yes, airSlate SignNow offers seamless integrations with various applications, including CRM systems and cloud storage services. This flexibility allows businesses to incorporate eSigning into their existing workflows without disruption. The integration capabilities make it a versatile choice for organizations looking to enhance their document management processes for around $500.

-

Can I try airSlate SignNow before committing to a plan?

Absolutely! airSlate SignNow provides a free trial that allows you to explore its features and functionalities without any commitment. This trial period is an excellent opportunity to see how the platform can meet your business needs, especially if you're considering a budget around $500 for a comprehensive eSigning solution.

-

What types of documents can I eSign with airSlate SignNow?

You can eSign a wide variety of documents using airSlate SignNow, including contracts, agreements, and forms. The platform supports multiple file formats, ensuring that you can manage all your essential documents efficiently. This versatility makes it an ideal choice for businesses looking to streamline their signing processes for under $500.

-

How secure is airSlate SignNow for document signing?

airSlate SignNow prioritizes security, employing advanced encryption and compliance with industry standards to protect your documents. This ensures that your sensitive information remains confidential and secure during the signing process. Investing in airSlate SignNow for around $500 provides peace of mind for businesses concerned about document security.

Get more for 500X Georgia Form Rev 080124 Amended Individu

- Swim a thon pledge form template

- Authority workcover form

- Guidelines on reassignment of pnp personnel form

- Chapter 105 formerly house substitute no 1 for house bill

- 71 delaware laws139th general assembly delaware code form

- Illinois statewide forms approved instructions emergency motion

- Local bankruptcy rules forms central district of california united cacb uscourts

- An act to amend title 16 of the delaware code relating to anatomical gifts and delcode delaware form

Find out other 500X Georgia Form Rev 080124 Amended Individu

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document