500X Print Form 2021

What is the 500X Print Form

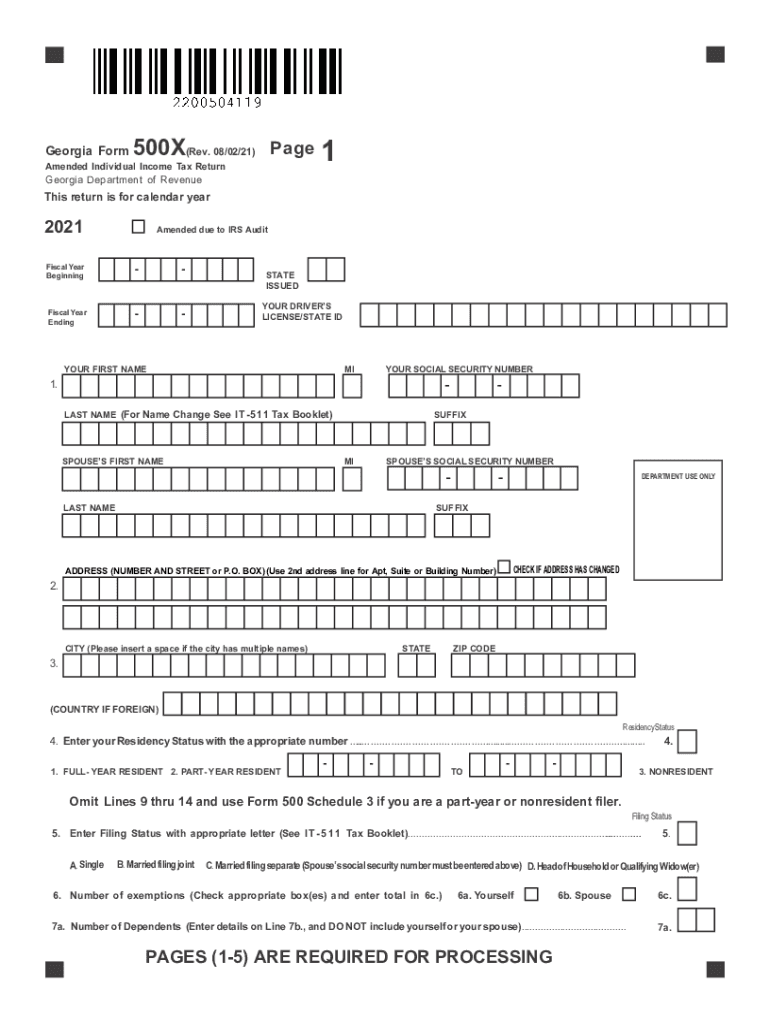

The 500X form, officially known as the Georgia Amended Income Tax Return, is used by taxpayers in Georgia to correct errors made on their original state income tax returns. This form is essential for individuals who need to amend their previously filed Georgia state income tax forms, such as the Georgia state income tax form 500. It allows taxpayers to report additional income, claim deductions they may have missed, or correct any inaccuracies to ensure compliance with state tax regulations.

How to use the 500X Print Form

Using the 500X form involves several steps to ensure accurate completion. First, obtain the form from the Georgia Department of Revenue website or through authorized tax preparation software. Next, fill in the required information, including your personal details, tax identification number, and the specific changes you are making to your original return. It's important to provide clear explanations for each amendment. After completing the form, review all entries for accuracy before submitting it to avoid delays in processing.

Steps to complete the 500X Print Form

Completing the 500X form requires careful attention to detail. Follow these steps:

- Gather your original tax return and any supporting documents related to the changes.

- Fill out your personal information at the top of the form.

- Indicate the tax year you are amending.

- Provide the corrected amounts in the appropriate sections.

- Include explanations for each change in the designated area.

- Sign and date the form before submission.

Legal use of the 500X Print Form

The 500X form is legally recognized as a valid method for amending a Georgia state income tax return. To ensure its legal standing, it must be filled out accurately and submitted within the state-mandated time frame. The use of this form complies with the regulations set forth by the Georgia Department of Revenue, which governs the filing and processing of amended returns. Proper use of the 500X form can help avoid penalties and interest associated with underreported income or other tax discrepancies.

Filing Deadlines / Important Dates

When filing the 500X form, it is crucial to be aware of specific deadlines. Generally, the amended return must be filed within three years from the original due date of the return or within one year of the date you paid the tax, whichever is later. Keeping track of these deadlines helps ensure that your amendments are processed efficiently and that you remain compliant with state tax laws.

Form Submission Methods (Online / Mail / In-Person)

The 500X form can be submitted through various methods. Taxpayers have the option to file the form online using authorized e-filing services, which can expedite processing times. Alternatively, the form can be mailed directly to the Georgia Department of Revenue. For those who prefer in-person submissions, visiting a local Department of Revenue office is also an option. Each method has its own processing times, so choosing the most convenient one is important for timely amendments.

Quick guide on how to complete 500x print form

Complete 500X Print Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent environmentally friendly alternative to conventional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, edit, and eSign your documents rapidly without delays. Manage 500X Print Form on any platform with airSlate SignNow Android or iOS applications and simplify any document-centric process today.

How to edit and eSign 500X Print Form with ease

- Find 500X Print Form and click Obtain Form to begin.

- Make use of the tools provided to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click the Complete button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your choice. Edit and eSign 500X Print Form and guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 500x print form

Create this form in 5 minutes!

People also ask

-

What is a 500x form and how can airSlate SignNow help?

A 500x form is a document type commonly used for specific administrative or compliance tasks. airSlate SignNow allows businesses to easily create, send, and eSign 500x forms seamlessly, streamlining the process and ensuring all parties can access and sign documents from anywhere.

-

How much does it cost to use airSlate SignNow for 500x forms?

Pricing for airSlate SignNow is competitive and varies based on the plan you choose. Basic features for managing 500x forms are available in our affordable plans, allowing businesses of all sizes to benefit from our eSignature solutions without breaking the bank.

-

What features are included for managing 500x forms?

airSlate SignNow includes a range of features for handling 500x forms, such as templates, customizable fields, and automated reminders. These tools enhance accuracy and efficiency, making document management easier for your business.

-

Can I integrate airSlate SignNow with other platforms for 500x form management?

Yes, airSlate SignNow offers seamless integrations with popular business applications. This means you can easily connect your existing systems to streamline the process of managing and eSigning 500x forms.

-

Is it safe to eSign 500x forms with airSlate SignNow?

Absolutely! airSlate SignNow ensures the utmost security when eSigning 500x forms. Our platform complies with industry-leading security standards, providing encryption and secure storage, so your documents are protected.

-

How can I track the status of my 500x forms?

You can easily track the status of your 500x forms within airSlate SignNow’s dashboard. Our platform provides real-time updates and notifications, allowing you to see who has viewed, signed, or completed the eSigning process.

-

Can I customize my 500x forms with airSlate SignNow?

Yes, customization is one of the strengths of airSlate SignNow when handling 500x forms. You can modify templates, add your branding elements, and create tailored fields to meet your specific requirements.

Get more for 500X Print Form

- Interrogatories to plaintiff for motor vehicle occurrence north carolina form

- Interrogatories to defendant for motor vehicle accident north carolina form

- Llc notices resolutions and other operations forms package north carolina

- North carolina accidents form

- Notice of dishonored check civil 1st notice keywords bad check bounced check north carolina form

- Notice dishonored form

- Mutual wills containing last will and testaments for man and woman living together not married with no children north carolina form

- Mutual wills package of last wills and testaments for man and woman living together not married with adult children north form

Find out other 500X Print Form

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed