S Georgia Form 600 Rev 081324 Page 1 Corporat

Understanding the 2024 Georgia Form 600S

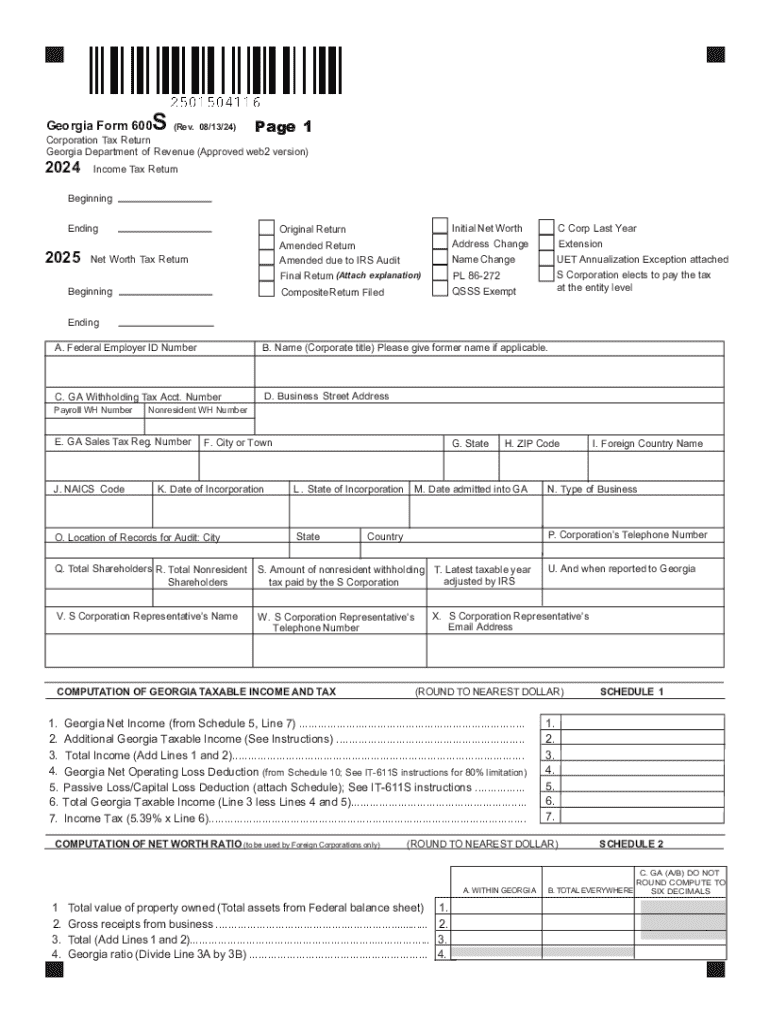

The 2024 Georgia Form 600S is a tax form specifically designed for S corporations operating in Georgia. This form is essential for reporting the income, deductions, and credits of S corporations to the Georgia Department of Revenue. By filing this form, businesses ensure compliance with state tax regulations and accurately report their financial activities.

Steps to Complete the 2024 Georgia Form 600S

Completing the 2024 Georgia Form 600S requires careful attention to detail. Here are the key steps involved:

- Gather all necessary financial documents, including income statements and expense reports.

- Begin by filling out the basic information section, including the name and address of the S corporation.

- Report the total income earned by the corporation and any applicable deductions.

- Complete the sections related to credits and other adjustments as required.

- Review the form for accuracy before submission to avoid penalties.

Filing Deadlines for the 2024 Georgia Form 600S

It is crucial to be aware of the filing deadlines for the 2024 Georgia Form 600S to avoid late fees. The form is typically due on the fifteenth day of the third month following the end of the corporation's tax year. For most S corporations operating on a calendar year, this means the form is due by March 15, 2024. Extensions may be available, but they must be requested in advance.

Required Documents for Filing the 2024 Georgia Form 600S

When preparing to file the 2024 Georgia Form 600S, certain documents are necessary to ensure a complete and accurate submission. These documents include:

- Financial statements, including profit and loss statements.

- Records of any deductions claimed by the corporation.

- Documentation of any tax credits the corporation is eligible for.

- Previous year’s tax returns for reference.

Submission Methods for the 2024 Georgia Form 600S

The 2024 Georgia Form 600S can be submitted through various methods, allowing flexibility for businesses. Options include:

- Online submission through the Georgia Department of Revenue’s e-filing system.

- Mailing a paper copy of the form to the appropriate address.

- In-person submission at designated Georgia Department of Revenue offices.

Key Elements of the 2024 Georgia Form 600S

Understanding the key elements of the 2024 Georgia Form 600S is essential for accurate completion. Important sections include:

- Identification information for the S corporation.

- Income and expense reporting sections.

- Credits and adjustments applicable to the corporation.

- Signature section for authorized representatives.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the s georgia form 600 rev 081324 page 1 corporat

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

How to elect S Corp status in Georgia?

File form 2553 to apply for S corp status When Georgia approves your LLC or C corporation formation, you need to file Form 2553, Election by a Small Business Corporation, with the IRS to get S corp status.

-

What is the corporate tax system in Georgia?

Corporate Income Tax The rate of taxation is 5.39% of a corporation's Georgia taxable net income. If S Corporation status is recognized for Georgia purposes, the shareholders of the corporation pay the tax as opposed to the corporation paying the tax.

-

Do I need to file a Georgia corporate tax return?

Georgia requires corporations to file an annual report, which is due April 1 and has a filing fee of $50. Georgia also has a franchise tax, which is calculated based on the corporation's paid-in capital.

-

Where do I file Form 600 in Georgia?

Electronically file or mail the return to: Processing Center, Georgia Department of Revenue, P. O. Box 740397, Atlanta, GA 30374-0397.

Get more for S Georgia Form 600 Rev 081324 Page 1 Corporat

Find out other S Georgia Form 600 Rev 081324 Page 1 Corporat

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy