SC11203091 PDF Form

Understanding the SC11203091 PDF

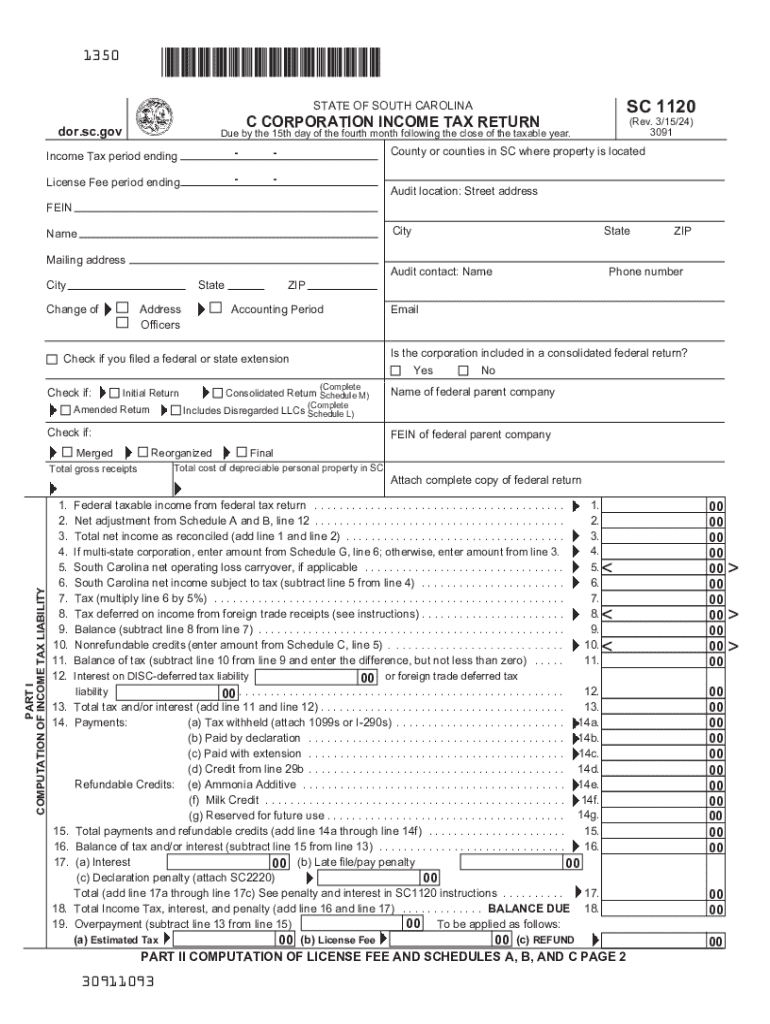

The SC11203091 PDF is a crucial document for businesses operating in South Carolina. This form is specifically designed for C corporations to report their income, deductions, and credits to the South Carolina Department of Revenue. Understanding the purpose and requirements of this form is essential for compliance with state tax regulations. The SC11203091 PDF serves as a means for corporations to calculate their state tax liability based on their earnings and ensure they meet their tax obligations.

Steps to Complete the SC11203091 PDF

Completing the SC11203091 PDF involves several key steps:

- Gather necessary financial documents, including income statements and expense records.

- Fill out the form accurately, ensuring all income, deductions, and credits are reported.

- Double-check calculations to avoid errors that could lead to penalties.

- Sign and date the form before submission.

Each section of the form must be filled out with precise information to ensure compliance with state tax laws.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the SC11203091 PDF. Typically, the form must be submitted by the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the deadline is April 15. Missing this deadline can result in penalties and interest on unpaid taxes.

Form Submission Methods

The SC11203091 PDF can be submitted in various ways to accommodate different preferences:

- Online: Corporations can file electronically through the South Carolina Department of Revenue's online portal.

- Mail: The completed form can be printed and mailed to the appropriate address listed on the form.

- In-Person: Businesses may also choose to deliver the form in person at their local Department of Revenue office.

Key Elements of the SC11203091 PDF

Understanding the key elements of the SC11203091 PDF is essential for accurate completion. The form includes sections for reporting:

- Total income earned during the tax year.

- Allowable deductions, such as business expenses.

- Tax credits that may reduce the overall tax liability.

Each section must be filled out with precise figures to ensure compliance with South Carolina tax laws.

Penalties for Non-Compliance

Failing to file the SC11203091 PDF on time or providing inaccurate information can lead to significant penalties. The South Carolina Department of Revenue imposes fines for late submissions and may assess interest on any unpaid taxes. It is crucial for corporations to adhere to filing requirements and ensure all information is accurate to avoid these consequences.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sc11203091 pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the South Carolina Form SC 1120?

The South Carolina Form SC 1120 is a tax return form used by corporations to report their income, deductions, and credits to the South Carolina Department of Revenue. This form is essential for businesses operating in South Carolina to ensure compliance with state tax laws. Properly completing the South Carolina Form SC 1120 can help avoid penalties and ensure accurate tax reporting.

-

How can airSlate SignNow help with the South Carolina Form SC 1120?

airSlate SignNow provides an efficient platform for businesses to electronically sign and send the South Carolina Form SC 1120. With its user-friendly interface, you can easily manage your documents and ensure they are securely signed and submitted on time. This streamlines the process, making tax season less stressful for your business.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs, starting with a free trial for new users. Each plan includes features that can assist with managing documents like the South Carolina Form SC 1120. By choosing the right plan, you can optimize your document workflow while staying within budget.

-

Are there any features specifically for tax forms like the South Carolina Form SC 1120?

Yes, airSlate SignNow includes features tailored for tax forms, including templates and automated workflows that simplify the completion of the South Carolina Form SC 1120. You can easily customize templates to fit your business needs, ensuring that all necessary information is included. This helps reduce errors and saves time during tax preparation.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax preparation software, enhancing your ability to manage the South Carolina Form SC 1120. These integrations allow for a smoother workflow, enabling you to import data directly into your forms and reduce manual entry errors.

-

What are the benefits of using airSlate SignNow for document signing?

Using airSlate SignNow for document signing offers numerous benefits, including enhanced security, ease of use, and time savings. With features like audit trails and secure cloud storage, you can confidently manage important documents like the South Carolina Form SC 1120. This ensures that your business remains compliant while streamlining your document processes.

-

Is airSlate SignNow suitable for small businesses handling the South Carolina Form SC 1120?

Yes, airSlate SignNow is an excellent solution for small businesses managing the South Carolina Form SC 1120. Its cost-effective pricing and user-friendly features make it accessible for businesses of all sizes. Small businesses can benefit from the efficiency and security that airSlate SignNow provides, especially during tax season.

Get more for SC11203091 pdf

Find out other SC11203091 pdf

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later