Form 901 Business Personal Property Rendition

What is the Form 901 Business Personal Property Rendition

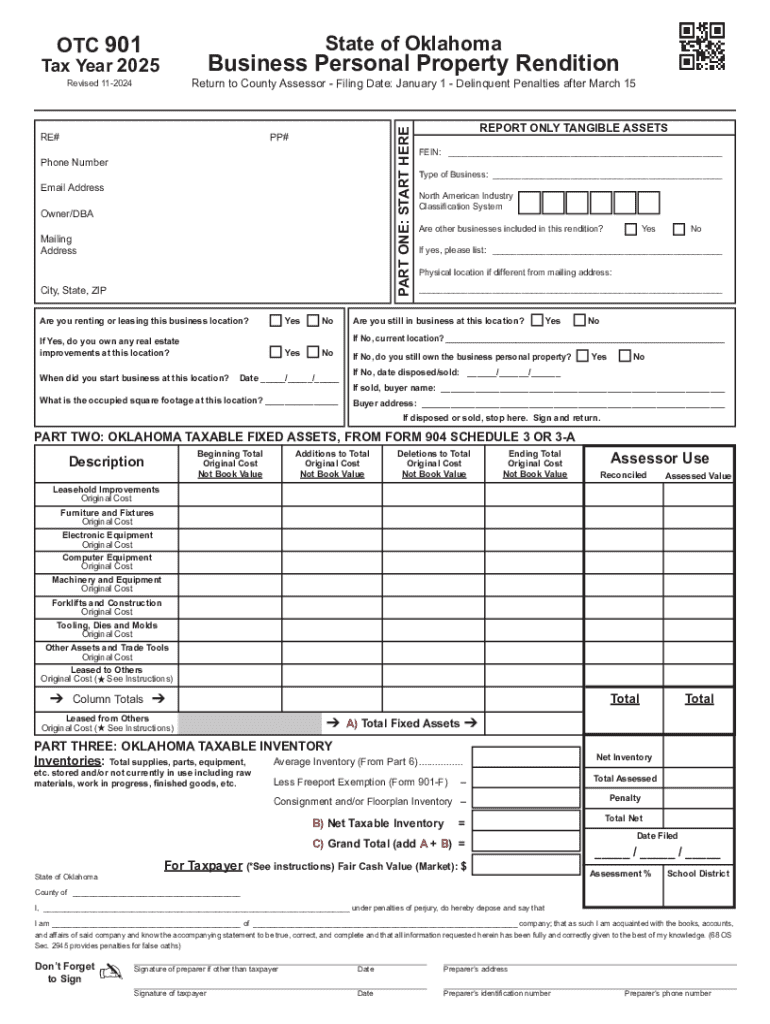

The Oklahoma Form 901, also known as the Business Personal Property Rendition, is a crucial document for businesses operating in Oklahoma. This form is used to report personal property owned by a business to the county assessor. The purpose of the form is to ensure that businesses accurately disclose their personal property, which is subject to taxation. This includes items such as machinery, equipment, furniture, and other tangible assets used in the operation of the business.

How to use the Form 901 Business Personal Property Rendition

To effectively use the Oklahoma Form 901, businesses must first gather all necessary information regarding their personal property. This includes details about the type of property, its location, and its estimated value. Once the information is compiled, the business owner or authorized representative can fill out the form, ensuring that all sections are completed accurately. The completed form must then be submitted to the appropriate county assessor's office by the specified deadline to avoid penalties.

Steps to complete the Form 901 Business Personal Property Rendition

Completing the Oklahoma Form 901 involves several key steps:

- Gather Information: Collect details about all personal property owned by the business.

- Complete the Form: Fill out the form, providing accurate descriptions and values for each item.

- Review for Accuracy: Double-check the form for any errors or omissions before submission.

- Submit the Form: Send the completed form to the county assessor's office by the deadline.

Key elements of the Form 901 Business Personal Property Rendition

Several key elements must be included when completing the Oklahoma Form 901:

- Business Information: Name, address, and contact details of the business.

- Property Description: A detailed list of all personal property, including type and quantity.

- Estimated Value: The fair market value of each item listed on the form.

- Signature: The form must be signed by the business owner or an authorized representative.

Filing Deadlines / Important Dates

It is essential for businesses to be aware of the filing deadlines associated with the Oklahoma Form 901. Typically, the form must be submitted by March 15 each year. Failure to file by this date may result in penalties or additional fees. Businesses should mark their calendars and ensure that all necessary documentation is prepared well in advance of the deadline.

Form Submission Methods (Online / Mail / In-Person)

The Oklahoma Form 901 can be submitted in several ways, depending on the county's regulations:

- Online Submission: Some counties may offer an online portal for form submission.

- Mail: The completed form can be mailed to the county assessor's office.

- In-Person: Businesses may also choose to deliver the form in person at the county assessor's office.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 901 business personal property rendition 771914222

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Oklahoma Form 901 instructions?

The Oklahoma Form 901 instructions provide detailed guidance on how to complete and submit the form correctly. This includes information on required fields, supporting documents, and submission methods. Following these instructions ensures compliance with state regulations.

-

How can airSlate SignNow help with Oklahoma Form 901?

airSlate SignNow simplifies the process of completing and eSigning the Oklahoma Form 901. Our platform allows users to fill out the form electronically, ensuring accuracy and saving time. Additionally, you can securely send the completed form to relevant parties.

-

Is there a cost associated with using airSlate SignNow for Oklahoma Form 901 instructions?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan provides access to features that streamline the completion of forms like the Oklahoma Form 901. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing Oklahoma Form 901?

airSlate SignNow offers features such as document templates, eSignature capabilities, and real-time tracking for Oklahoma Form 901. These tools enhance efficiency and ensure that your documents are processed quickly and securely. You can also collaborate with team members seamlessly.

-

Can I integrate airSlate SignNow with other applications for Oklahoma Form 901?

Absolutely! airSlate SignNow integrates with various applications, allowing you to streamline your workflow when handling the Oklahoma Form 901. This includes popular tools like Google Drive, Dropbox, and CRM systems, enhancing your document management process.

-

What are the benefits of using airSlate SignNow for Oklahoma Form 901 instructions?

Using airSlate SignNow for Oklahoma Form 901 instructions offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform's user-friendly interface makes it easy to navigate the form completion process, ensuring you meet all requirements.

-

How secure is airSlate SignNow when handling Oklahoma Form 901?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your data. When handling the Oklahoma Form 901, you can trust that your information is safe and secure. Our platform also provides audit trails for added accountability.

Get more for Form 901 Business Personal Property Rendition

- Healthrigovlicensesdetailemergency medical services licensing department of health form

- Due by the 10th of form

- Instructions for filing a petition for modification of child form

- Reg 15 form

- Division of social services dss form

- Medical orders for life sustaining treatment molst doh 5003 form

- Empire station po box 2052 form

- Attach an additional page if necessary form

Find out other Form 901 Business Personal Property Rendition

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document